Area: Finance

Why Rising Stocks Sometimes Reverse, Then Rally

Cultural differences and investor behavior can drive reversals and momentum

Rise of Nonbank Lenders Undermines Community Reinvestment Act Effectiveness

Traditional banks pull out of lower- and median-income neighborhoods the federal program aims to help

Locally, the Extent of British Rule in India Still Holds Back Economic Opportunity

Areas under direct rule lost the components of human capital

As AI Supercharges Finance Research, Will We Believe the Results?

Building benchmarks to guide researchers and validate AI-enabled findings

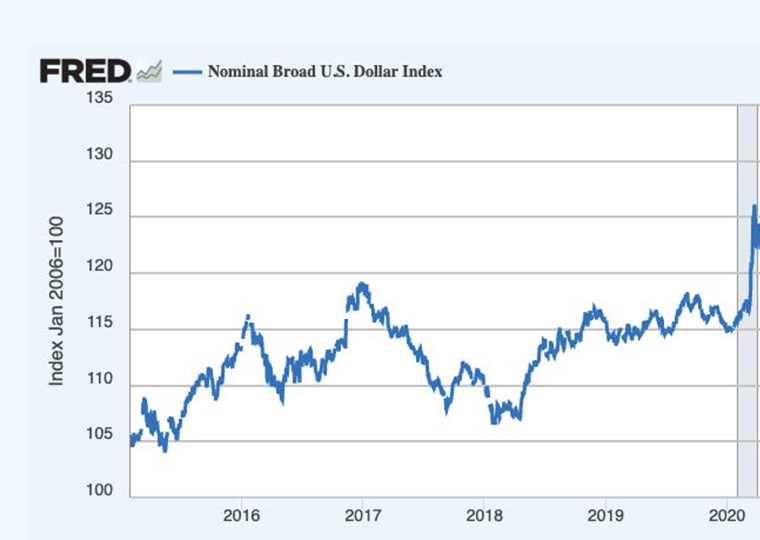

When Exchange Rates Move, U.S. Companies Feel It — Even More Than Previously Thought

Firm-specific export data enables researchers to potentially solve a puzzle in economics

LA Residents Exposed to Wildfire Smoke Face Heightened Health and Financial Risk

Far from burn zones, especially for renters and those with iffy credit, money troubles follow fires

A Quiet Expansion of Deposit Insurance Could Disrupt U.S. Banking

Seen as a backstop to small- and midsized banks, the program, allowing insurance in multiples of $250,000, alters banking’s risk calculus

One Way the Stock Market Sends Signals to Bond Traders

Thin stock trading, amid both price volatility and a period of potential economic change, leads bond investors to seek a higher yield

Think Your Job Is Safe From Robots?

Automation depresses career pay for many workers, notably including those in industries not automating

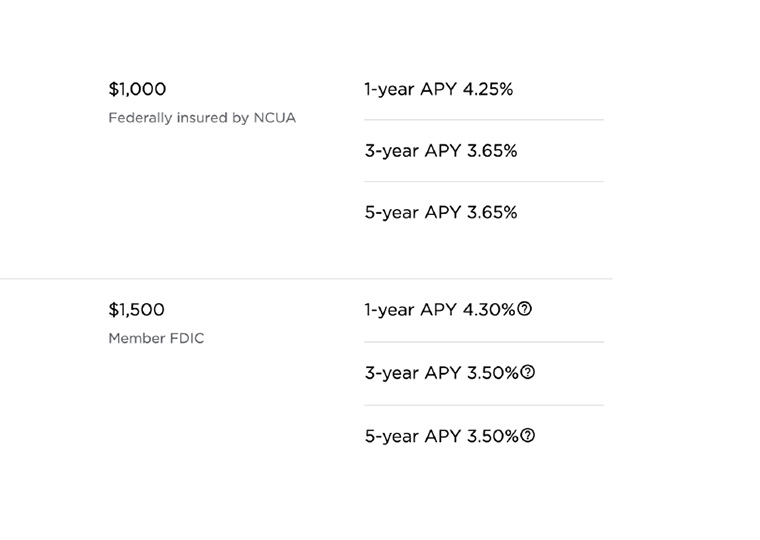

CD Withdrawal Penalties: Often More Than Worth the Risk

Banks know you won’t do the math: Even after a penalty for early withdrawal, the longer-term CD often nets out to a better deal

Prediction Markets + Polls + Economic Indicators: Better Election Forecasting?

A model incorporating markets that allow betting on elections suggests a role in prognostications

How Banking’s Bifurcated Deposit Approach Is Altering Lending — and Risk

Offering higher deposit rates lessens emphasis on loans of fixed rate and longer maturity

Unintended Consequence of Stale Corporate Bond Fund Prices Amid Fed Tightening

In wild markets, do the most dated prices actually reduce redemptions?

Inclusion in an ETF Can Improve the Pricing of Underlying Stocks

It can also help management make capital expenditure decisions

Political Football: Inclusion of ESG Funds in 401(k)s

In nation accustomed to litigation, availability of funds has varied by U.S. Circuit Court boundary

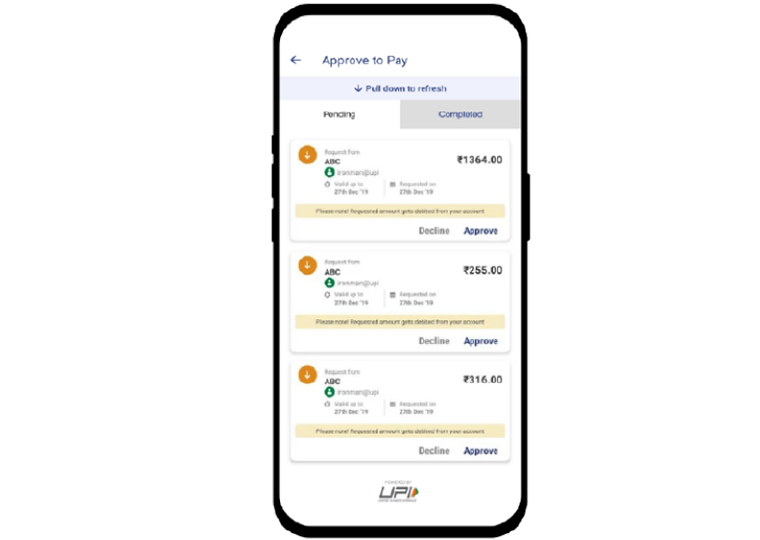

Cashless Payments: Faster Transactions, Easier Borrowing and Increased Household Income

System provides digital record of payments for India’s vast self-employed ranks, satisfying lenders, and raising the likelihood of starting a business