It can also help management make capital expenditure decisions

Exchange-traded funds celebrated their 30th anniversary in 2023. And according to the management consulting firm OliverWyman, the growth of ETFs has been “the single most disruptive trend within the asset management industry over the last 20 years.”

Like mutual funds, ETFs are a portfolio of assets that can be traded — but ETFs have several advantages over mutual funds. They trade throughout the day, are generally cheaper because of lower expense ratios and are typically more tax efficient because the holder can choose when to take profits. Another characteristic in common with mutual funds is that ETFs can be market ETFs that track a specific index, like SPY for the S&P 500, or nonmarket ETFs that don’t track an index but are more likely to track specific industry sectors, like SMH for semiconductors.

Of course, the price of market instruments — be they individual stocks, mutual funds, ETFs, future contracts or options — conveys information. And some instruments do a better job than others, based on who’s investing in them and how well informed they are and other factors.

Opt In to the Review Monthly Email Update.

It’s early days in researching ETFs’ role in this information hierarchy. Some researchers say that as ETF ownership of a company rises, it amplifies the stock’s volatility and that makes it more difficult for the company’s management to use its stock price to make decisions. To oversimplify, if the market is valuing a company’s production capacity highly, management will want to acquire more of it, raising capital expenditures. Other researchers contend that rising stock ownership by informed traders through ETFs leads to greater information embedded into stock prices. This, they say, enables companies to better use their stock price to make decisions.

University of Warwick’s Constantinos Antoniou, Singapore Management University’s Frank Weikai Li, University of Hong Kong’s Xuewen Liu, UCLA Anderson’s Avanidhar Subrahmanyam and Hong Kong Polytechnic University’s Chengzhu Sun wade into this developing scene. In a paper published by The Review of Financial Studies, they explore how ETFs influence firms’ investment decisions on capital expenditures for property, plants, equipment, technology and R&D.

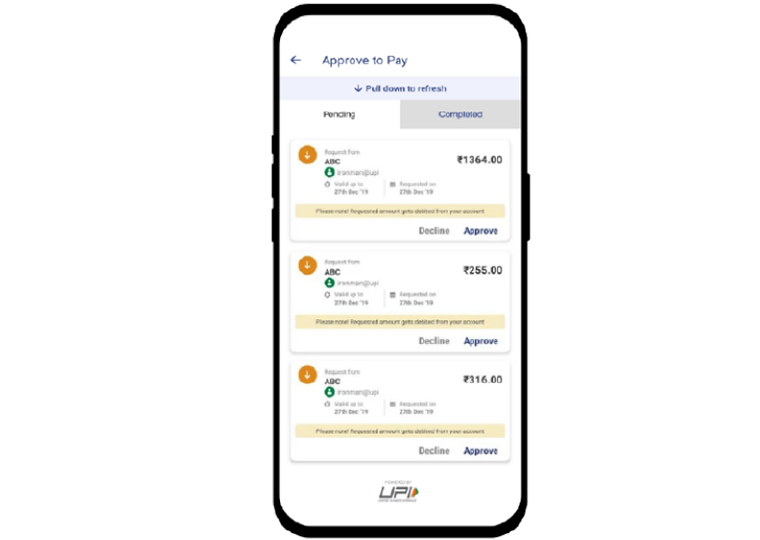

They find that companies with higher ETF ownership of their stock are more influenced by a metric called Tobin’s Q, which compares the market value of their firm to their asset replacement costs, when making decisions about capital expenditures. They also report that the type of ETF that holds a company’s stock is an important factor in this influence. It affects the level of earnings information reflected in stock prices, even before official earnings announcements.

Where the Informed Traders Are

The researchers studied 605 equity ETFs listed in the U.S. from 2003 to 2016. Additionally, stock price information from the Center for Research in Security Prices and accounting data from Compustat was used to scrutinize changes at the company level.

Analyzing the data, the researchers found that as ETF ownership of a company increased, the price of the company’s stock became more informative, or predictive, of its future earnings. And company managers appeared to learn from the (more informative) stock price. This is illustrated by the fact that their capital expenditure decisions become more influenced by the market value of their firm (a function of the stock price) and its relation to the replacement cost of its assets. In fact, as ETF ownership of the company rose, the firm’s investment decisions became more influenced by their own stock price and less by the prices of their peers.

Not All ETFs Are Equally Predictive

Antoniou, Li, Liu, Subrahmanyam and Sun next built upon existing research that suggests informed trading is linked to nonmarket ETFs like those concentrating on an industry. To test this, the researchers split their data between market ETFs (like an S&P 500 ETF) and nonmarket ETFs.

The researchers found that corporate investment decisions were more sensitive to a company’s own stock price when the firm experienced greater ownership by nonmarket ETFs. And no such relationship existed between market ETF ownership and stock prices.

This is likely because there are more “noise traders” in market ETFs that tend to make irrational or emotional trading decisions, while nonmarket ETFs attract traders more informed about the sector that the ETF is based on. These traders are more likely to make decisions based on macroeconomic or systematic risk factors.

Antoniou, Li, Liu, Subrahmanyam and Sun back up this idea by looking at stock returns around earnings announcements. They find that stocks included in nonmarket ETFs have more subdued responses to earnings announcements. This is likely because much of the earnings news was already incorporated into stock prices before the earnings announcement by traders knowledgeable about the dynamics in the industry sector.

“These findings collectively suggest that ownership by nonmarket ETFs brings fundamental information into prices, which the manager uses in real decisions,” the researchers state.

To see if managers really do glean information that was transmitted to stock prices by nonmarket ETFs, the researchers tested whether investment decisions by companies with higher nonmarket ETF ownership were more sensitive to their own stock price than their peers’ stock prices. To accomplish this, they added a factor to their model that considered the Tobin’s Q of peer firms when the company’s stock was held by nonmarket ETFs. They found that the increasing information in the company’s stock price does indeed lead to managers’ increasing reliance on their own stock price and decreasing consideration of peers’ stock prices as nonmarket ETF ownership increased.

Overall, the researchers’ findings suggest nonmarket ETFs play an important role in disseminating information to stock prices and can influence real economic decisions made by company managers.

Featured Faculty

-

Avanidhar Subrahmanyam

Distinguished Professor of Finance; Goldyne and Irwin Hearsh Chair in Money and Banking

About the Research

Antoniou, C., Weikai Li, F., Liu, X., Subrahmanyam, A., & Sun, C. (2023). Exchange-traded funds and real investment. The Review of Financial Studies, 36(3), 1043-1093.