Topic: Corporate Finance

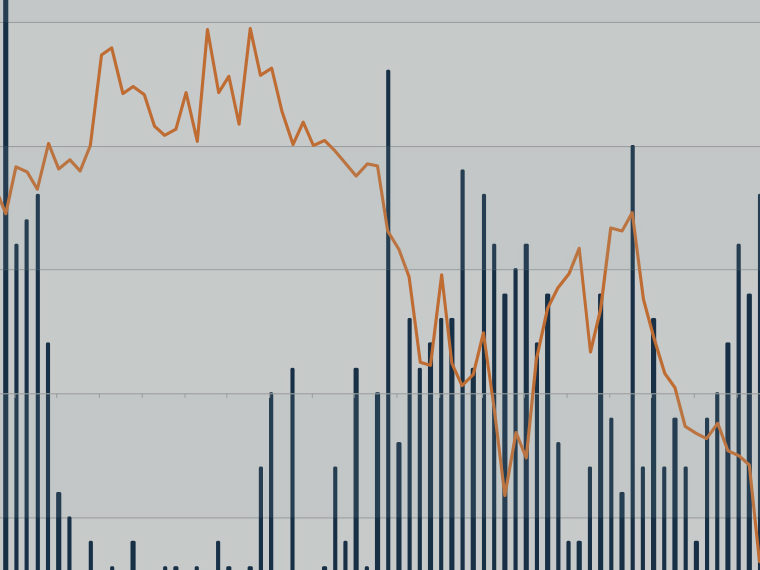

With Bonds, the Past Can Be Prologue

Patterns in corporate bond returns include abrupt short-term performance reversals and “momentum” waves that persist

Why Do Banks With Little Skin in the Game Still Monitor Borrowers?

Tax policy change triggers an incentive for lenders to be more aggressive

When the Fed Taps the Brakes, Not All Banks Slow Down

Some lenders’ balance sheets are less affected by a rising federal funds rate

When Lenders Put a Muzzle on Borrowers

Companies hide from shareholders information about loans — more than likely to appease banks

When Exchange Rates Move, U.S. Companies Feel It — Even More Than Previously Thought

Firm-specific export data enables researchers to potentially solve a puzzle in economics

What Limited Attention Does to Efficient Market Theory

Stocks don’t react to news immediately because, well, we’re human

What Drives LBO Fever? More Than Just Cheap Loans

Private equity investors weigh the total cost of capital — not just debt, but equity as well — when pursuing buyouts

Upside Earnings Surprise Issued Late: Signal of Possible Manipulation

Companies that take longer than expected to announce results may be buying time for accounting tricks

The Debt Market’s Indirect Antidote to ESG Greenwashing

Loans that include a sweetener or penalty tied to ESG performance seem to induce more honest reporting

Sorting Out Conflicts of Interest in Commercial Loan Syndicates

Syndicate voting rules reflect varying levels of trust and familiarity

Might More Lobbying Groups, Rather than Fewer, Be Good for Industry and the Public?

Make the influence industry more competitive, a theoretical study suggests

Low-Quality Earnings: The Uncoupling of Stock Price from Fundamentals

Studying Chinese A and B shares reveals investor uncertainty

Looming Risk to Financial System: $1 Trillion in Commercial Loan Pools

Known as collateralized loan obligations, their aim is actually to reduce risk

Loan Pool Covenants, Meant to Contain Risk, Can Instead Spread It

Forced sale of assets could stretch illiquidity across industries

Less Leveraged Than the Competition: Ready to Snag Distressed Assets in a Recession

When bad times hit, highly indebted companies often have to sell operations and equipment at fire-sale prices