Topic: Investing

What Drives LBO Fever? More Than Just Cheap Loans

Private equity investors weigh the total cost of capital — not just debt, but equity as well — when pursuing buyouts

Upside Earnings Surprise Issued Late: Signal of Possible Manipulation

Companies that take longer than expected to announce results may be buying time for accounting tricks

Unintended Consequence of Stale Corporate Bond Fund Prices Amid Fed Tightening

In wild markets, do the most dated prices actually reduce redemptions?

Underappreciated Investment Edge: Company Trademark Filings

Not part of financial reporting, trademark activity predicts stock returns

Treasury Securities Are Actually Cheap Sometimes

They don’t trade at an absolute equal to intrinsic value, despite their image as the world’s investment bedrock

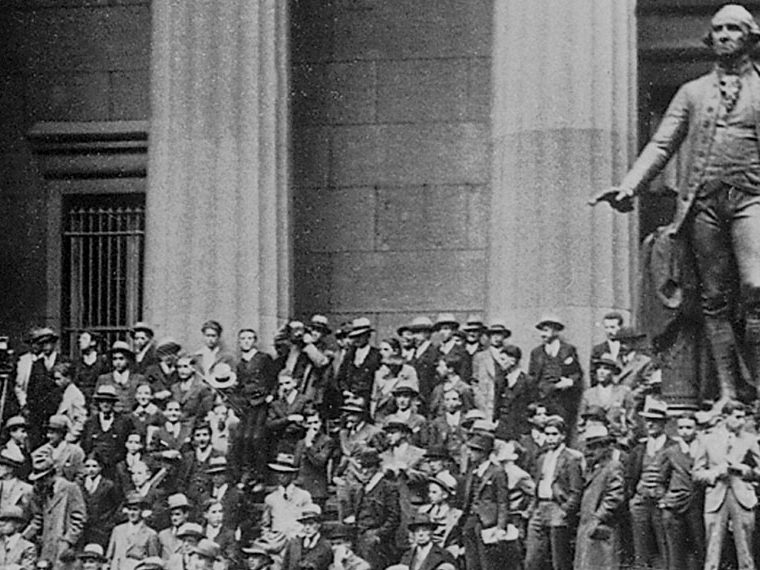

To Wall Street, There’s No Crisis Like a Banking Crisis

Tyler Muir finds that neither war nor deep recession darkens investor sentiment like sudden turmoil in the financial system

Thinking Small Could Deliver Bigger Retirement Success for Gig Workers

Daily, weekly and monthly contribution schemes gauge behavior

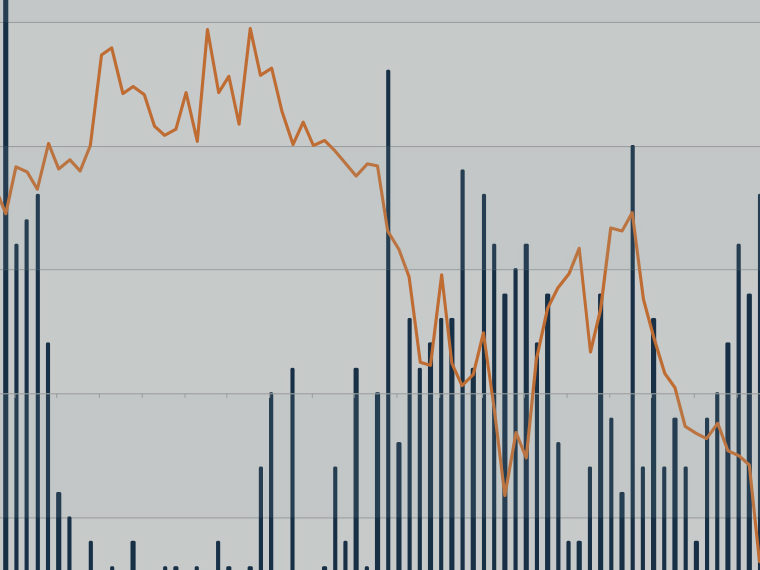

The Strange Case of the Missing Stock Market Return

Investors in leveraged companies take on extra risk, but research indicates they see no offsetting return

The Role of Board-of-Directors Pay in Effective Corporate Investing

A model juggles who should suffer when a project goes awry; job market prospects of the CEO; and the quality of information shared in the boardroom

The Relative Well-Being of Generations: An Explanation for Falling Interest Rates?

Doing worse than mom and dad is a drag on the entire economy

The Moat That Keeps Complex Asset Strategies Profitable

Andrea Eisfeldt finds that hedge funds with infrastructure to execute sophisticated arbitrage crowd out less-expert investors

The Mechanics of How Social Media Turbocharges Asset Bubbles

Establishment media coalesces around a lone narrative, but online chatter hops between storylines, sometimes shocking traders

The Debt Market’s Indirect Antidote to ESG Greenwashing

Loans that include a sweetener or penalty tied to ESG performance seem to induce more honest reporting

The Collective Wisdom of Options Trades as Interest Rate Predictor

Skewness, measuring the range of biases, strongly suggests rate moves

State Tax Credits for Angel Investors Backfire

Good ideas may be scarce, capital to fund them is not