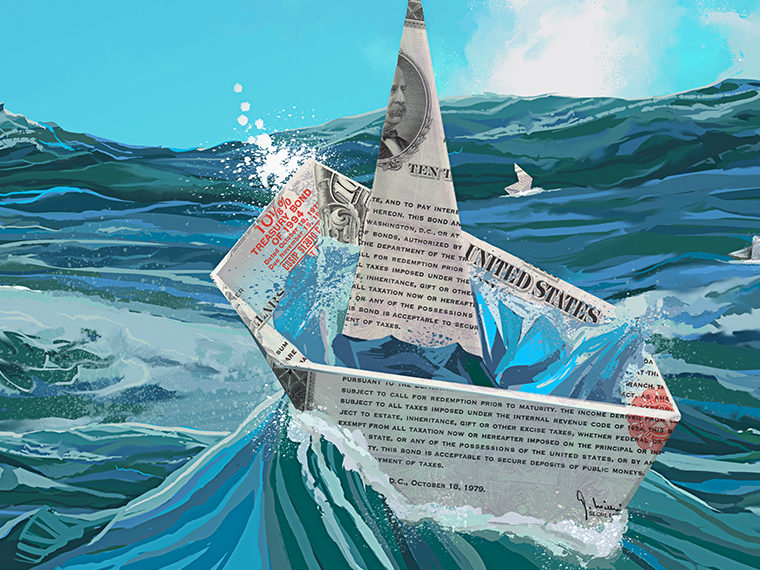

Thin stock trading, amid both price volatility and a period of potential economic change, leads bond investors to seek a higher yield

At brokerage houses and asset managers, stock and bond traders often operate separately — so how does information from the stock market transmit to the bond market?

A paper published in the Journal of Financial and Quantitative Analysis searches for a hidden information channel that connects these markets.

University of Vienna’s Stefanie Schraeder, University of New South Wales’ Elvira Sojli, UCLA Anderson’s Avanidhar Subrahmanyam and University of New South Wales’ Wing W. Tham use real market data to demonstrate how information can spill over from the equity market to the Treasury bond market. They identified a particular measure of trading activity in the stock market that can be used to predict changes in Treasury bond risk premiums (the extra return investors demand for taking on risk) whenever the condition of the economy undergoes changes.

When the state of the economy appears to be shifting (perhaps toward a more rapid growth or a slowdown), equity traders informed about this development will seek to buy or sell, but the economic uncertainty causes uninformed traders to become hesitant and cut back their trading. This is because they become suspicious that the better informed traders possess superior signals. As a result, equity trading volume falls, while stock price volatility increases. These changes result in the volatility-to-volume ratio, or VVR, increasing.

The researchers found that the equity market’s VVR ratio can be monitored as a proxy for informed traders identifying a shift in the macroeconomic state. This is important information for the Treasury bond market because periods of economic change result in larger Treasury bond risk premia due to uncertainty about events and how central banks may react.

Schraeder, Sojli, Subrahmanyam and Tham gathered data on U.S. Treasury bonds from the Center for Research in Security Prices database to calculate excess bond returns, or returns above the risk-free rate; forward rates, which are interest rates implied by current bond prices for future borrowing or lending; and data on stocks to calculate stock returns and trading volumes to determine the equity market VVR. Armed with data from January 1964 to December 2018, the researchers tested a theoretical model on real world data.

They sought to determine whether a relationship between the VVR and excess Treasury bond returns existed. They found that it did. The relationship between VVR and excess bond returns remained even after the researchers backed out other possible contributing factors to the Treasury bond risk premia, like liquidity risk, other macroeconomic factors and investor sentiment measures.

Their work suggests that the higher the equity market VVR — suggesting a greater probability of informed trading occurring — the higher the likelihood of excess Treasury bond returns. In fact, the researchers found that a significant move in VVR led to an 84 basis point increase in average expected excess Treasury bond returns.

The findings have important implications for investors, suggesting that by watching trading activity in the stock market — specifically the VVR — investors can gain insight into future performance of Treasury bonds. The researchers’ work also highlights the importance of considering how information may flow across markets when studying asset pricing.

Featured Faculty

-

Avanidhar Subrahmanyam

Distinguished Professor of Finance; Goldyne and Irwin Hearsh Chair in Money and Banking

About the Research

Schraeder, S., Sojli, E., Subrahmanyam, A., & Tham, W. W. (2023). Equity Trading Activity and Treasury Bond Risk Premia. Journal of Financial and Quantitative Analysis, 58(2), 677-710.