Area: Finance

Migration — and Home Price Escalation — Happens Along Established Routes

Major cities reliably feed residents to the same smaller markets, and housing booms predictably travel with them

Muni Bond Buyers Pay a Little Extra for the Pleasure of Not Being Taxed

Doing so, they subsidize government, which is, well, sort of like a tax

46 Possible Stock Market Strategies from Academics Get a Retest

We won’t call it debunking, but not all investing tips hold up

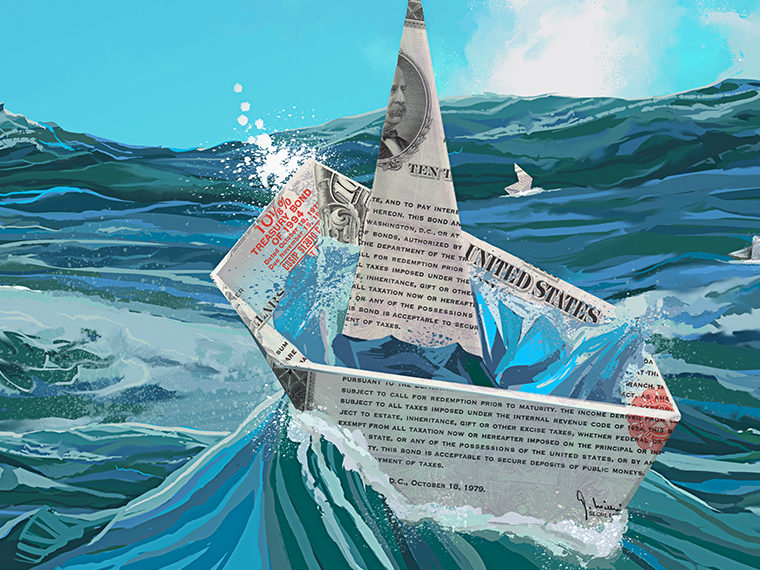

A ‘Safer’ Treasury Bond

The government’s floating rate notes feature an added measure of security: higher interest earnings in times of rising rates

A Different Way to Evaluate Private Equity Performance

An approach tailored to investor risk appetite and more comparable to stocks

A Quiet Expansion of Deposit Insurance Could Disrupt U.S. Banking

Seen as a backstop to small- and midsized banks, the program, allowing insurance in multiples of $250,000, alters banking’s risk calculus

A Solution to the Debate over Momentum’s Cause?

Investors may underreact when information arrives in small, continuous bits

Across 145 Years and 17 Countries, a Common Thread in Risky Credit Booms

Do investors misprice assets, revise their risk appetite or make some other misjudgment?

Adapting Value Investing to the 21st Century

Including intangible assets in book value vastly improves the strategy’s returns

Addressing Its Lack of an ID System, India Registers 1.2 Billion in a Decade

Digital identity used in nearly every realm of life

Are Interest Rates Really So Low?

Adjusting for inflation — and, crucially, for taxes — shows bond investors fare better than they might think

As AI Supercharges Finance Research, Will We Believe the Results?

Building benchmarks to guide researchers and validate AI-enabled findings

As Passive Investing Spreads, Overall Market Becomes Less Competitive

Active investors take up some — but not all — of the slack created by index funds

Banks Rent Out Their Balance Sheets — So Derivatives Cost More

Even before Dodd-Frank rules, the costs were significant

Banks Transmit Financial Shocks, Including from Natural Disasters

How a localized flood may result in fewer loans to a far-off community

Banks, Freed to Operate Across State Lines, Helped Stabilize the Economy

Lenders financed expansion in some markets, offsetting problems in others