A review of research comes as AI promises to turbocharge the tools and regulators allege they promote price-fixing

As with much new technology, pricing algorithms were put into use before most people even knew they existed, altering purchasing decisions and management practices. Regulators, researchers and others are now working to make sense of this new pricing landscape.

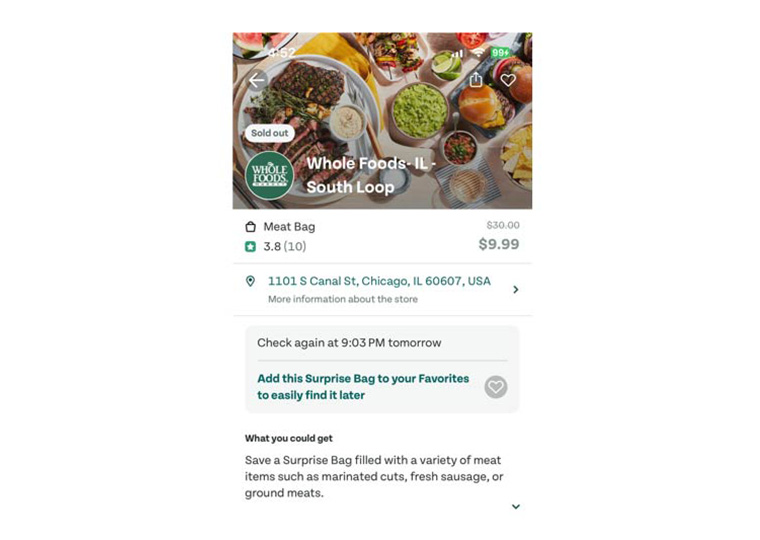

It’s been barely a decade since Airbnb laid down the new-economy gauntlet of a pricing algorithm property owners could use to optimize rental rates. Today, such tech-driven pricing systems are nearly ubiquitous, whether we’re shopping online for the kid’s school supplies or we’re the purchasing manager for a Fortune 500 company.

While pricing algorithms can benefit both business and consumers, a spate of recent lawsuits brings potential harms center stage, just as the practice is taking its next giant leap forward harnessing the power of AI.

Collusion or Merely Competition?

In September 2023, the Federal Trade Commission and 17 state attorneys general sued Amazon for monopolistic business practices. Among the allegations is that Amazon deployed a pricing algorithm that identified its own products that it could raise prices on, with a good probability that competitors on the Amazon platform would follow along and raise their prices too, to the detriment of shoppers.

Software companies providing pricing information to multifamily property managers currently face multiple lawsuits alleging price collusion. And in late August 2024, the U.S. Department of Justice, along with multiple state attorneys general, filed a civil suit against one of the largest third-party algo providers. The heart of the rental pricing dispute is the assertion that algorithm pricing software popular with commercial landlords has become the 21st century version of the clandestine backroom dealmaking among competitors. The pricing software aggregates rental market data from competitors who are users of the software and then spits out recommended rental rate advice. The FTC and the DOJ filed a “statement of interest” in one of the cases (predating the DOJ civil suit) that asserts “price-fixing by algorithm is still price-fixing.” A message intended to reach far beyond the commercial rental sector.

There are also pending lawsuits centered on how pricing algorithms give hotel booking systems an unfair advantage over consumers, and a flurry of suits and legislative proposals aimed at the convergence of pricing algos and AI.

As the legal cases play out, implications of pricing algos for consumers and regulators — and notably, for the managers who employ the tools — are under study. Thirteen researchers from around the world, including UCLA Anderson’s Robert Zeithammer, participating in an algorithmic pricing working group at the Triennial Invitational Choice Symposium in 2023, summarized the current state of research after reviewing studies on the topic. The team also proposed future research questions for this business practice.

Algos as (Inadvertent) Price-Fixers?

The literature review cites four papers published in the last four years that suggest pricing algorithms can produce “potential collusive behaviors.” One 2020 paper echoes the FTC’s recent assertion that shared third-party algorithms may be a form of price-fixing. A model, designed to study how competitor firms use the same algorithm, found that even though those competitors weren’t communicating directly, the algo was effectively guiding all of them to raise their prices to levels that wouldn’t be sustainable in a competitive market.

A 2023 paper found that real estate rental markets with a higher propensity of having property managers using pricing algos in the aftermath of the 2007-2008 financial crisis faced higher rents and lower occupancy. The working group framed this finding as being “consistent with either price coordination through the algorithm or widespread pricing errors among nonadopters.”

A 2024 study of retail gas pricing practices in Germany found that one company using an algorithm to set pricing at its stations didn’t boost profits, but once the algorithm was adopted by two or three firms and deployed across all their stations, the parent companies all enjoyed higher profit margins.

The academics who produced the research review take care to point out that, in these early stages of exploring the impact of this still fairly new technology, there’s “little theoretical certainty” that algorithmic price competition leads to collusive outcomes. That said, they also raise the yellow warning flag: “The recent capability of (large language model)-driven agents raises concerns about algorithmic collusion.”

The review cites research published in 2024 that found that when a pricing algorithm leverages LLM technology — effectively giving the system the ability to make its own decisions based on its learning — it effectively learned to “collude in oligopoly settings to the detriment of consumers.” That happened even though none of the models used in the research explicitly or implicitly mentioned price collusion.

While price collusion is the focus of litigation, there seems to be plenty of more general uneasiness among businesses about various impacts of using pricing algos. The team that produced this review conducted its own survey of more than 70 business managers with pricing oversight. While the majority said their firm employed pricing algorithms for at least some of their products, there was significant hand-wringing about how, and how much, to use it.

“The reluctance to implement pricing algorithms is not due to a misunderstanding of their benefits,” the review authors write. “On the contrary, it seems to stem from negative perceptions surrounding pricing algorithms, such as reduced transparency and managerial control, along with negative consumer perception.”

Zeithammer, in an email exchange, noting the nascent nature of the technology, cautioned that it’s impossible to know at this point precisely how companies are using the tools — or how effective the use is.

“Several key challenges remain unresolved,” the review team noted, putting forth a dozen topics for future research, touching on issues impacting businesses, consumers and regulators.

In the meantime, we also have the growing roster of lawsuits centered on pricing algos to follow for insights on how this powerful new technology will be allowed to evolve.

Featured Faculty

-

Robert Zeithammer

Professor of Marketing

About the Research

Aparicio, D., Bertini, M.,Chen, Y., Fantini, F., Jin, G.Z., Koenigsberg, O., Morwitz, V., Popkowski Leszczyc, P., Spann, M., Vitorino, M.A., Williams, G. Y., Yoo, H., & Zeithammer, R. (2024). Algorithmic Pricing: Implications for Consumers, Managers, and Regulators. (No. w32540). National Bureau of Economic Research.