Valentin Haddad

Associate Professor of Finance

About

Valentin Haddad’s research interests lie in asset pricing and macroeconomics with financial frictions. He has looked at how financial institutions trade and manage risk, and how their practices affect market prices and the economy — and found that a lot of what we thought was obvious is not. His recent studies show that life insurance companies’ investments in Treasuries, contrary to traditional assumptions, are actually quite risky.

Topics

8 Articles

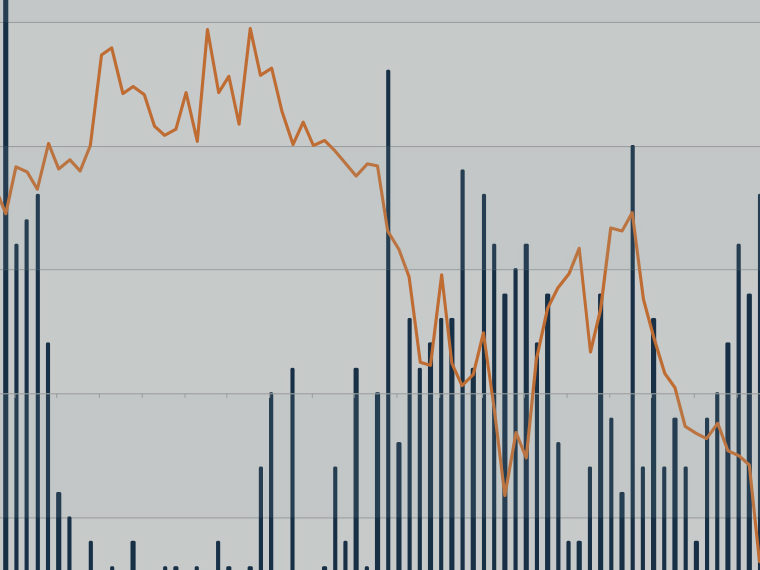

How Quantitative Easing Changed the Bond Market

Investors’ future expectations about QE policy lowered long-term yields, made investors feel safer holding the bonds

Options Market Signals Scope of Federal Reserve Interventions

Traders see an implicit promise beyond specific asset purchases

As Passive Investing Spreads, Overall Market Becomes Less Competitive

Active investors take up some — but not all — of the slack created by index funds

When Financial Intermediaries Sneeze, These Assets Catch a Cold

Some investment vehicles are more reliant than others on the health of trading firms

Market Bubbles Aren’t Entirely Irrational Exuberance

A model examines the relationships between innovation, speculation and market values

What Drives LBO Fever? More Than Just Cheap Loans

Private equity investors weigh the total cost of capital — not just debt, but equity as well — when pursuing buyouts

Ignorance — About One’s Investments, Anyway — Isn’t Always Bliss

Valentin Haddad’s research looks at the phenomenon of “information aversion,” when individual investors stop tracking their portfolios for fear of bad news

How Life Insurers Insulate the Markets from Turmoil

Valentin Haddad’s research finds that insurers’ patient investing shields risky assets — and those who hold them — from steeper declines