1 of 5

1 of 5

As ride-hailing companies like Uber and Waymo shift to EVs, factoring in charging station infrastructure and charge times, which of these EV models would best suit the business?

2 of 5

2 of 5

Continuing with the fleets of Uber and its competitors, during a shift to autonomous vehicles, in a series of research simulations, how did service — the percentage of ordered cars actually showing up — fare?

3 of 5

3 of 5

A 1994 federal rule set a minimum level of protection in side-impact car crashes and fatalities fell 44% overall. The rule’s mandated crash-test dummy was about 5 foot, 8 inches, 170 pounds (similar to a typical man). People of other sizes — shorter, taller, lighter, heavier — weren’t as protected. But some carmakers did protect those other body types, and a researcher set out to determine why some did and some didn’t. Which factor or factors mattered, according to the study?

4 of 5

4 of 5

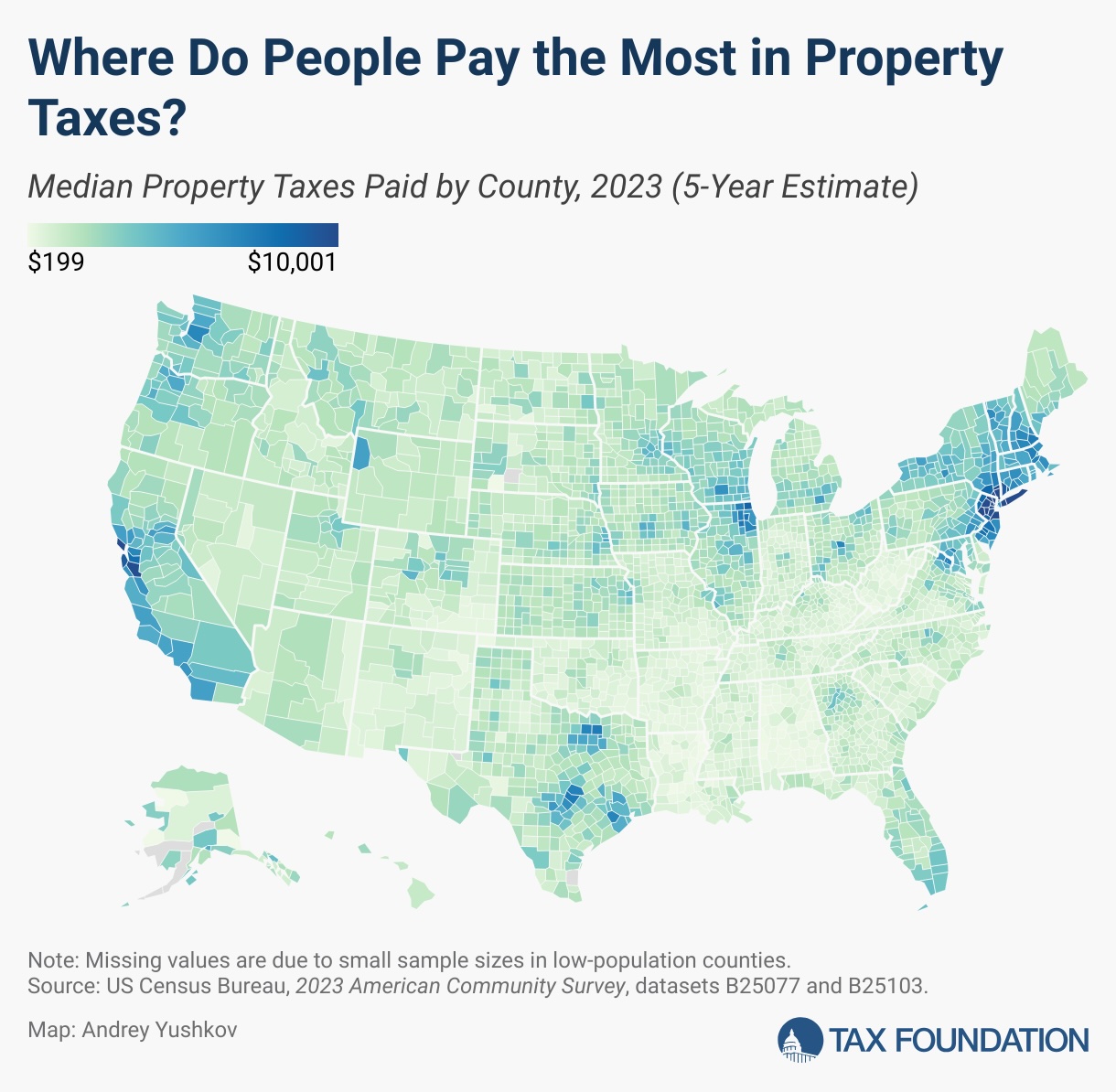

Property tax rates vary widely by state, roughly 2% of market value in New Jersey and Illinois, and 0.5% of market value in Colorado. Because they’re levied annually — as opposed to, say, paying sales tax on a car once — they chew up a lot of a home’s value over time. As an exercise, if you bought a $1 million home in Denver and invested the $1,250-a-month savings versus taxes you’d have paid on a $1 million home in Chicago, assuming a conservative 5% return, after 30 years of compounding you’d have:

5 of 5

5 of 5

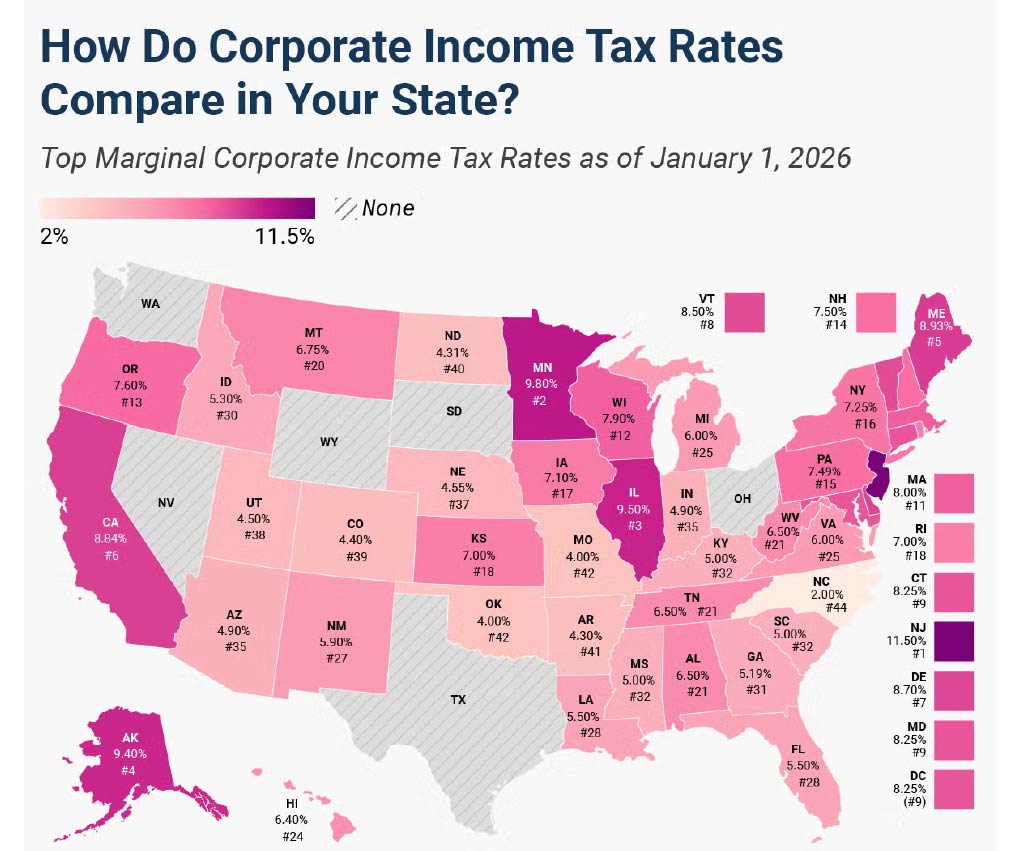

With income disparity rising, one hears calls to tax the rich and to tax corporations. Does taxing corporations at a higher rate affect consumers? A 1 percentage point increase in corporate tax rates: