Sebastian Edwards finds Keynes’ public take-down of Roosevelt’s gold policies still relevant today

In 1933, when Franklin D. Roosevelt’s bold economic experiments were just beginning to raise both hope and doubt about an end to the Great Depression, a famous British economist offered a colorful critique. In an open letter that ran almost a full page in the New York Times, John Maynard Keynes berated the president’s gold program, suggesting that he might have been subjected to some “crack-brained and queer” economic advice, and he asserted that FDR had his priorities wrong. While FDR mostly had the right idea in undertaking grand policies, Keynes’ letter seems to say, the president needed a better understanding of how and when to implement them.

The letter predates Keynes’ General Theory of Employment, Interest and Money, the 1936 book that would convince generations of economists that capitalism sometimes needs heavy-handed economic policies to function smoothly. But with these directions to FDR, Keynes offered an early look at how he thought economic policy should be practiced during times of crisis.

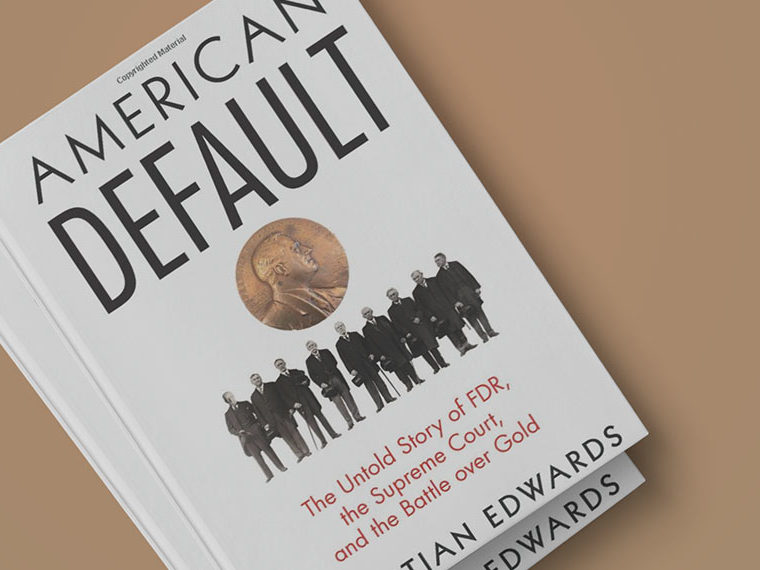

UCLA Anderson’s Sebastian Edwards makes a detailed analysis of Keynes’ letter in a working paper that is part of a project that led to Edwards’ new book, American Default: The Untold Story of FDR, the Supreme Court, and the Battle over Gold (Princeton University Press, 2018). The paper particularly focuses on Keynes’ insistence that FDR successfully implement recovery policies, such as programs aimed at raising prices or reducing unemployment, before imposing reform policies, such as regulations for fair wages. In Keynes’ letter, Edwards finds a certain sequencing of policies — a sort of order-of-go for economic stimulation — that suggests strategies devised and successfully employed decades later by governments in the chaotic economies of Latin America and the former Soviet Union.

Opt In to the Review Monthly Email Update.

In the letter, Keynes chastised FDR for taking on reform projects before gaining investor and public confidence from successful recovery policies. But the letter does not specify which policies were most likely to bolster confidence.

To Edwards, Keynes’ letter essentially advocates for exchange rate stability as a key component of building support during economic crisis. Keynes’ emphasis on this factor comes through in the repeated criticism he lobbed at FDR’s gold-related policies, Edwards states.

Keynes wrote that FDR’s policies, which included abandoning the gold standard and buying almost all of the nation’s gold at arbitrary prices, had set up an undignified and counterproductive “game of blind man’s bluff with exchange speculators.” In another oft-cited passage from the letter, Keynes said, “The recent gyrations of the dollar have looked to me more like a gold standard on the booze than the ideal managed currency of my dreams.” Keynes went on to criticize the “foolish” reasoning behind the gold-buying program.

The question of how to sequence policies for economic stimulus became a hot topic among economists in the 1980s and 1990s. Debt crises in Latin America and the fall of the Soviet bloc led to numerous countries’ looking to reduce inflation, open up markets to competition and stabilize public accounts. Experts in academia and institutions such as the World Bank debated whether all goals should be tackled as quickly as possible, or if a certain order of policy might work better. Getting the right policies in the right order remains crucial. Following the 2009 financial collapse, governments were criticized roundly for installing (or forcing others to install) austerity policies before national economies had begun to revive, lengthening and deepening the downturn in the view of many; in Europe, at least, currency stabilization was less an issue this time around thanks to the earlier adoption of the Euro.

Although Keynes’ letter to FDR isn’t mentioned in the literature that came from those debates, Edwards finds parallels between the consensus findings of the late 20th century and the sequencing advice Keynes gave to FDR five decades earlier.

An ordered sequence of policies that generated confidence in the process is key to long-term success, the modern economists determined. Creating a stable and competitive exchange rate, they maintained, is necessary for credibility. “By emphasizing the key role of the exchange rate in programs of deep economic transformation, literature of the 1980s and 1990s was remarkably Keynesian,” Edwards concludes.

Featured Faculty

-

Sebastian Edwards

Professor of Global Economics and Management; Henry Ford II Chair in International Management

About the Research

Edwards, S. (2018). Keynes on the sequencing of economic policy: Recovery and reform in 1933.