Topic: Investing

Is Post-Earnings Announcement Drift a Thing? Again?

Considered dead, the phenomenon resurfaces in two studies — which are critiqued in a third paper

Companies Sued for Securities Fraud Adopt More Conservative Accounting

The shift spreads through auditors to other clients, potentially clouding the financial information investors rely upon

How Our Collective Struggle With Self-Control Shapes Stock Prices

Overspending rises in times of stress and that affects investment decisions

Disclosure of Climate Risk Helps Stocks Trade More Smoothly

Dropping facts into a polarized investor pool reduces the impact of ideology and leads to broader ownership

Airline Shareholders Were the Big Losers from Deregulation

Consumers, on the other hand, gained in good times and bad

Companies at Risk of an Earnings Miss Allow More Third-Party Trackers on Their Websites

Managing earnings at the cost of privacy

How Quantitative Easing Changed the Bond Market

Investors’ future expectations about QE policy lowered long-term yields, made investors feel safer holding the bonds

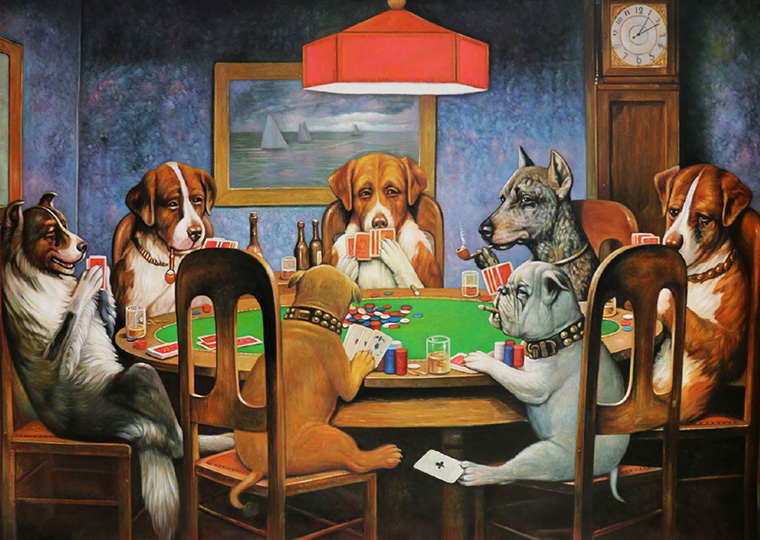

Why the Stock Market Needs Gamblers

They counteract the impulses of two other market personality types

Climate Disclosures by the S&P 500: Separating Corporate Action From the Political Environment

In a challenging time, collecting and analyzing actual performance data become even more crucial

Why Rising Stocks Sometimes Reverse, Then Rally

Cultural differences and investor behavior can drive reversals and momentum

Rise of Nonbank Lenders Undermines Community Reinvestment Act Effectiveness

Traditional banks pull out of lower- and median-income neighborhoods the federal program aims to help

The Mechanics of How Social Media Turbocharges Asset Bubbles

Establishment media coalesces around a lone narrative, but online chatter hops between storylines, sometimes shocking traders

One Way the Stock Market Sends Signals to Bond Traders

Thin stock trading, amid both price volatility and a period of potential economic change, leads bond investors to seek a higher yield

Why Would a Hedge Fund Manager Reveal Stock Positions?

A model suggests that the data might lead index funds to target those same stocks in oversight of corporate management

The Role of Board-of-Directors Pay in Effective Corporate Investing

A model juggles who should suffer when a project goes awry; job market prospects of the CEO; and the quality of information shared in the boardroom

Prediction Markets + Polls + Economic Indicators: Better Election Forecasting?

A model incorporating markets that allow betting on elections suggests a role in prognostications