Topic: Investing

Lack of Urgency Can Undermine a Popular Behavioral Nudge

Encouraging pre-commitment to a future behavior helps people do hard things — but it can backfire

How to Properly Incentivize Your Unicorn Finder

VCs and other investors need a contract with their seeker that blunts conflicts of interest

How a Stock Analyst’s Face Affects Their Earning Estimates

Trustworthy and dominant-seeming men: access to corporate management. Dominant-seeming women: not so much.

As Concentrated Shareholder Ownership Rises, Wages and Employment Suffer

Where big investors gather, corporate wealth is reallocated away from workers

When Individuals Concentrate in a Stock, Earnings Surprises Play Out Differently

Price movements can be more extreme

The Debt Market’s Indirect Antidote to ESG Greenwashing

Loans that include a sweetener or penalty tied to ESG performance seem to induce more honest reporting

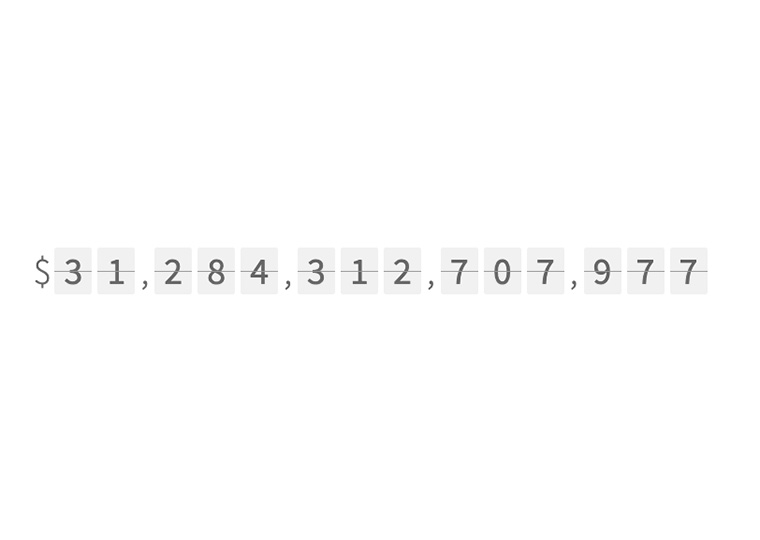

How Much Debt Can the Government Roll Over Forever?

Public bonds compete against other investments; a model of that relationship

ESG Investors in China Focused on Profit Potential of Climate Change

Less attention to downside of nation’s carbon-neutral goals

What Limited Attention Does to Efficient Market Theory

Stocks don’t react to news immediately because, well, we’re human

Banks Transmit Financial Shocks, Including from Natural Disasters

How a localized flood may result in fewer loans to a far-off community

What Happens to Pesos When Dollars Go Digital?

As major central banks adopt digital currency, emerging countries will feel mixed effects

A Solution to the Debate over Momentum’s Cause?

Investors may underreact when information arrives in small, continuous bits

The Collective Wisdom of Options Trades as Interest Rate Predictor

Skewness, measuring the range of biases, strongly suggests rate moves

Does Cross Ownership By Big Investors Make Industries Less Competitive?

Examining executive pay tied to revenue growth to identify any correlation

46 Possible Stock Market Strategies from Academics Get a Retest

We won’t call it debunking, but not all investing tips hold up

Underappreciated Investment Edge: Company Trademark Filings

Not part of financial reporting, trademark activity predicts stock returns