Stuart Gabriel’s research shows how a vibrant economic hub loses essential residents

With median home values that are six times the national average, San Francisco and Manhattan are textbook superstar cities, the moniker ascribed to economically robust metro areas where strong housing demand collides with limited supply growth to push prices skyward.

Superstar cities have always been expensive, but growing income inequality adds a newer wrinkle. The battle for limited housing supply is increasingly becoming a faceoff among the wealthy. Less-flush colleagues a few rungs down the org chart, the service sector employees that make their city hum, and the public safety workers who make it function are effectively priced out.

The end is not nigh for boom towns like San Francisco or other superstar cities, but recent trends could portend a shifting reality. Real estate firm Redfin reports that more than 20 percent of searches by Bay Area residents lately have been for homes in Sacramento, where the median price is about 75 percent lower. And anecdotal U-Haul evidence suggests stronger demand for DIY move-outs, relative to demand for those moving into the region.

Opt In to the Review Monthly Email Update.

Danny Ben-Shahar and Roni Golan of Tel Aviv University and UCLA Anderson’s Stuart Gabriel posit that, if left unchecked, outsized housing gains “may sow the seeds of superstar city demise” (more on what “demise” means below). The researchers also develop a metric that could aid local and state officials everywhere in deciding what mix of transportation investment and additional housing units would best ease an affordability crisis.

To explore the potential for affordability run amok to unhinge an economic powerhouse, they developed a unique metric to measure the relative housing cost of Tel Aviv, Israel’s economic superstar city, compared to other parts of the country. Using a trove of Israeli housing data, they were able to estimate a tipping point at which affordability differentials are so large that a sizable chunk of homeowners would seek to move out of Tel Aviv. Their research was published online in April 2018 by Regional Science and Urban Economics.

From 1998 to 2005, Tel Aviv home prices grew at a pace in line with the country norm. But over the next decade, the authors calculate, Tel Aviv home prices appreciated 160 percent, compared to about 100 percent outside of Tel Aviv.

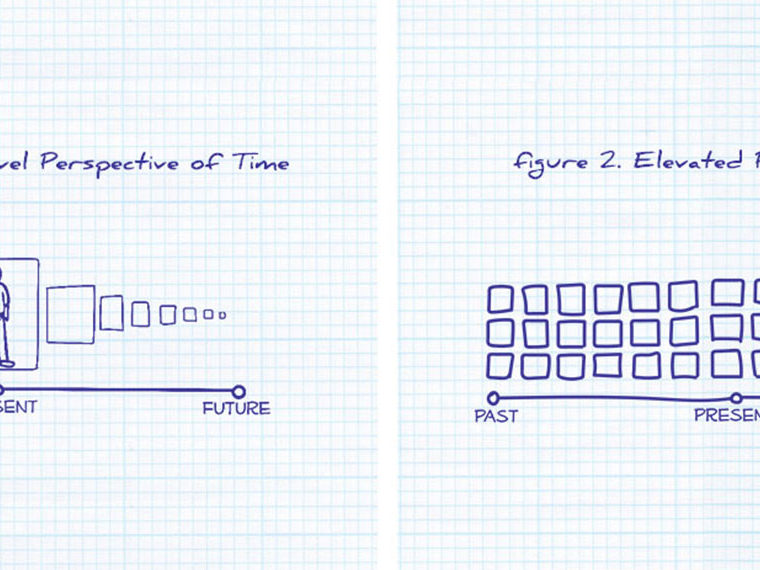

That gap becomes the focal point for Ben-Shahar, Gabriel and Golan around which to construct a new measure that calculates the extra months of after-tax income, on average, that a defined Israeli household outside of Tel Aviv would need to buy a home in Tel Aviv. Their Affordability Distance to the Superstar City (ADS) metric is a proxy for the relative quality-and-consumption-adjusted affordability gap between the superstar and the workhorse regions.

To avoid an apples-to-oranges mismatch, they took care to compare demographically similar “clusters” of households. For instance, a two-adult household with no kids in Tel Aviv was compared to a similar household outside of Tel Aviv. In 2000, that demographic needed about 58 additional months of after-tax income to be able to buy in Tel Aviv. By 2015, the ADS was above 81 months. Households with two adults and two kids saw their ADS rise from 50 months to 70 months.

Slicing housing data by physical distance to Tel Aviv exposes a similar and marked house price gradient. As the table below shows, median housing costs per square foot drop by 50 percent just 20 kilometers (about 12 miles) outside of the economic hub. At 100 kilometers (62 miles), median home prices are just one-third of what it costs to buy in Tel Aviv.

That makes for ballooning ADS levels in far-flung areas such as the Negev and Galilee regions; the authors calculate that the ADS for “peripheral” areas has stretched from about eight years in 2000 to more than 13 years in 2015. For closer-in areas, the ADS rose from less than five years to more than 6.5 years.

On a per-kilometer basis, the overall ADS in the study increased from 0.6 months of extra income needed in 2000 to 1.4 months in 2015.

Ben-Shahar, Gabriel and Golan then turn to the potential impact of this widening affordability disparity. They estimate that every 10 additional months of ADS causes out-migration from Tel Aviv to increase from 6 percent to 7 percent. Recall that their ADS calculations for 2005–2015 ranged from around 10 additional months to more than 20 months; any further widening of the income distance would seem to be a heightened public policy concern.

With that in mind, the researchers looked at the two main public policy levers — increasing the supply of housing or of public transportation to make the superstar city more accessible.

They calculate that spending the equivalent of 1 percent of Israeli GDP (in 2015, roughly $3 billion) on transportation would reduce the ADS by 35 percent. That might be more politically feasible than building out supply. Ben-Shahar, Gabriel and Golan estimate that every 100 new units in Tel Aviv would lower the ADS by 0.7 percentage points. That suggests it would take roughly 5,000 new housing units in Tel Aviv to match the potential impact of the transportation solution. Given the global penchant for nimbyists who flinch at the notion of increasing urban density as an affordability solution, that could be a harder sell. Yet in the wake of elevated affordability distance to Tel Aviv, that city may continue to see out-migration of population and jobs and related erosion in economic attractiveness.

Featured Faculty

-

Stuart Gabriel

Arden Realty Chair; Distinguished Professor of Finance; Director, Richard S. Ziman Center for Real Estate at UCLA

About the Research

Ben-Shahar, D., Gabriel, S., & Golan, R. (2018). Can’t get there from here: Affordability distance to a superstar city. Regional Science and Urban Economics. Advance online publication. doi: 10.1016/j.regsciurbeco.2018.04.006