Topic: Interest Rates

Discontinued Car Models, Often Sold to Lower-Income People, Carry a Magnified Risk of Collateral Shortfall

After the repo: Borrowers’ post-default payments account for 27% of lender recoveries

A Quiet Expansion of Deposit Insurance Could Disrupt U.S. Banking

Seen as a backstop to small- and midsized banks, the program, allowing insurance in multiples of $250,000, alters banking’s risk calculus

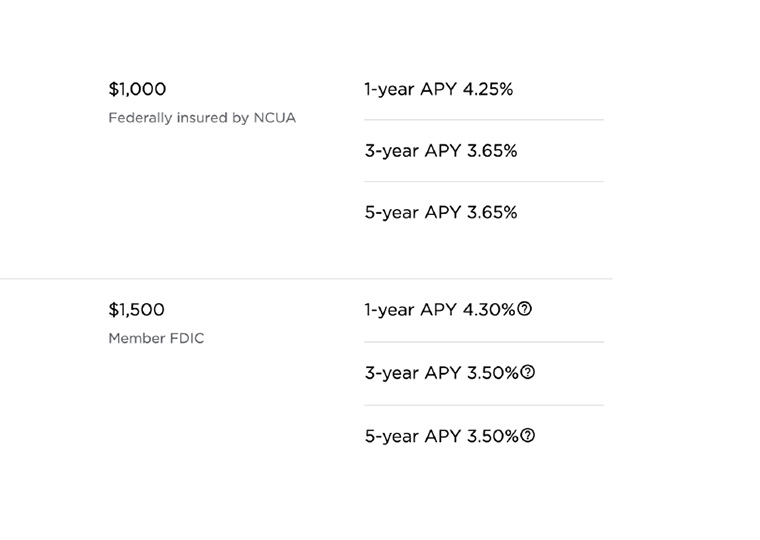

CD Withdrawal Penalties: Often More Than Worth the Risk

Banks know you won’t do the math: Even after a penalty for early withdrawal, the longer-term CD often nets out to a better deal

How Banking’s Bifurcated Deposit Approach Is Altering Lending — and Risk

Offering higher deposit rates lessens emphasis on loans of fixed rate and longer maturity

Local Banks Provide an Early Warning System on Recessions

When they’re forced to pay up for deposits, it’s a bad sign for area’s economy

Across 145 Years and 17 Countries, a Common Thread in Risky Credit Booms

Do investors misprice assets, revise their risk appetite or make some other misjudgment?

Forecasting a Recession Using Easy-to-Grasp Images

A look at the shape of five variables through the last seven downturns vs. today’s numbers

Fed Policy Helped Distressed Homeowners But Wasn’t a Cure-All

Modifications curtailed foreclosures during 2008-09 crisis, but borrowers remained at high risk of delinquency

The Collective Wisdom of Options Trades as Interest Rate Predictor

Skewness, measuring the range of biases, strongly suggests rate moves

How Commodity Price Swings Destabilize Bank Relationships

Small firms in Peru shop nationwide for cheap credit, but loyalty runs two ways

When the Fed Taps the Brakes, Not All Banks Slow Down

Some lenders’ balance sheets are less affected by a rising federal funds rate

The Relative Well-Being of Generations: An Explanation for Falling Interest Rates?

Doing worse than mom and dad is a drag on the entire economy

When Lenders Put a Muzzle on Borrowers

Companies hide from shareholders information about loans — more than likely to appease banks

Forgoing a Tax Refund to Signal Brightening Financial Prospects

Companies that use loss carry-forwards to offset future tax liability, instead of claiming a refund, enjoy favorable lending terms

A ‘Safer’ Treasury Bond

The government’s floating rate notes feature an added measure of security: higher interest earnings in times of rising rates

Are Interest Rates Really So Low?

Adjusting for inflation — and, crucially, for taxes — shows bond investors fare better than they might think