Topic: Investing

Muni Bond Buyers Pay a Little Extra for the Pleasure of Not Being Taxed

Doing so, they subsidize government, which is, well, sort of like a tax

What Investors Infer From External News And Management Silence

Uncertainty about outside news alters company disclosures and how markets interpret them, study finds

46 Possible Stock Market Strategies from Academics Get a Retest

We won’t call it debunking, but not all investing tips hold up

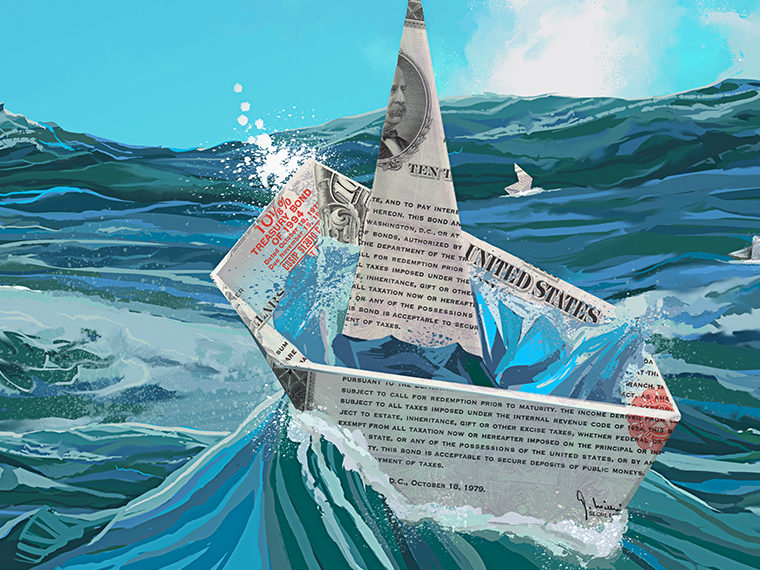

A ‘Safer’ Treasury Bond

The government’s floating rate notes feature an added measure of security: higher interest earnings in times of rising rates

A Different Way to Evaluate Private Equity Performance

An approach tailored to investor risk appetite and more comparable to stocks

A Simplified Tax Code and Post-Communist Growth

Study suggests flat tax systems boosted GDP in former Soviet republics and satellites

A Skeptical Board Can Protect Shareholders From an Empire-Building CEO

Director expertise disciplines CEO into providing better information

A Solution to the Debate over Momentum’s Cause?

Investors may underreact when information arrives in small, continuous bits

A Tool for Finding Mispriced Stocks

Less sophisticated investors reveal their sentiment in certain trades, and a 20-year study measures it company by company

Across 145 Years and 17 Countries, a Common Thread in Risky Credit Booms

Do investors misprice assets, revise their risk appetite or make some other misjudgment?

Adapting Value Investing to the 21st Century

Including intangible assets in book value vastly improves the strategy’s returns

Are Americans Really Annuity-Averse? Clear Thinking on Retirement Income

A monthly check, not just a pile of cash: Studies demystify the instruments too few are using

As Concentrated Shareholder Ownership Rises, Wages and Employment Suffer

Where big investors gather, corporate wealth is reallocated away from workers

As Passive Investing Spreads, Overall Market Becomes Less Competitive

Active investors take up some — but not all — of the slack created by index funds

Assessing Climate Disclosure as U.S. Drops Scope 3 Requirement

What emerges is a fragmented view of corporate contribution to global warming

At Last, the Momentum Investing Puzzle Solved?

The simplest explanation — “I can’t believe you know something I don’t” — may trump all the rest