Using Chinese A and B shares, institutional players outperform individuals

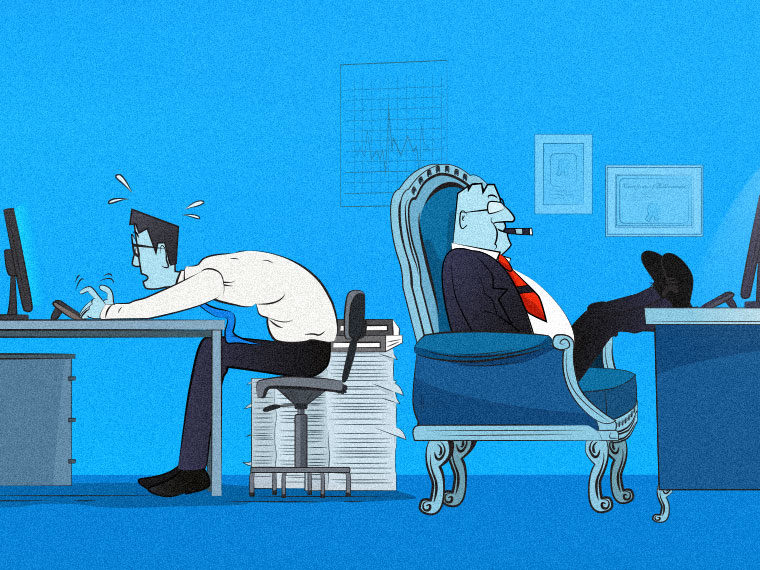

Watching seemingly unsophisticated retail investors slaughter Wall Street short sellers in January 2021 by pushing GameStop shares up tenfold, the guy at his basement laptop could be forgiven for thinking, Hey, this momentum investing thing is a breeze.

A working paper published by the National Bureau of Economic Research suggests that, such notable exceptions aside, the individual buyer of stocks is poorly suited to momentum investing.

Hong Kong Polytechnic University’s Andy C.W. Chui, UCLA Anderson’s Avanidhar Subrahmanyam and University of Texas-Austin’s Sheridan Titman, using a real-world data set, find individual investors seem to lack the patience and fortitude to stick with a momentum investing strategy, compared with professional investors.

Some useful background: Nearly 30 years ago Titman co-authored research that essentially gave momentum investing its chops. He and Narasimhan Jegadeesh (both at UCLA Anderson at the time) showed that stocks that have done very well (or very poorly) over a short period — three, six or 12 months — generally continue to ride that same momentum for the next similar time period.

Ever since, academics have been wrestling with how to explain momentum’s success in an investing world that has bought into the efficient market theory. Subrahmanyam is a longtime contributor to that discussion.

Chinese A and B Shares

For this round of momentum research, Chui, Subrahmanyam and Titman exploited the unique structure of the Chinese stock market to compare the momentum investing acumen of domestic retail investors with institutional (including foreign) investors.

In China, stocks can be issued as A shares or B shares (or a firm can choose to offer both).

A shares are typically reserved for domestic retail investors.

B shares are available for both domestic and international investors. Historically B shares have been used by international institutional investors seeking exposure to China.

Because they are simply different classes of stock of the same operating company representing exactly the same claim on cash flows, any difference in performance of A and B shares of one firm isn’t explained by a change in fundamentals.

The researchers compiled a database of Chinese stock performance from January 2001 through December 2018. They had more than 2,400 A share-only stocks and 88 companies that issued both A and B shares.

They used six months as their core performance variable. Stocks were ranked by six-month performance and sorted into winner (high return), middle and loser (lowest return) groups. The performance of those stocks was then measured after another six months. Each month they re-ran the rankings and created a new six-month grouping to analyze.

The “momentum effect” they measured was the spread in performance between the winner and loser portfolios in a given month.

As you can see in the graph below, among firms with both A and B shares, the B shares (red) delivered plenty of the momentum effect, while the retail A shares (blue) didn’t.

Among firms with both A and B shares, one dollar invested in B shares in 2001 grew to more than $8 by the end of 2018. One dollar in A shares rose to less than $2.25. These results include the effect of weighting shares by exposure to institutional investors.

Noisy Traders Do Not Equal Momentum Investors

In academic circles, retail investors in individual stocks have been deemed to be “noise” traders, whose trading activity is not necessarily driven by an understanding or implementation of fundamental analysis. Novice would be a more plain-English take.

The researchers suggest that when faced with a momentum stock, “noise” traders are too jittery and don’t stick with it. Meanwhile, institutional investors who would likely be well-aware of the momentum factor, might “underreact” to momentum moves, effectively riding the momentum wave. To more success.

Featured Faculty

-

Avanidhar Subrahmanyam

Distinguished Professor of Finance; Goldyne and Irwin Hearsh Chair in Money and Banking

About the Research

Chui, A.C.W., Subrahmanyam, A., Titman, S. (2021). Momentum, Reversals and Investor Clientele. http://dx.doi.org/10.2139/ssrn.3674871