Topic: Securities

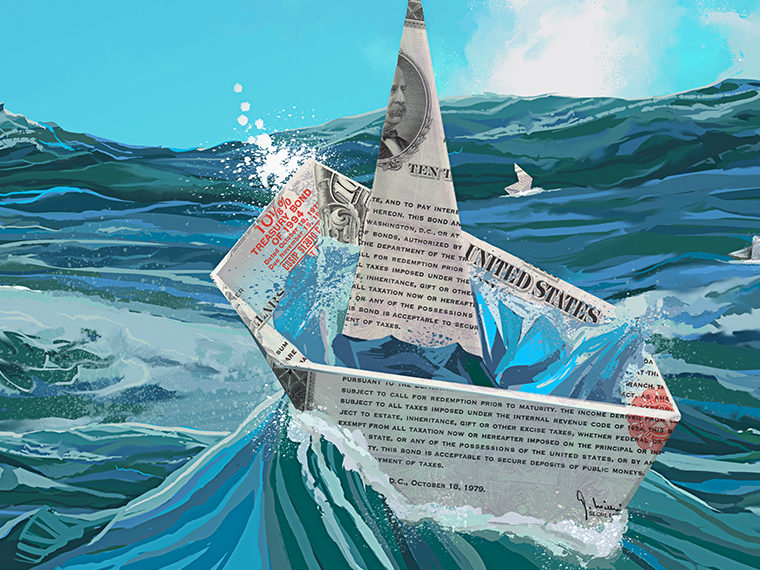

A ‘Safer’ Treasury Bond

The government’s floating rate notes feature an added measure of security: higher interest earnings in times of rising rates

Banks Rent Out Their Balance Sheets — So Derivatives Cost More

Even before Dodd-Frank rules, the costs were significant

Borrowings Suggest Small Company Owners Face Higher Risk

Analysis uses business credit card loans to gauge market perception

Financial Constraints on Intermediaries Cause Asset Mispricing

Real-world bond data reveals how the capital positions and liquidity of middlemen affect prices of securities they broker

The Moat That Keeps Complex Asset Strategies Profitable

Andrea Eisfeldt finds that hedge funds with infrastructure to execute sophisticated arbitrage crowd out less-expert investors

Treasury Securities Are Actually Cheap Sometimes

They don’t trade at an absolute equal to intrinsic value, despite their image as the world’s investment bedrock

When Financial Intermediaries Sneeze, These Assets Catch a Cold

Some investment vehicles are more reliant than others on the health of trading firms