Francis Longstaff

Distinguished Professor of Finance; Allstate Chair in Insurance and Finance, Area Chair

About

Francis A. Longstaff is a certified public accountant and a chartered financial analyst. He was head of fixed income derivative research at Salomon Brothers Inc. in New York and also worked in the research department of the Chicago Board of Trade and for Deloitte and Touche as a management consultant. Several of his recent term structure papers have focused on the expectations hypothesis. His research in the area of derivatives has focused on the valuation of American options by simulation and on the valuation of interest rate derivatives in string models of the term structure. Many of his valuation models have been used widely on Wall Street and throughout the global financial markets.

Topics

12 Articles

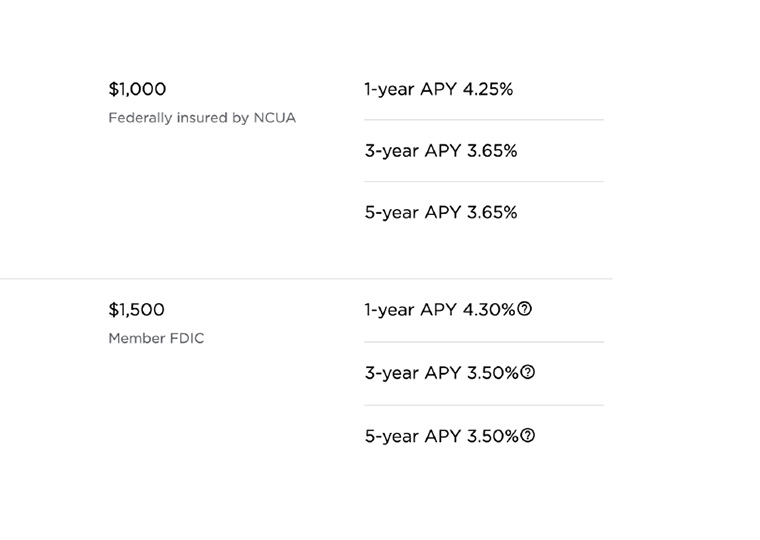

Short-Term or Long-Term CDs: Which Should You Buy?

Researchers find higher-yielding, long-term CDs often pay more than short-term options even if you need to incur an early-withdrawal penalty

CD Withdrawal Penalties: Often More Than Worth the Risk

Banks know you won’t do the math: Even after a penalty for early withdrawal, the longer-term CD often nets out to a better deal

Municipal-Bond Investors Pay a Hefty Price for Not Being Taxed

A new study suggests that ‘investors overvalue the pleasure’ of tax-exemption

Muni Bond Buyers Pay a Little Extra for the Pleasure of Not Being Taxed

Doing so, they subsidize government, which is, well, sort of like a tax

Banks Rent Out Their Balance Sheets — So Derivatives Cost More

Even before Dodd-Frank rules, the costs were significant

Treasury Securities Are Actually Cheap Sometimes

They don’t trade at an absolute equal to intrinsic value, despite their image as the world’s investment bedrock

Borrowings Suggest Small Company Owners Face Higher Risk

Analysis uses business credit card loans to gauge market perception

Did Bank Capital Rules Make Credit Card Borrowing More Expensive?

Though defaults are low, rates on credit card loan-backed notes are high

A ‘Safer’ Treasury Bond

The government’s floating rate notes feature an added measure of security: higher interest earnings in times of rising rates

Mortgage Prepayments: Factors beyond Interest Rate Movements

A model estimates the impact of economic variables on the pricing of prepayment risk

Financial Constraints on Intermediaries Cause Asset Mispricing

Real-world bond data reveals how the capital positions and liquidity of middlemen affect prices of securities they broker