On your phone, about 20. How retailers can best harvest sales from those glances

Online shopping offers an overabundance. Tea cups? Amazon lists some 50,000. Dining table? Wayfair has nearly 19,000.

Given these large assortments, online retailers need to understand how shoppers move around their websites and how best to guide them to a purchase. In a working paper, University of Washington Tacoma’s Luna Zhang, New York University’s Raluca Ursu, UCLA Anderson’s Elisabeth Honka and Lehigh University’s Oliver Yao observe actual shopper behavior — sandal shoppers — and offer some pointers to retailers on optimizing the experience.

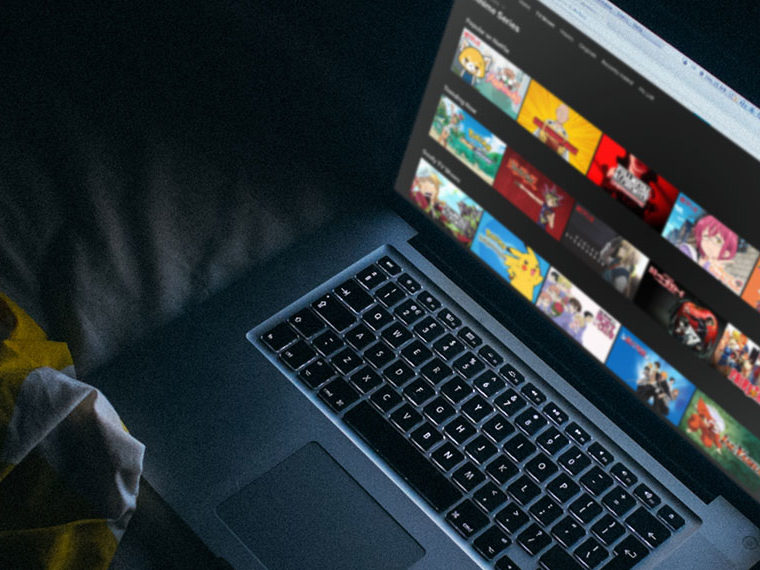

The authors observe shoppers who’re using their phones. It’s four times more costly (in terms of time and effort) for consumers to process the information on an individual product page, the researchers report, than to process the information on a products list page. Consumers understand this. And fatigue is an enemy of sales.

Opt In to the Review Monthly Email Update.

Observing mobile app shoppers (the retailer isn’t named) looking for women’s sandals for the six months ending February 2018, Zhang, Ursu, Honka and Yao recorded 3,621 consumers over 9,128 shopping sessions; 203 of those sessions resulted in purchases. Shoppers land on sandal pages by taking varied routes. For example, some consumers discover and shop for sandals by going through the sandal category page, while others use the sales page or search function.

App users often use different routes to reach the same product. Shoppers used an average of 1.27 search routes per session to find an average of 21.22 pairs of sandals and then actually examined an average of 1.88 pairs. The researchers employed an existing theoretical framework to jointly analyze shoppers’ decisions in discovering, examining and purchasing products in order to determine just how they arrived at product detail pages and how the route a consumer chooses affects which products they see and potentially purchase.

The authors suggest shoppers were very sensitive to price, more likely to examine and buy the app’s lower-priced sandals and sandals that were on sale. In fact, when there were price reductions, mobile shoppers scrolled fewer products, finding something they wanted to purchase earlier. Less work, it seems, and faster sales.

When the difficulty of online shopping — cost, in the researchers’ argot, of finding and examining products — goes up 50%, shoppers scrolled 10.17% fewer items and actually examined 1.53% fewer. Purchases fell 3.49%.

But when difficulty is reduced 50%, shoppers examined 13.68% more items (they have more time) and their purchases rose 19.63%. These are estimates from the researchers’ framework.

A special sales page? Purchases fell 4% when it disappeared. This provides the e-commerce retailer a way to value the sales page.

With e-commerce projected to grow to 24% of total U.S. retail sales in 2025, from 14% in 2020; the authors’ work can help e-commerce retailers prepare for this growth and be better aware of the impact that design changes can make on the decisions made by their shoppers using mobile apps.

Featured Faculty

-

Elisabeth Honka

Associate Professor of Marketing

About the Research

Zhang, X. L., Ursu, R., Honka, E., & Yao, Y. O. (2023). Product Discovery and Consumer Search Routes: Evidence from a Mobile App. Available at SSRN 4444774.