A favored Federal Reserve index fails to filter out petroleum’s impact

In 2021, U.S. consumers experienced something that had been absent for more than three decades: notable inflation.

The causes are complicated. How much was due to snarled supply chains during the COVID-19 pandemic? Did overly generous stimulus spending flood the money supply? Where does the spike in oil prices spurred by Russia’s invasion of Ukraine fit in?

Understanding the role of oil is especially important. Crude prices, like those of food, are volatile, which is why the Federal Reserve, when setting interest-rate policy, prefers to look at a measure of inflation — the core personal consumption expenditures price index — that aims to remove food and oil from the equation.

Opt In to the Review Monthly Email Update.

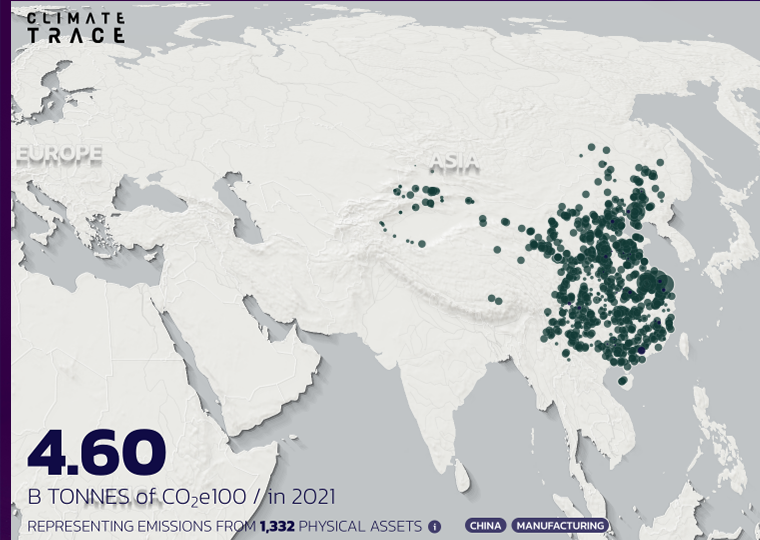

But core inflation measures can still be affected by the movement of oil prices through the supply chain. For example, a vinyl sofa with foam cushions is made primarily of inputs derived from petroleum — but only indirectly after that petroleum has been refined, processed and transformed by a sequence of other industries. Yet, despite the significant (indirect) use of oil in such a sofa, the sofa will still be included in official measures of core inflation. To provide a more accurate picture of inflation that fully strips out the volatility of oil, Harvard’s Robert Minton and UCLA Anderson’s Brian Wheaton analyzed 25 years of economic data on industry prices and supply chains to develop a model of oil’s direct and indirect effect on prices in the economy.

The Less Immediate Effects of Inflation

In a working paper, Minton and Wheaton suggest that the total indirect effects of oil prices are twice as large as their direct effect on gasoline prices. What’s more, those full effects can take years to work their way through the economy. As a result, official measures of inflation either overestimate or underestimate its actual severity.

“Core inflation is not doing its claimed job, and it is not doing its job precisely because of those indirect effects,” Wheaton says in an email exchange.

For example, in the current inflationary episode, removing oil’s indirect supply-chain effects from core PCE would indicate that inflation in mid-2022 peaked at 5% instead of 6.5% shown by the official measure. The situation was reversed by the end of the year. As oil prices fell, actual inflation — minus the direct and indirect effects of oil — rose even as official core PCE showed a decline.

“Reductions in inflation in the latter half of 2022 were entirely driven by oil price decreases,” Wheaton asserts.

For consumers, an increase in the price of crude is most readily apparent in prices at the gasoline pump, which rise quickly. At the same time, petroleum permeates the economy as a raw material in thousands of products, from antifreeze to yarn, and as a source of energy for transportation, utilities and manufacturing. It is less apparent how quickly a change in the price of oil moves through this lengthy supply network.

To measure that, the authors tapped data from the Bureau of Economic Analysis showing inputs and outputs for more than 400 industries since 1997. They then used the producer price index — which contains data on prices in each industry of the economy — to track how price changes are passed through a supply chain.

The answer depends on how far removed from the source of oil production an industry is and how much of its cost is passed through to next-level buyers. For instance, nearly 80% of the cost of refining oil into gasoline comes from the price of crude; that’s why an increase at the wellhead shows up almost immediately at the pump. The asphalt-paving industry mainly buys refined petroleum products, so oil accounts for about half of its total costs. Further downstream, oil prices contribute about 20% of the costs for synthetic-rubber manufacturing, partly in purchases of refined oil and partly from petrochemical products, which themselves are made with refined oil.

Why the Supply Chain Sees Delayed Effects

In the analysis, industries that directly rely on oil pass through prices changes almost immediately, while the indirect effect filters through the supply chain more gradually. For more upstream industries, about 75% of the indirect effect shows up in their prices within six months, while prices in more downstream industries can take more than two years for 75% of the increase to pass through to buyers. A spike in oil prices will continue to ripple through inflation numbers long after the original shock.

The authors also apply their analysis to remove the direct and indirect effects of oil prices on official measures of inflation going back to 1960. In one example, this analysis suggests that the twin jolts of the Arab oil embargo of 1973 and the 1979 Iranian revolution, which each caused a sudden and unexpected rise in oil prices, weren’t directly responsible for the extreme inflation in the 1970s and 1980s. (However, they almost certainly contributed to consumer expectations of the runaway inflation that occurred.)

As for the current COVID-19-influenced inflation episode, falling oil prices in the early months of the pandemic masked other factors contributing to overall PCE inflation, which the analysis suggests would have been about 3.5% if the oil effects had been excluded, instead of the published 0.6% in May. By January 2023, PCE inflation would have been nearly a percentage point higher without the direct and indirect effects of oil price changes. The economy — minus the influence of oil — was more inflated than policymakers could see at the time and this may have colored the Fed’s expansive response to COVID-19 and its aftershocks.

Featured Faculty

-

Brian Wheaton

Assistant Professor of Global Economics and Management

About the Research

Minton, R. and Wheaton, B. (2023). Delayed Inflation in Supply Chains: Theory and Evidence.