Immigrants show saving tendencies that carry through several generations

Personal savings drive individual wealth, but also local and global economies. So there’s an enduring interest in determining why and how people save. We know that demographics play a part, as do differences in income, taxes and housing prices.

New research points to another factor: culture. When migrants move to a new country, they leave behind the economics and institutions that typically influence saving habits. But cultural beliefs don’t disappear just because someone relocates. Does that influence saving habits?

Yes, according to a study by Joan Costa-Font of the London School of Economics, UCLA Anderson’s Paola Giuliano and Berkay Ozcan, also of the London School of Economics. Their research, published in 2018 in PLoS ONE, uses data from the “Understanding Society” survey, a longitudinal study of 40,000 households in the United Kingdom, one of the largest and most diverse immigrant-receiving countries in the world.

Opt In to the Review Monthly Email Update.

The UK data set is more comprehensive than the Canadian data used in an earlier, unrelated study that is considered seminal in the field: It established the previously accepted view that doubts a cultural correlation for saving patterns.

Costa-Font, Giuliano and Ozcan were able to study a much larger immigrant population identified by specific places of origins versus broad geographical regions. The UK data also covers three generations, which creates a sort of natural experiment to see if cultural beliefs are transmitted from grandparent to parent to child. And since all three generations were living in the UK, in the same general economic and institutional environment, cultural influences could be more easily isolated.

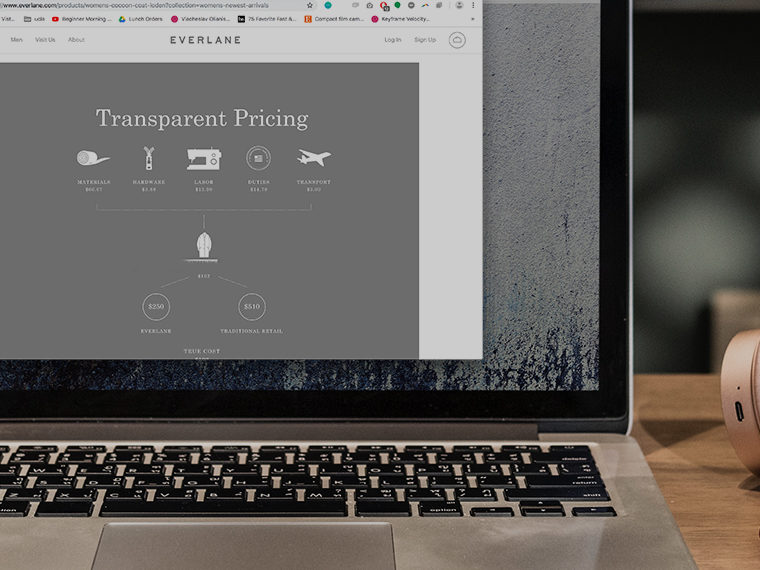

To get at these cultural effects, the authors assessed three saving measures: total amount of monthly savings; propensity to save (assessed with “yes” or “no” questions); and how much personal wealth increases (or doesn’t) over time. As a proxy for culture, they used a measure of how saving rates exceed GDP in the individual’s home country. “We attribute the association found in our data between the behavior of immigrants and the saving rate in the country of origin to differences in cultural beliefs across immigrant groups,” the authors write.

The authors found that migrants from cultures with high saving rates did tend to save proportionately more once in the UK, a finding especially strong for first- and second-generation immigrants, but present even in the third generation. Among the countries with high saving rates: China and Ireland. On the lower end: Pakistan and Uganda.

To put this cultural effect in perspective: In terms of financial well-being, it’s equal to 41 percent of the effect of having a college degree, and 51 percent of the effect of increased income.

Featured Faculty

-

Paola Giuliano

Professor of Economics; Chauncey J. Medberry Chair in Management

About the Research

Costa-Font, J., Giuliano, P., & Ozcan, B. (2018). The cultural origin of saving behavior. PLoS ONE, 13(9). doi: 10.1371/journal.pone.0202290