Topic: Investing

Rethinking Buy-and-Hold Investing

The case for using rising market volatility as a signal to pare back on stocks — does higher risk always mean higher return?

Rise of Nonbank Lenders Undermines Community Reinvestment Act Effectiveness

Traditional banks pull out of lower- and median-income neighborhoods the federal program aims to help

Sensitivity to Debt Type Predicts Financial Health

Research reveals that those wary of payday loans tend to manage their finances better

Separating Auditing from Consulting: More Complex than it Seems

Market concentration, price and quality drive choice of firms

Single-Family Rentals: What Drives Investor Return?

A unique data set provides fresh insights for the growing institutional investor market

State Tax Credits for Angel Investors Backfire

Good ideas may be scarce, capital to fund them is not

The Collective Wisdom of Options Trades as Interest Rate Predictor

Skewness, measuring the range of biases, strongly suggests rate moves

The Debt Market’s Indirect Antidote to ESG Greenwashing

Loans that include a sweetener or penalty tied to ESG performance seem to induce more honest reporting

The Mechanics of How Social Media Turbocharges Asset Bubbles

Establishment media coalesces around a lone narrative, but online chatter hops between storylines, sometimes shocking traders

The Moat That Keeps Complex Asset Strategies Profitable

Andrea Eisfeldt finds that hedge funds with infrastructure to execute sophisticated arbitrage crowd out less-expert investors

The Relative Well-Being of Generations: An Explanation for Falling Interest Rates?

Doing worse than mom and dad is a drag on the entire economy

The Role of Board-of-Directors Pay in Effective Corporate Investing

A model juggles who should suffer when a project goes awry; job market prospects of the CEO; and the quality of information shared in the boardroom

The Strange Case of the Missing Stock Market Return

Investors in leveraged companies take on extra risk, but research indicates they see no offsetting return

Thinking Small Could Deliver Bigger Retirement Success for Gig Workers

Daily, weekly and monthly contribution schemes gauge behavior

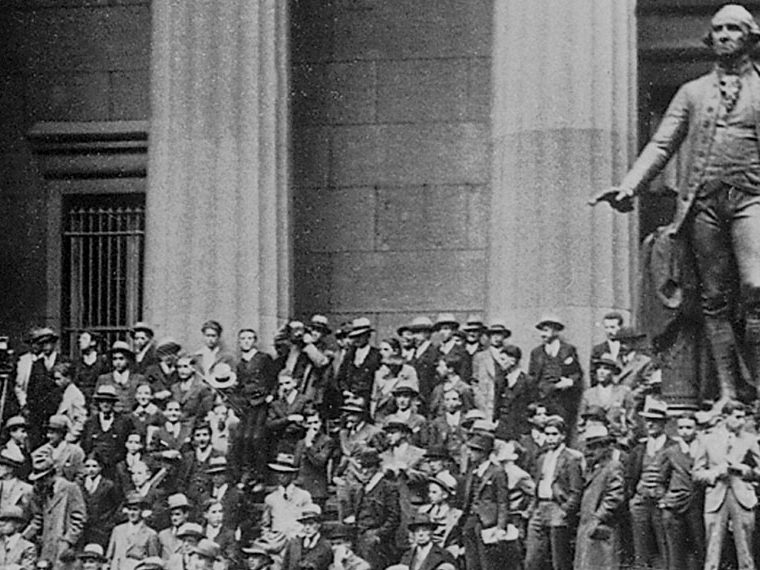

To Wall Street, There’s No Crisis Like a Banking Crisis

Tyler Muir finds that neither war nor deep recession darkens investor sentiment like sudden turmoil in the financial system