During a lengthy transition, customer service — and driver income — could suffer significantly

As long as customers of Uber, Lyft and other ride-sharing companies are game to ride in an unmanned car, a future of autonomous vehicles, or AVs, could be highly profitable for the firms:

- No drivers to compensate. Uber alone said it paid out (including tips) $20.8 billion in 2025’s second quarter to some 8.8 million drivers.

- All the guesswork gone from scheduling. No drivers who clock in as they please, quit (many do) within the first year or refuse a ride. Just computer-controlled cars the companies own or lease, available virtually 24 hours a day, 365 days a year.

But arriving at the driverless future involves a long and difficult transition for the likes of Uber and Lyft, one that presents considerable corporate risks. The transition, if not managed appropriately, can result in poorer service to customers and lower income for drivers, suggests a working paper by UCLA Anderson’s Francisco Castro, Amazon’s Jian Gao and Northwestern’s Sébastien Martin.

Who — or What — Gets the Best Fares?

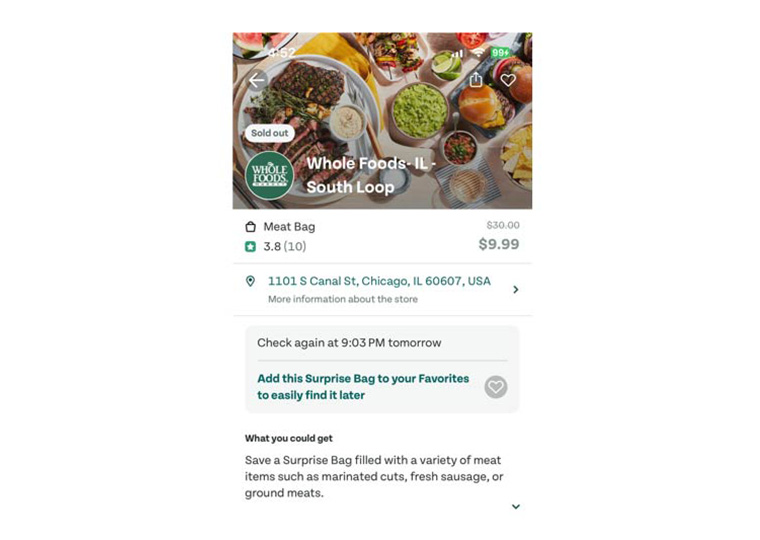

Uber has 8.8 million drivers and couriers globally. Even if one AV (working round the clock and without a lunch break) can replace three drivers, acquiring such a vast fleet and running it across cities, suburbs and in ever-changing weather will likely involve years of ramp up, investment and tweaking of operations, Castro, Gao and Martin write. Thus, a mixed fleet — some human drivers, some autonomous vehicles — presents itself as one of the most plausible interim landscapes. In Austin this is already a reality.

“The fundamentally different economic structures of these two types of supply bring an essential trade-off between a platform’s profitability and service reliability,” the authors note. “First the participation of human drivers must be secured through sufficiently high incentives and pay. Second, while autonomous vehicles do not need to be incentivized, the platform must incur the cost of buying and maintaining them. In principle, as a platform introduces AVs, it may prefer to lean more on them because they are a sunk cost, and using them is potentially more profitable than paying” human drivers.

But, if the good fares — airport runs, high demand regions and the like — go to the autonomous vehicles, human drivers will experience lower utilization or reduced fares, making some of them quit at a faster rate than AVs are introduced. There aren’t enough AVs to handle demand. Service in some regions suffers and some customers can’t get a ride. During the transition period, while autonomous vehicles can increase profitability (they don’t require a wage), there is a risk that they may hurt the business rather than help it, the researchers surmise.

Test Driving a Theory

Castro, Gao and Martin suggest that ride-hailing companies will need to adjust dispatch policies and carefully balance driver pay and opportunity with platform profitability to avoid precipitous dips in service.

To see how the introduction of self-driving cars might affect one’s ability to hail an Uber, Lyft or Via in New York City, the researchers created a simulator based on the 1.1 million trips that occurred between 11 a.m. and 1 p.m. on workdays during the month of January 2020, before traffic was affected by the COVID-19 pandemic. In the experiment, the simulator acts as dispatcher, estimating travel and arrival times and dispatching the car nearest to a ride request. The researchers predict the human drivers’ response as they vary the number of autonomous vehicles in the market.

In the simulation, the introduction of self-driving cars into New York City hurt service in a couple of ways. It pushed some drivers out of the market. It also caused the platforms to locate the autonomous vehicles in the highest-demand parts of the city where they would be most profitable, leaving shortages in other areas.

In a simulation of 13,000 driver-driven cars (and no self-driving cars), the service level was 93% —meaning 93% of those requesting rides got them. As driverless cars were added to the mix, the platform tended to prioritize them, reducing human drivers’ earnings and driving some of them out of the market at an increased rate. When the service level dips below a threshold, to slow down the exodus of humans while maintaining profitability, the platform starts to reprioritize driver-driven cars until it amasses a large enough fleet of AVs. Eventually, the platform only operates AVs. In a simulation of 9,000 self-driving cars (and no driver-driven cars), 84% of those requesting rides got them.

The impact was uneven. Service in Times Square dropped by about 5%. In the Stapleton neighborhood on Staten Island, service fell 13%. Wait times increased, too — and disproportionately. The time it took to get a car in Times Square rose by about one minute on average. In some suburbs, the wait time increased by an average of 20 minutes. The experiment assumes that 20 minutes is the longest time customers will wait for a ride before canceling it.

Disrupting the Industry that Disrupted Transit

The paper adds to a growing body of research that explores the possible impact of self-driving cars on ride hailing and proposes different ways to manage hybrid fleets. One study predicts that the lower cost of self-driving cars may not lead to lower prices. Another suggests that the introduction of autonomous vehicles into a ride-hailing fleet won’t necessarily harm — and might benefit — drivers, depending on a platform’s dispatching policy.

Some research indicates it may be optimal for a ride-hailing platform to strategically reject demand in low-demand locations to induce drivers to reposition themselves in high-demand locations.

Other research suggests ways that the use of autonomous vehicles can be adjusted in order to keep traditional drivers engaged.

Meanwhile, AV technology is being refined. Uber, Lyft and Alphabet’s Waymo are running test pilots in various cities. Amazon’s Zoox is developing an autonomous taxi. Cars are driving themselves all over San Francisco and Los Angeles.

The research suggests that the ride-hailing industry, rather than easing into a highly profitable and mature business, may have years more of investment, adjustments and inevitable setbacks ahead. Customers, drivers and investors may need patience..

Featured Faculty

-

Francisco Castro

Assistant Professor of Decisions, Operations and Technology Management

About the Research

Castro, F., Gao, J., & Martin, S. (2024). Autonomous vehicles in ride-hailing and the threat of spatial inequalities. Available at SSRN 4332493.