Homebuyers ignore warnings of rising seas; lenders keep lending

A financial crisis often seems to arrive out of nowhere — dot-com stocks plunging in 2000, the American mortgage meltdown of 2008 — but when we look back, we always find early and substantial signs of trouble to come. What’s more, these crises are often preceded by a very public debate over their likelihood, with the doomsayers initially few and often mocked.

A decade or two from now — perhaps much sooner — we may be parsing the early signs of the Coastal Housing Crisis, brought on by climate change and its rising seas. If present trends continue, that crisis would also involve soaring home prices and mortgage debt in the most flood-vulnerable zones, and regular, if not catastrophic, flooding that makes once-prized areas undesirable, if not unlivable.

That could lead to hundreds of billions of dollars in losses, given the $1 trillion-plus size of the market and even a modest correction.

Opt In to the Review Monthly Email Update.

Rising seas are creeping onto large swaths of today’s expensive coastal markets, and the encroachment is accelerating. Unless trends in carbon emissions change, the higher sea levels will leave millions of U.S. coastal homes underwater or chronically flooded before the year 2100, according to forecasts endorsed by thousands of scientists.

Long before these houses become uninhabitable, buyers will begin to price them as risky assets, rather than the top-dollar luxuries they are today.

When the market correction comes, perhaps due to a particularly devastating hurricane season and resulting change in sentiment about homes near the water, taxpayers and institutional investors stand to lose money alongside coastal homeowners. And, if the country is unlucky, this could trigger broader economic repercussions.

If that scenario seems hyperbolic, take a look at the fresh wave of research on sea level rise. Note that investment banks, financial regulators and municipalities have joined climate scientists and environmental activists in worrying about rising seas:

- In Florida, coastal home prices recently started declining, after sales volume first tailed off, even as the broader housing market continues to gain value. This is a pattern seen in past real estate bubbles, according to a University of Pennsylvania study.

- BlackRock, the G20-backed Financial Stability Board and the U.S. Commodity Futures Trading Commission are voicing concerns about unflagged flood risks squirreled away in mortgage-backed securities, bond markets and other real estate-backed investments. Common themes: The exact size of exposure is elusive but big; markets don’t currently price for it; these assets pose a threat to the stability of the global financial system.

In the Bloomberg Barclays Aggregate Index, which is a popular investment among pension funds and other conservative investors, about one-fifth of the underpinning properties were in New York, Houston and Miami; cities particularly vulnerable to sea level rise. —BlackRock

- U.S. lenders continue to underwrite sales of homes exposed to sea level rise, even as they are taking steps to insulate themselves from the risks. These moves include selling the exposed loans to Freddie Mac and Fannie Mae faster than their other mortgages. The transactions move the risk of default to Fannie and Freddie, which are ultimately backed by taxpayers.

- Millions of at-risk homes lack sufficient flood insurance. Homes that have any coverage typically buy it through the National Flood Insurance Program, an insolvent program also guaranteed by taxpayers.

“Alarmingly, more than half of that (at-risk property) exposure is estimated to lie outside FEMA flood zones. That means those properties are at higher risk of being underinsured, and, therefore, the loans attached to them are at higher risk of impairment, with increased risk for the value of the related CMBS (securities).” —CFTC

- Borrowing costs among coastal governments are rising as municipal bond investors demand more from issuers in places where sea level rise will threaten property values.

In the actual housing market, however, evidence of this threat is hard to find. Some 40% of the U.S. population lives along the continental coasts, according to the National Oceanic and Atmospheric Administration. Values on homes exposed to sea level rise usually trend up as fast as prices on less risky properties nearby. Where price trends on coastal properties have broken from broader markets, discounts are typically minimal.

“Coastal real estate is still in high demand in the U.S., whether in California or on any other coast,” UCLA Anderson Forecast’s William Yu writes in a recent report. “An ocean view and proximity to the beach continue to make these properties more expensive and attractive to buyers despite warnings of danger.”

In California’s coastal home market, Yu finds some 66,600 homes housing about 155,600 people likely to drop in value under moderate scenarios for sea level rise. He estimates potential property value losses in the state at about $93 billion, or slightly less than 1% of the total California housing value.

And yet, prices on California homes most at risk from sea level rise climbed faster between 2011 and 2020 than the state’s housing market at large, and faster than coastal homes in less exposed locations nearby, according to Yu’s findings. Building in these zones continues.

HOW HIGH WILL THE SEAS RISE?

The U.S. Global Change Research Program developed three categories of risk projections varying according to future levels of global carbon emissions, a determining factor in ice melt that causes sea level to rise.

*The high scenario assumes increases in carbon emissions continue at recent (pre-pandemic) rates: average sea level rise around the U.S. of about 2 feet by 2045 and about 6.6 feet by 2100.

*The intermediate scenario assumes mitigation efforts turn carbon trends down by midcentury: sea levels rise an average of about 1 foot by 2035 and 4 feet by 2100.

*The low scenario assumes more immediate reductions in carbon emissions, similar to those outlined in the 2016 Paris Agreement: 1.6 feet by 2100.

For homeowners in risky areas now, the slow creep of rising seas and the parallel threat of sudden destruction from increasingly violent storms are more financially dangerous than the end-of-century forecasts. A stunning ocean view might still attract top dollar, even as king tides occasionally sop the lawn. But homebuyers start losing interest when regular tides flood cars five, six, seven times a year. That could occur decades before what’s known as chronic inundation, defined as tidal flooding covering at least 10% of the community 26 times a year or more.

Yu suspects market corrections will play out slowly and locally, varying as effects of sea level rise become apparent. But extreme weather could trigger sharper and more widespread corrections, he says. Potential buyers tend to remember images of major devastation, he says, whether its floodwaters plowing through houses or wildfires consuming them.

The question is no longer if rising seas will erode coastal home values, but who will get stuck with the devalued assets when the markets turn.

Threats to Homes and People

The most respected projections for sea level rise and its effects come from massive, peer-reviewed research projects that involve hundreds of experts across academia, government and the private sector. They include separate reports published by government-backed groups such as the United Nations Intergovernmental Panel on Climate Change and the U.S. Global Change Research Program, as well as nonprofit organizations including the Union of Concerned Scientists and First Street Foundation. A few takeaways:

- By 2100, nearly 490 communities nationwide will experience chronic inundation. These include Huntington Beach and San Mateo, California, as well as roughly 40% of all oceanfront communities on the East and Gulf coasts. That’s an intermediate scenario, not worst case.

- FEMA designations incorrectly peg millions of properties as having little risk of flooding, according to most experts. By the agency’s own accounts, some 40% of flood insurance claims between 2017 and 2020 were on properties its maps deemed low risk.

- The rate of sea level rise has generally picked up in recent years and is expected to rapidly accelerate in coming decades. Beyond 2100, sea level will continue to rise for hundreds of years more.

“Our research suggests many of these risks are not priced in.” —BlackRock

An Omen from Florida

The Great Recession taught us a lot about housing market trends ahead of a crash. The number of homes sold trends down for months or years before prices react. By the time home prices crashed in 2008, annual sales volumes had fallen for almost two years, running about 60% below the peak volume when prices began declining.

Florida’s coastal market appears to be following that pattern. Home sale volumes on the most flood-exposed properties declined 16% to 20% relative to less exposed areas between 2013 and 2018, according to a working paper by University of Pennsylvania’s Benjamin Keys and Philip Mulder. Prices, however, only recently disconnected from the broader market rise, they find. Between 2018 and 2020, they calculate relative prices in the at-risk locations declined 5%.

The authors attribute the trends to typical real estate bubble dynamics, in which prospective sellers remain confident in their value estimates long after buyers turn pessimistic.

Lenders Are Catching on

Lenders in coastal counties from the Texas Gulf Coast to Carolina’s Outer Banks are targeting loans on flood risk properties for rapid securitization, according to a 2020 study in Climatic Change by Tulane’s Jesse Keenan and Jacob T. Brandt. In 2009, local lenders sold 43% of their mortgages on exposed homes, which was about the same rate of securitization as their other home loans. By 2017, they were unloading 57% of loans with flood risk while remaining relatively constant in the less exposed group, the study finds.

HEC Montreal’s Amine Ouazad and Johns Hopkins’ Matthew E. Kahn found a similar effect when looking at thousands of mortgage lenders in areas hit by major hurricanes between 2004 and 2012. After a storm created at least $1 billion in property damage, local lenders increased the share of home loans sold to Fannie and Freddie by almost 10%, according to their working paper.

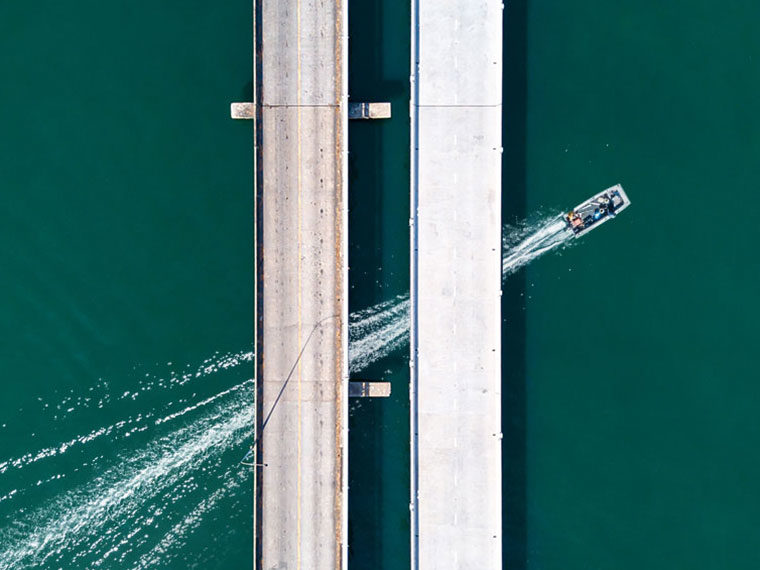

SEE THE THREAT

Online tools make it easier to visualize the effects of rising seas.

Floodfactor.com offers detailed predictions for any property. It shows chances of flooding 5, 10, 15 years out and more. The tool is a vast improvement over FEMA’s floodplain maps, which are not user-friendly and, in many cases, grossly underestimate flood risks. For some 6 million properties, the updated ratings reveal flood risks that don’t show up on FEMA maps.

Hidden Risks for Investors and Taxpayers

Investment institutions and regulatory agencies, researching flood risks within financial markets and portfolios tied to real estate, generally find the size of the problem all but impossible to quantify, yet disturbing:

- Fannie and Freddie carry about $5.6 trillion in assets, mainly home mortgages and related securities. Ultimately, taxpayers backstop the payments on loans under the agencies’ control, UCLA’s Yu explains. Their regulator, the Federal Housing Finance Agency, issued a request for information in January, in part to assess flood risks. The entities require flood insurance that might mitigate their losses only on properties inside FEMA’s poorly drawn flood zones. Coverage limits imposed by NFIP — $250,000 for the structure and $100,000 for personal property — mean many coastal homes that have coverage are grossly underinsured.

- In a November 2020 report, The Financial Stability Board, an international advisory group, warned that climate risks could “amplify credit, liquidity and counterparty risks and challenge financial risk management in ways that are hard to predict.”

A confluence of natural disasters due to climate change “could lead to a sharp fall in asset prices … This could have a destabilizing effect on the financial system, including in the relatively short term.” —Financial Stability Board

- BlackRock in 2019 analyzed mortgage-backed securities affected by recent hurricanes that hit Houston and Miami: Roughly 80% of properties lie outside FEMA flood zones. The finding suggests ferreting out at-risk properties before securitization is especially difficult.

“Within a decade, more than 15% of the current S&P National Municipal Bond Index by market value would come from (metropolitan statistical areas) suffering likely average annualized economic losses from climate change of up to 0.5% to 1% of GDP. The impacts are projected to grow more severe in the decades ahead.” —BlackRock

Watch the Bonds

The municipal bond market may give off early warnings ahead of price declines in coastal housing. This is where banks, pension funds, nonprofits and other, often conservative, investors lend money to cities and states. These investors, research suggests, appear sensitive to the risks.

“Extreme weather events pose growing risks for the creditworthiness of state and local issuers in the $3.8 trillion U.S. municipal bond market. … A rising share of muni bond issuance over time will likely come from regions facing economic losses from climate change.” —BlackRock

One working paper, examining a sample of municipal bonds issued by school districts in coastal counties, finds no relationship between an issuer’s sea-level rise risk and its bond credit spreads prior to 2014, when prominent research groups like IPCC publicly doubled projections of sea level rise. Between 2014 and 2017, credit spreads for exposed districts widened steadily, according to findings by Yale’s Paul S. Goldsmith-Pinkham, Pennsylvania State’s Matthew Gustafson, University of Colorado’s Ryan Lewis and University of Pennsylvania’s Michael Schwert. The authors suggest investors are becoming aware of greater risks in coastal investment but are not yet pricing in the potential for material losses.

The findings are similar to those in a study published last year in the Journal of Financial Economics. Saint Louis University’s Marcus Painter looked at costs of issuing bonds for counties whose expected annual loss from sea level rise is at least 1% of its GDP. He finds these counties pay more in underwriting fees and initial yields to issue long-term bonds but not short-term debt.

Featured Faculty

-

William Yu

Economist, UCLA Anderson Forecast

About the Research

Keys, B. and Mulder, P. (2020) Neglected No More: Housing Markets, Mortgage Lending, and Sea Level Rise.

BlackRock Investment Institute (2019). Getting Physical: Scenario Analysis for Assessing Climate Risks.

Financial Stability Board (2020) The Implications of Climate Change for Financial Stability.

Report of the Climate-Related Market Risk Subcommittee, Market Risk Advisory Committee of the U.S. Commodity Futures Trading Commission (2020) Managing Climate Risk in the U.S. Financial System.

Yu, W. (2020). Sea Level Rise and Its Impact on California Housing Markets, The UCLA Anderson Forecast, December 2020.

U.S. Global Change Research Program (USGCRP) (2018). Impacts, risks, and adaptation in the United States: Fourth National Climate Assessment.

Oppenheimer, M., B.C. Glavovic , J. Hinkel, R. van de Wal, A.K. Magnan, A. Abd-Elgawad, R. Cai, M. Cifuentes-Jara, R.M. DeConto, T. Ghosh, J. Hay, F. Isla, B. Marzeion, B. Meyssignac, and Z. Sebesvari, (2019): Sea Level Rise and Implications for Low-Lying Islands, Coasts and Communities. In: IPCC Special Report on the Ocean and Cryosphere in a Changing Climate [H.-O. Pörtner, D.C. Roberts, V. Masson-Delmotte, P. Zhai, M. Tignor, E. Poloczanska, K. Mintenbeck, A. Alegría, M. Nicolai, A. Okem, J. Petzold, B. Rama, N.M. Weyer (eds.)].

Union of Concerned Scientists (2017) When Rising Seas Hit Home.

First Street Foundation (2020) The First National Flood Risk Assessment: Defining America’s Growing Risk.

Keenan, J.M. & Bradt, J.T. (2020). Underwaterwriting: From Theory to Empiricism in Regional U.S. Coastal Mortgage Markets. Climatic Change.

Ouazad, A. and Kahn, M.. (2021) Mortgage Finance and Climate Change: Securitization Dynamics in the Aftermath of Natural Disasters.

Goldsmith-Pinkham, P., Gustafson, M.T., Lewis, R.C. and Schwert, M. (2019) Sea Level Rise and Municipal Bond Yields.

Painter, M. (2020) An Inconvenient Cost: The Effects of Climate Change on Municipal Bonds. Journal of Financial Economics.