Topic: Investing

Adapting Value Investing to the 21st Century

Including intangible assets in book value vastly improves the strategy’s returns

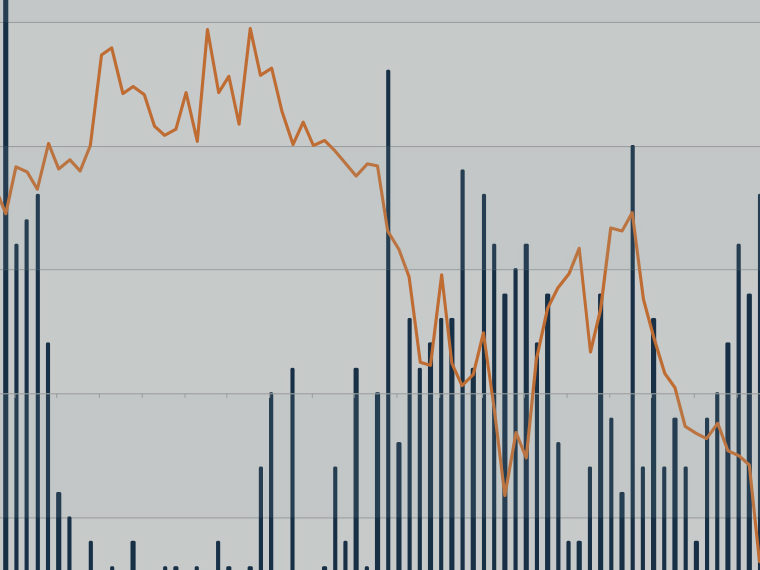

When the Fed Taps the Brakes, Not All Banks Slow Down

Some lenders’ balance sheets are less affected by a rising federal funds rate

Out of the 1990s Asian Crisis, a New Bond Market Rises

Local currency sovereign bonds transfer risk from issuer to buyer

Puncturing the Small-Investors-are-Bad-Investors Narrative

Individuals using the Robinhood trading app appear to beat the market

Private Equity Boosts Nursing Home Staffing — When Compelled by Competition

But in uncompetitive markets, the financial owners cut staff

The Relative Well-Being of Generations: An Explanation for Falling Interest Rates?

Doing worse than mom and dad is a drag on the entire economy

When Lenders Put a Muzzle on Borrowers

Companies hide from shareholders information about loans — more than likely to appease banks

Upside Earnings Surprise Issued Late: Signal of Possible Manipulation

Companies that take longer than expected to announce results may be buying time for accounting tricks

At Last, the Momentum Investing Puzzle Solved?

The simplest explanation — “I can’t believe you know something I don’t” — may trump all the rest

A Tool for Finding Mispriced Stocks

Less sophisticated investors reveal their sentiment in certain trades, and a 20-year study measures it company by company

A ‘Safer’ Treasury Bond

The government’s floating rate notes feature an added measure of security: higher interest earnings in times of rising rates

Rethinking Buy-and-Hold Investing

The case for using rising market volatility as a signal to pare back on stocks — does higher risk always mean higher return?

What Drives LBO Fever? More Than Just Cheap Loans

Private equity investors weigh the total cost of capital — not just debt, but equity as well — when pursuing buyouts

Behind the Annuity Conundrum: The Belief They’re Unfair

Researchers find little commonality among haters of the difficult-to-sell retirement products, except when discussing fairness

Momentum Investing: It Works, But Why?

After a quarter century of sprawling study, it’s time to narrow the focus and settle on an explanation

How ETFs Muffle Stock Market Feedback to Managers

The rise of passive investing leaves companies mistrusting market signals on how best to deploy capital