Tyler Muir

Associate Professor of Finance

About

Tyler Muir’s main research interests are at the intersection of asset pricing, financial intermediaries and financial crises. His recent work has focused on how the health of the financial sector affects variation in asset prices. Muir finds that an intermediary-based asset pricing model can help explain returns across assets previously considered anomalies. He has also examined the behavior of asset prices during financial crises using historical data over 150 years and 14 countries, and documented substantial declines in stock and bond prices, even relative to the declines in macroeconomic fundamentals.

Topics

8 Articles

How Banking’s Bifurcated Deposit Approach Is Altering Lending — and Risk

Offering higher deposit rates lessens emphasis on loans of fixed rate and longer maturity

Across 145 Years and 17 Countries, a Common Thread in Risky Credit Booms

Do investors misprice assets, revise their risk appetite or make some other misjudgment?

Options Market Signals Scope of Federal Reserve Interventions

Traders see an implicit promise beyond specific asset purchases

When Financial Intermediaries Sneeze, These Assets Catch a Cold

Some investment vehicles are more reliant than others on the health of trading firms

Why Risk and Reward Don’t Always Move in Concert

Investors initially underreact to volatility, then overreact

Rethinking Buy-and-Hold Investing

The case for using rising market volatility as a signal to pare back on stocks — does higher risk always mean higher return?

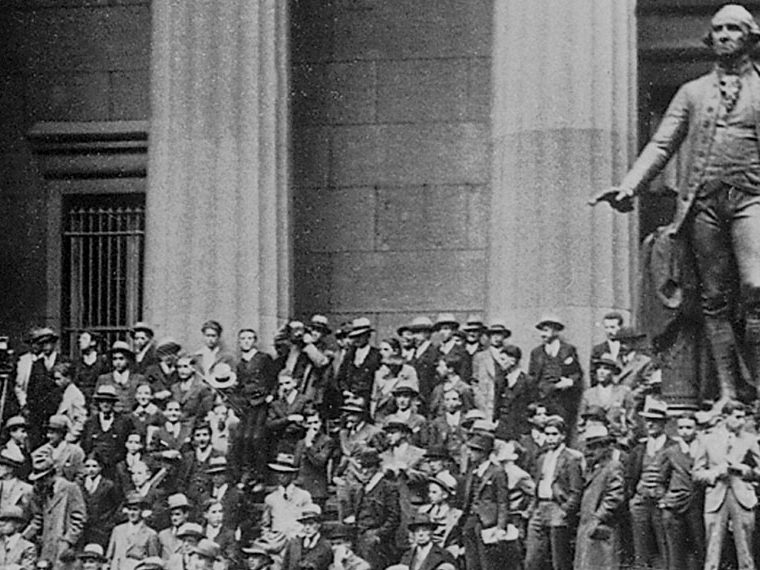

What Makes a True Financial Crisis?

Data back to 1870 show similarities in the worst banking system shocks — focusing on loose lending before a meltdown

To Wall Street, There’s No Crisis Like a Banking Crisis

Tyler Muir finds that neither war nor deep recession darkens investor sentiment like sudden turmoil in the financial system