Topic: Investing

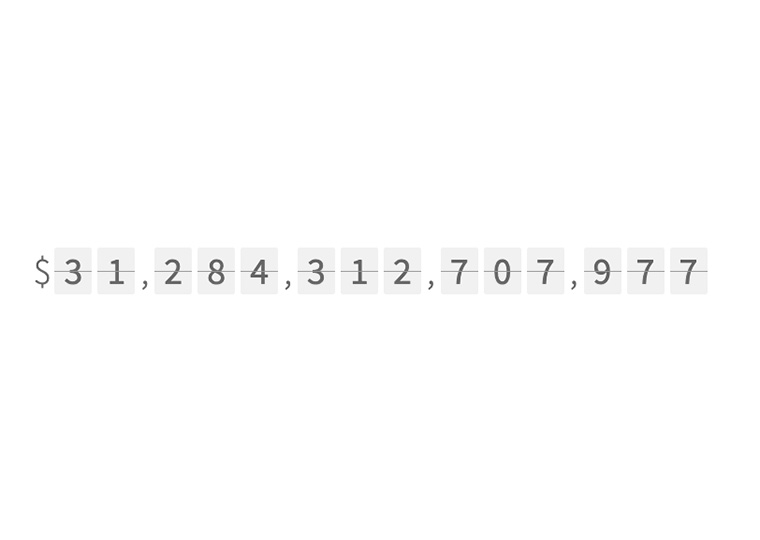

How Much Debt Can the Government Roll Over Forever?

Public bonds compete against other investments; a model of that relationship

How Life Insurers Insulate the Markets from Turmoil

Valentin Haddad’s research finds that insurers’ patient investing shields risky assets — and those who hold them — from steeper declines

How ETFs Muffle Stock Market Feedback to Managers

The rise of passive investing leaves companies mistrusting market signals on how best to deploy capital

How Bond and Stock Prices Combine to Influence Corporate Investment

Equity volatility can encourage — or dampen — investment, depending on a firm’s bond spread

How an Excess of Stock Analyst Optimism Lands on Companies Least Deserving of It

Results of financially weak firms are difficult to forecast; in uncertainty, Wall Street’s views are overly generous

How a Stock Analyst’s Face Affects Their Earning Estimates

Trustworthy and dominant-seeming men: access to corporate management. Dominant-seeming women: not so much.

Heading for a Divorce? Might Want to Go Easy on Stock Picking

Active traders lose their edge as a marital breakup approaches

GameStop Aside, Retail Investors Might be Terrible at Momentum Investing

Using Chinese A and B shares, institutional players outperform individuals

Financial Constraints on Intermediaries Cause Asset Mispricing

Real-world bond data reveals how the capital positions and liquidity of middlemen affect prices of securities they broker

ESG Investors in China Focused on Profit Potential of Climate Change

Less attention to downside of nation’s carbon-neutral goals

Does Cross Ownership By Big Investors Make Industries Less Competitive?

Examining executive pay tied to revenue growth to identify any correlation

Does Big News Drown Out Corporate Earnings Disclosures?

Henry Friedman’s research finds, surprisingly, that major economic news actually heightens attention paid to company announcements

Do Fair Disclosure Rules Lead to More or Less Information?

Managers, forced to inform a broader audience, choose not to gather information even for themselves

Disclosure of Climate Risk Helps Stocks Trade More Smoothly

Dropping facts into a polarized investor pool reduces the impact of ideology and leads to broader ownership

Companies Sued for Securities Fraud Adopt More Conservative Accounting

The shift spreads through auditors to other clients, potentially clouding the financial information investors rely upon

Companies at Risk of an Earnings Miss Allow More Third-Party Trackers on Their Websites

Managing earnings at the cost of privacy