Poorer residents of states refusing to expand Medicaid hit hardest

Even before the pandemic saddled COVID-19 sufferers with piles of unpaid doctor and hospital bills, medical debt was a huge burden on the financial, emotional and physical health of millions of Americans. A study published in in JAMA, sheds light on just how big that burden really is.

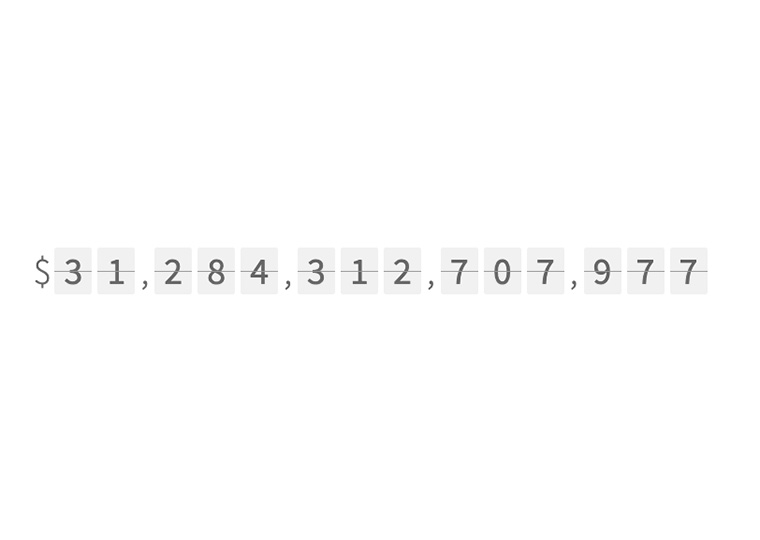

Harvard’s Raymond Kluender, Stanford’s Neale Mahoney, Francis Wong of the National Bureau of Economic Research and UCLA Anderson’s Wesley Yin analyze a decade’s worth of medical bills that were referred to collection agencies. Their estimate of total medical debt in collection — $140 billion as of June 2020 — is not only larger than previous estimates, it’s bigger than all other sources of debt in collection combined.

Medical debt is concentrated in low-income neighborhoods, in the South, and — an important finding for policymakers — in states that refused to expand Medicaid coverage under the Affordable Care Act. Medical debt was cut in half in states that took advantage of Medicaid expansion, but declined only 10% in the dozen states — eight in the South — that didn’t.

Medical Debt Concentrated in Poorest Areas

One result: The highest levels of medical debt in 2009 were found in the poorest neighborhoods in states that didn’t expand Medicaid, and these communities also experienced the largest debt increases in the decade since.

“Communities that had been most burdened by medical debt have become even worse off, in absolute and relative terms, due to their leaders choosing not to expand Medicaid,” UCLA’s Yin said in an email exchange. “The results are important because they indicate that these problems are within the control of public policy.”

COVID-19 brings renewed attention to the way the U.S. health care system weighs down patients — such as the estimated 26 million who still lack health insurance — with large medical bills. And for those with high-deductible plans, large copays and deductibles create a financial burden. A California woman hospitalized with COVID-19 still owed, after insurance, more than $42,000, which was turned over to a debt collector.

Medical debt is a leading contributor to personal bankruptcy, a factor in more than 60% of filings. Having debt in collection drags down credit ratings, making access to credit more difficult and often resulting in higher interest charges on other borrowings that can be obtained. There’s also the emotional toll of potentially harassing phone calls. And many households aren’t aware of debt-relief programs or of the ability to negotiate with health care providers on price.

To see the magnitude of the problem, the researchers analyzed a random sample of consumer credit reports from the Transunion credit-reporting agency covering January 2009 to June 2020. The sample, about 10% of the total, consisted of nearly 33 million people, with an average medical debt of $429 in June 2020, down from a high of $827 in 2010 following the Great Recession.

From that, they extrapolated total medical debt in collection at $140 billion, the largest source of debt in collection, and larger than debt in collection from all other sources combined. As high as it is, this figure doesn’t reflect all outstanding medical debt, since it doesn’t include medical bills paid with credit cards or debt that hasn’t been sent to collection agencies. It also doesn’t include the potentially large debts incurred during the pandemic.

Medical debt is also fairly concentrated — often in the most vulnerable economic groups. Of the total sample, only about 18% of the credit reports showed medical debt, with an average of more than $2,400 owed. Debt also was five times higher in ZIP codes with the lowest per capita income than in the highest income neighborhoods.

There are also stark regional differences. In the South, 24% of the reports had an average of $2,595 in medical debt. Only about 11% of reports from the Northeast included medical debt, with an average of $1,549.

Medical Debt Falls in Medicaid Expansion States

The effect of Medicaid expansion was especially important, Yin says. The ACA, in its efforts to extend health care insurance coverage to millions of the uninsured, financed states to expand eligibility for Medicaid, the federal-state program providing medical coverage for low-income and disabled Americans. A large majority of states took advantage of expansion; 12 states, all with Republican governors or legislatures, have not.

In Medicaid expansion states, new medical debt — bills sent to collection in the previous 12 months — fell sharply among all income groups, with the largest declines in the poorest ZIP codes. That reduced the gap between richest and poorest areas by nearly 40%.

The opposite occurred in states not expanding Medicaid, where the gap between the richest and poorest widened by half. These results, write the authors of a JAMA editorial about the paper, provide “further evidence of the many benefits of the ACA and specifically Medicaid expansion.”

Looking beyond Medicaid, Yin says, the findings underline the important role played by government support in easing the burden of medical debt. For example, the American Rescue Plan, a $1.9 trillion package adopted this year to speed the economic recovery from pandemic, provides subsidies for insurance premiums in ACA marketplaces, which those who lack other coverage rely on for health insurance. Yin says the subsidies, which are set to expire next year, should be made permanent. “The ARP subsidies finally make good quality health plans truly affordable,” Yin says.

Featured Faculty

-

Wesley Yin

Associate Professor of Public Policy and Management

About the Research

Kluender, R., Mahoney, N., Wong, F., Yin, W. (2021). Medical Debt in the US, 2009-2020. JAMA. doi:10.1001/jama.2021.8694