Study of L.A.-area restaurants gauges effect on owners, customers, landlords

The tight U.S. labor market, coming out of COVID-19 lockdown, seems to be doing what unions and others have long struggled to achieve: setting a $15 minimum wage, in many locales, more than double the federal legal minimum of $7.25.

A long list of major retailers, including Amazon and Costco, are now at or above $15 an hour and still can’t fill many jobs, suggesting wages could move still higher for entry-level positions. Arguments that a minimum wage can create jobs, rather than destroy them, are gaining currency. And the phenomenon known as monopsony — major employers using monopoly-like power in local labor markets to depress wages — is getting attention outside academic circles.

It all adds up to an enormous shift in actual pay and in the long-running debate over minimum wage. The escalating wages occurring in the marketplace, however, don’t answer the question long argued over — in expert testimony, industry and labor advocacy, and from individual workers and employers — when minimum wage hikes come through the drawn-out legislative process: Who pays?

That’s the question taken up in a working paper by University of Chicago’s Christopher Esposito and UCLA Anderson’s Edward Leamer and Jerry Nickelsburg. Drawing on a unique set of mandated wage hikes in the Los Angeles area, the researchers present evidence that minimum wage changes led area restaurants to raise prices, change menu items, obtain lower rents in the high wage areas and, in some cases, caused eateries to shut down.

The Effect Of Different Wage Requirements In Bordering Areas

Which of these parties sacrificed most — customers, landlords or owners — depended largely on the wealth of the restaurant’s surrounding area and the proximity of competition subject to different wage requirements, the study suggests.

Some background: Starting in 2015, the city of Los Angeles and the state of California legislated separate series of minimum wage hikes, at different rates of escalation. The changes, adopted variously by 88 municipalities within Los Angeles County, created a patchwork of dueling minimum wage requirements across the county.

In multiple border areas, hundreds of employers find themselves face to face with competitors subjected to higher (or lower) wage requirements. The city rate will continue to be significantly higher than the state rate until 2022 when annual increases are supposed to converge for everyone at $15 an hour.

Study of minimum wage has long been hampered by an inability to filter out other economic factors when studying wage impacts on employment levels and business results, and the issue has often devolved into an ideological debate instead. Thus, the Los Angeles area represents a unique opportunity, with nearly identical businesses literally across the street from each other at times, facing the same economic situations except the mandated minimum wage.

The study team sampled 800 restaurants randomly from health inspection records. Each restaurant was categorized by its minimum wage schedule (city or state), whether in or out of a border area, and its census tract income level. The study team set the state, nonborder areas as a reference (control) group, then compared the difference in changes of pricing, menus and closures there to those in border areas and the city-rate, nonborder group.

- In affluent neighborhoods, restaurants raised menu prices. In areas away from competition with a lower minimum wage, the price hikes were enough to cover almost all of the cost of the higher wages.

- Restaurants in lower income neighborhoods rarely passed on the costs in such a direct way. Instead, they changed menu items, possibly swapping in items with bigger profit margins.

- Landlords could be compelled by market pressure to lower rent for tenants whose hourly wage requirements rose above that of nearby competition. Then some of the burden of the minimum wage increases is borne by the landlords.

- Of 800 restaurants in the initial sample, 166 had closed by the end of the four-year survey in December 2019. Restaurants on the higher wage side of border areas were most likely to close in both affluent and low-income areas, which suggests that the higher wage rates factored into some closures. Areas far from the boundary where the minimum wage changed, whether city or state rates, had much lower closure rates.

The study did not address whether workers themselves increased productivity, suffered job losses, worked fewer hours or otherwise supported rising wage requirements. Nor does it explore business profit changes beyond closings.

While major, national employers have adopted $15 as a starting wage, many smaller employers and those in areas with less competitive labor markets, remain far below that area. Some of the biggest employers publicly support a mandated $15 wage, which of course would force higher costs on some of their competitors. So legislative efforts to lift state and local minimum wages could continue.

And the data from Los Angeles County, with more than 10 million people and nearly twice as much land as Delaware, has implications for the national debate over fair minimum wages, as well as the research needed to create constructive minimum wage policies.

A Cheaper Side Of The Street

Although California’s minimum wage technically covers all employers in the state, its cities and counties can require higher (not lower) minimums. Dozens of independent municipalities that lie wholly within Los Angeles County adopted the state rate schedule. The city of Los Angeles, however, adopted a schedule that made rates for its businesses $0.75 to $1.50 higher than the state minimum until 2022. Santa Monica, Malibu and unincorporated Los Angeles County were among a handful of jurisdictions that also adopted the city rate schedule.

For employers keen on paying no more than required minimums, the state-ruled sides of streets became obvious favorites. Between 2015 and 2019, the state wage increased to $12 an hour from $9, a 33% rise. The city rate went to $13.25 from $9, a more than 47% increase. In border areas across the county, businesses with the 47% wage hike operated within a mile of competitors that paid only 33% more.

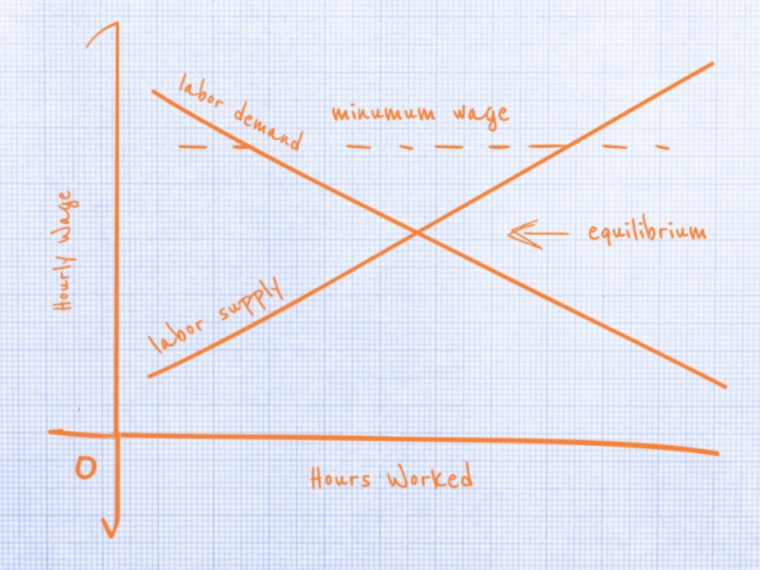

Research on minimum wage has focused on a handful of ways employers might generate funds for such rate increases, UCLA’s Leamer explains in an interview. Some pull the extra wages from their own profits. Or maybe they raise prices, requiring customers to pay the higher costs.

Landlords, the researchers argue, also have a keen interest in helping out their tenants on high wage sides of borders. “The restaurants will just go across the street (for cheaper labor), unless there are significant rent reductions,” Leamer says. It’s expensive, he notes, for a landlord to convert restaurant properties for other uses.

Alternatively, he says, the employee collecting higher wages can pay for them by working harder to produce more company profits, by always showing up on time or by accepting reduced hours to keep a lid on employer costs. Collectively, workers may bear the cost burden if employers simply shut down or lay off workers. Ideally, all the workers that got raises could cover the additional cost by increasing their spending enough to boost businesses throughout the economy, as well as for their own employers.

Complicating Fair Policy

Some 29 states and 45 municipalities have already rejected the federal $7.25 an hour minimum as inadequate, and many have (or are on schedule to) more than double the federal requirement to $15. If the Raise the Wage Act of 2021 succeeds in boosting the national rate to $15 an hour by 2025, about 17 million additional workers would either get a raise (or have a floor put under market wages they’ve recently achieved), and another 10 million more are likely to win raises, according to estimates by the Congressional Budget Office.

The differences in reactions between Los Angeles restaurants in affluent and low-income areas make a case for localized rates that vary with area wealth, the researchers note. However, they continue, the study uncovered several unintended consequences with wages set so granularly.

Customers make their choices at least in part based on the fallout from uneven wage rates, the findings suggest. They appear inclined to move their business out of high wage restaurants when a cheaper wage option is nearby. (Even restaurants in wealthy areas went out of business more frequently when they were on the high sides of borders.) Landlords, too, stood to gain or lose depending which side of wage borders their properties stood.

Balancing these offsetting effects will be one more requirement for crafting fair and effective minimum wage policies.

Featured Faculty

-

Edward E. Leamer

Director, UCLA Anderson Forecast; Chauncey J. Medberry Chair in Management; Distinguished Professor Emeritus of Global Economics and Management

-

Jerry Nickelsburg

Adjunct Full Professor and Director, UCLA Anderson Forecast

About the Research

Esposito, C., Leamer, E.E. and Nickelsburg, J. (2021). Who Paid Los Angeles’ Minimum Wage? A Side-By-Side Minimum Wage Experiment in Los Angeles County. doi:10.3386/w28966