Topic: Corporate Investment

Why Corporate Leasing Practices Deserve More Respect

Most companies use asset leasing for business reasons, not accounting window dressing

The Strange Case of the Missing Stock Market Return

Investors in leveraged companies take on extra risk, but research indicates they see no offsetting return

The Role of Board-of-Directors Pay in Effective Corporate Investing

A model juggles who should suffer when a project goes awry; job market prospects of the CEO; and the quality of information shared in the boardroom

The Debt Market’s Indirect Antidote to ESG Greenwashing

Loans that include a sweetener or penalty tied to ESG performance seem to induce more honest reporting

Sorting Out Conflicts of Interest in Commercial Loan Syndicates

Syndicate voting rules reflect varying levels of trust and familiarity

Low-Quality Earnings: The Uncoupling of Stock Price from Fundamentals

Studying Chinese A and B shares reveals investor uncertainty

Looming Risk to Financial System: $1 Trillion in Commercial Loan Pools

Known as collateralized loan obligations, their aim is actually to reduce risk

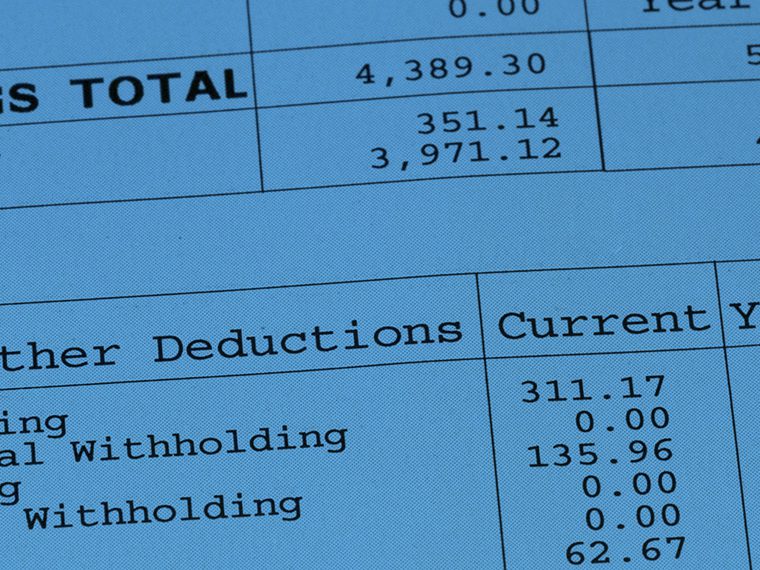

Largest Firms’ Stock Gains Skew Big Picture on Worker-Owner Income Division

Wage earners get larger (relative) share at smaller companies, not at giants like Apple, Alphabet and Amazon

How Very Small Stocks Skew Investing Wisdom

Well-known market anomalies are largely absent among the biggest stocks

How to Spur Capital Spending: Plan for Failure

Companies might invest more in new ventures if they could see in advance how to redeploy the assets if things don’t pan out

How Tech’s Disruption Alters Investors’ Appetite for Risk

New technology’s upending of the old creates demand for alternative assets to offset risk

How ETFs Muffle Stock Market Feedback to Managers

The rise of passive investing leaves companies mistrusting market signals on how best to deploy capital

How Bond and Stock Prices Combine to Influence Corporate Investment

Equity volatility can encourage — or dampen — investment, depending on a firm’s bond spread

Financial Constraints on Intermediaries Cause Asset Mispricing

Real-world bond data reveals how the capital positions and liquidity of middlemen affect prices of securities they broker

Does Cross Ownership By Big Investors Make Industries Less Competitive?

Examining executive pay tied to revenue growth to identify any correlation