Some lenders’ balance sheets are less affected by a rising federal funds rate

The Federal Reserve’s go-to tool for getting banks to lend more or lend less — and thus heat up or cool down the economy — is known as the federal funds rate, a narrow range of interest rates between which banks lend each other money on an overnight basis.

A lowered federal funds rate reduces a bank’s cost of money (deposits) making a loan whose interest rate is fixed more profitable for the bank because the bank enjoys a wider spread. Raise the federal funds rate and that margin between cost of money and interest paid to the bank narrows, and profits are squeezed.

As the graph below shows, however, bank loans — in this case business loans known as commercial and industrial — hardly move in lockstep with changes in the federal funds rate. But you can see the Fed’s influence, as when loan growth decelerated beginning in 2016 when the Fed finally started hiking rates post-financial collapse.

Effective Federal Funds Rate data by YCharts

And banks don’t react uniformly to changes in the federal funds rate. Some reduce lending sharply, and others seem almost impervious to the change. In a working paper, UCLA Anderson’s Matthieu Gomez, HEC Paris’ Augustin Landier, University of California-Berkeley’s David Sraer and MIT’s David Thesmar show that a bank’s reaction to changes in the federal funds rate depends on a metric they call the income gap.

Opt In to the Review Monthly Email Update.

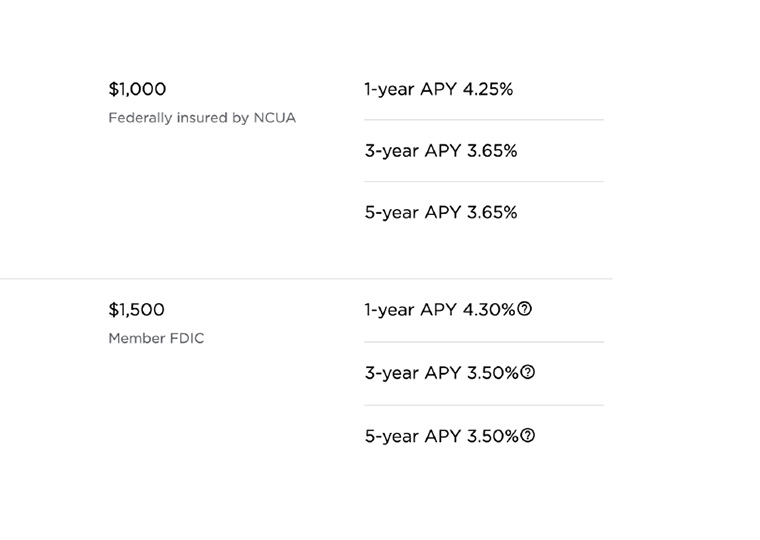

The income gap is defined as the difference between the share of a bank’s assets that re-price during the year, minus the share of liabilities that reprice during the year. Indeed, much of a bank’s balance sheet is made of assets and liabilities that don’t immediately re-price: fixed rate loans or those that adjust annually, say; and certificates of deposit with rates guaranteed for periods of 90 days to multiple years. In other words, when the Fed raises the federal funds rate, it isn’t squeezing the bank’s entire balance sheet, just a portion of it, and the researchers’ income gap seeks to quantify that portion of the bank.

In a rising-rate environment, having more assets than liabilities re-price widens a bank’s spread and boosts profits. From 1986 through 2013, the researchers calculated the average difference of such assets and liabilities was equal to about 12% of a bank’s total assets.

During periods when the federal funds rate increased by 1 percentage point, bank holding companies with an above average income gap (75th percentile; average income gap of 23.9%) reduced their average quarterly lending growth over the ensuing five quarters by 0.27 percentage points less than banks with a below average income gap (25th percentile; average income gap of 1%). That’s a significant difference given the average quarterly loan growth for the entire period is 1.6%.

A bank’s income gap difference matters to bank customers, too. “(B)anks with a higher income gap generate larger earnings and contract their lending by less than other banks. This, in turn, allows their corporate borrowers to invest more than other firms,” the authors say.

That income-gap finding persisted when they controlled for other factors such as bank size, leverage and exposure to adjustable rate mortgages.

They also were able to comb through loan data for individual corporations that had borrowing relationships with both high income-gap and low income-gap banks. Firms were more successful continuing to borrow in the wake of Fed tightening from the banks that were profiting more from rising rates.

Overall, firms with access to lenders with above average income gaps reduced their investment less than firms whose lenders were more negatively impacted by interest rate increases.

Featured Faculty

-

Matthieu Gomez

Visiting Assistant Professor

About the Research

Gomez, M., Landier, A., Sraer, D., Thesmar, D., Banks’ Exposure to Interest Rate Risk and the Transmission of Monetary Policy. (2020 working paper).