Topic: Bond Market

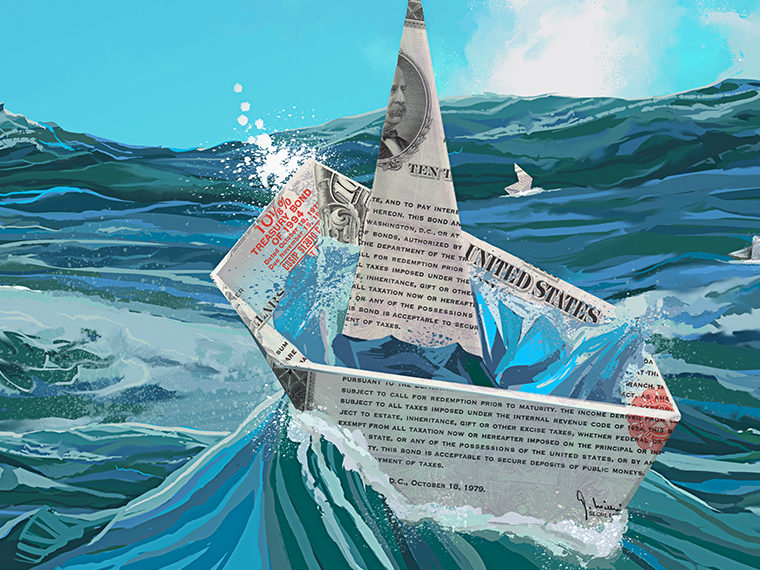

How Quantitative Easing Changed the Bond Market

Investors’ future expectations about QE policy lowered long-term yields, made investors feel safer holding the bonds

One Way the Stock Market Sends Signals to Bond Traders

Thin stock trading, amid both price volatility and a period of potential economic change, leads bond investors to seek a higher yield

How Banking’s Bifurcated Deposit Approach Is Altering Lending — and Risk

Offering higher deposit rates lessens emphasis on loans of fixed rate and longer maturity

Unintended Consequence of Stale Corporate Bond Fund Prices Amid Fed Tightening

In wild markets, do the most dated prices actually reduce redemptions?

Muni Bond Buyers Pay a Little Extra for the Pleasure of Not Being Taxed

Doing so, they subsidize government, which is, well, sort of like a tax

Options Market Signals Scope of Federal Reserve Interventions

Traders see an implicit promise beyond specific asset purchases

How Much Debt Can the Government Roll Over Forever?

Public bonds compete against other investments; a model of that relationship

How Bond and Stock Prices Combine to Influence Corporate Investment

Equity volatility can encourage — or dampen — investment, depending on a firm’s bond spread

Banks Rent Out Their Balance Sheets — So Derivatives Cost More

Even before Dodd-Frank rules, the costs were significant

When Financial Intermediaries Sneeze, These Assets Catch a Cold

Some investment vehicles are more reliant than others on the health of trading firms

Out of the 1990s Asian Crisis, a New Bond Market Rises

Local currency sovereign bonds transfer risk from issuer to buyer

Corporate Bond Market Meltdown Averted after Fed Action

Decade-old bank-risk limits may have exacerbated liquidity problems

A ‘Safer’ Treasury Bond

The government’s floating rate notes feature an added measure of security: higher interest earnings in times of rising rates

With Bonds, the Past Can Be Prologue

Patterns in corporate bond returns include abrupt short-term performance reversals and “momentum” waves that persist

How Life Insurers Insulate the Markets from Turmoil

Valentin Haddad’s research finds that insurers’ patient investing shields risky assets — and those who hold them — from steeper declines

Financial Constraints on Intermediaries Cause Asset Mispricing

Real-world bond data reveals how the capital positions and liquidity of middlemen affect prices of securities they broker