Topic: Banking

Rise of Nonbank Lenders Undermines Community Reinvestment Act Effectiveness

Traditional banks pull out of lower- and median-income neighborhoods the federal program aims to help

A Quiet Expansion of Deposit Insurance Could Disrupt U.S. Banking

Seen as a backstop to small- and midsized banks, the program, allowing insurance in multiples of $250,000, alters banking’s risk calculus

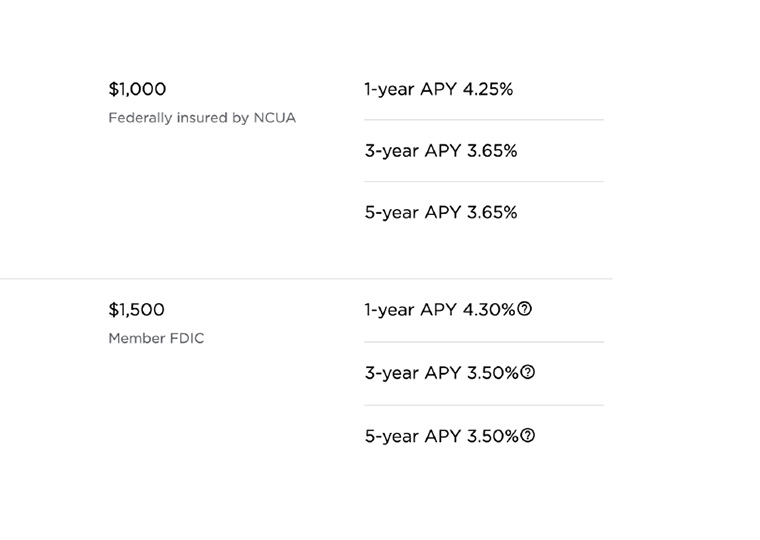

CD Withdrawal Penalties: Often More Than Worth the Risk

Banks know you won’t do the math: Even after a penalty for early withdrawal, the longer-term CD often nets out to a better deal

How Banking’s Bifurcated Deposit Approach Is Altering Lending — and Risk

Offering higher deposit rates lessens emphasis on loans of fixed rate and longer maturity

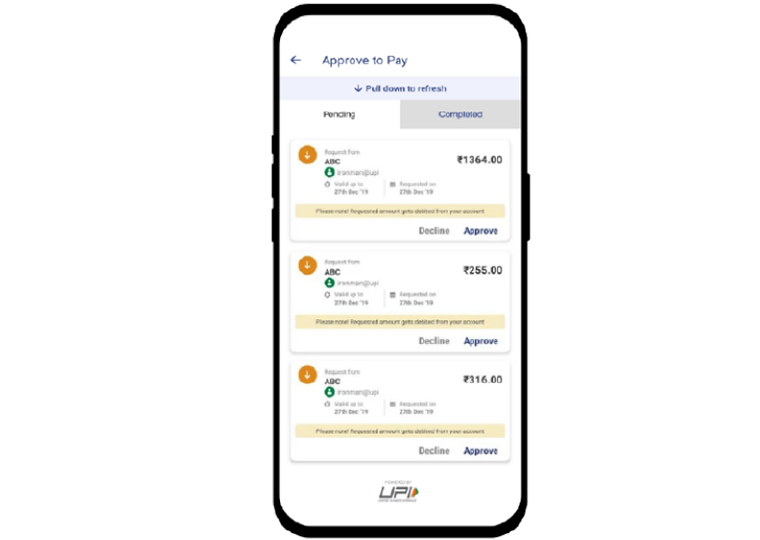

Cashless Payments: Faster Transactions, Easier Borrowing and Increased Household Income

System provides digital record of payments for India’s vast self-employed ranks, satisfying lenders, and raising the likelihood of starting a business

Why Do Banks With Little Skin in the Game Still Monitor Borrowers?

Tax policy change triggers an incentive for lenders to be more aggressive

Why Big Banks Can Pay Less on Deposits

Their level of technology and services makes up for it; it’s vice versa with little banks

Can Banks, Disrupted by Fintech, Adopt New Habits, Too?

In China, patent data shows commercial banks’ use of new technologies helps improve efficiency and reduce risk

Local Banks Provide an Early Warning System on Recessions

When they’re forced to pay up for deposits, it’s a bad sign for area’s economy

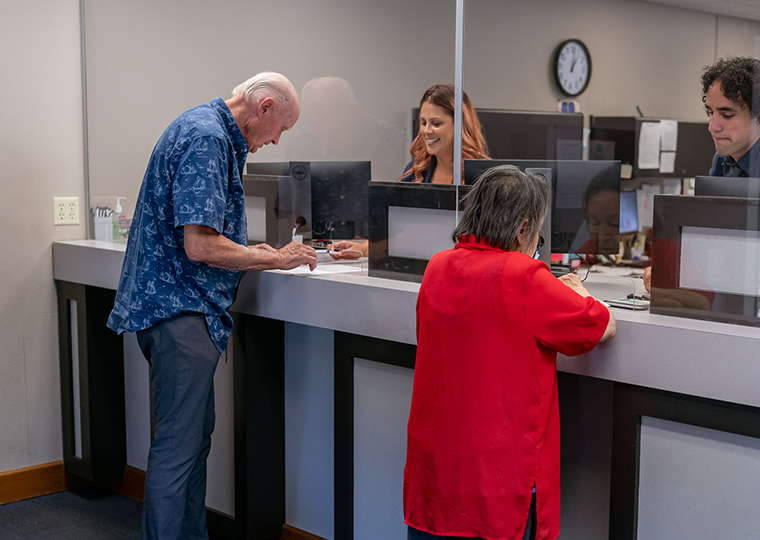

Mobile Banking, a Boon to Many, Disadvantages Those Who Bank at Branches

Banks close neighborhood outlets and raise prices for branch-delivered services

Looming Risk to Financial System: $1 Trillion in Commercial Loan Pools

Known as collateralized loan obligations, their aim is actually to reduce risk

Banks Transmit Financial Shocks, Including from Natural Disasters

How a localized flood may result in fewer loans to a far-off community

In a Crisis, Solvent Borrowers are Overcharged, Subsidizing Troubled Bank Clients

An unusual data trove from Greece’s economic collapse reveals the practice

Sorting Out Conflicts of Interest in Commercial Loan Syndicates

Syndicate voting rules reflect varying levels of trust and familiarity

Banks, Freed to Operate Across State Lines, Helped Stabilize the Economy

Lenders financed expansion in some markets, offsetting problems in others

Banks Rent Out Their Balance Sheets — So Derivatives Cost More

Even before Dodd-Frank rules, the costs were significant