Stavros Panageas

Professor of Finance

About

Stavros Panageas studies asset pricing and macroeconomics. He has worked as a fixed income quantitative analyst for Fidelity Investments and was a co-founder and board member of AIAS NET, one of the first Greek internet service providers. His latest research connects the tech boom with dramatic changes in investor behavior.

Topics

8 Articles

Should the U.S. Aim for a Zero-COVID-19 Policy?

Tolerating a low level of transmission just might be the better strategy

A Different Way to Evaluate Private Equity Performance

An approach tailored to investor risk appetite and more comparable to stocks

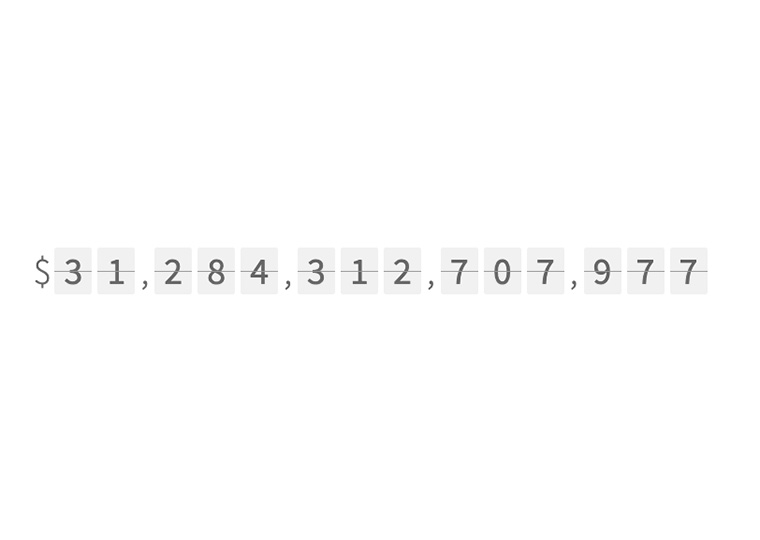

How Much Debt Can the Government Roll Over Forever?

Public bonds compete against other investments; a model of that relationship

In a Crisis, Solvent Borrowers are Overcharged, Subsidizing Troubled Bank Clients

An unusual data trove from Greece’s economic collapse reveals the practice

Often Reviled, Short Sellers Are Newly Vulnerable to the Meme Mob

A short squeeze can ripple across short sellers’ positions

Could Tech Giants Be Making Our Economy Less Innovative?

With a business model built on fewer employees, their dominance saps dynamism.

The Relative Well-Being of Generations: An Explanation for Falling Interest Rates?

Doing worse than mom and dad is a drag on the entire economy

How Tech’s Disruption Alters Investors’ Appetite for Risk

New technology’s upending of the old creates demand for alternative assets to offset risk