Data back to 1870 show similarities in the worst banking system shocks — focusing on loose lending before a meltdown

Financial system crashes have been a recurring problem for individual countries and their banks for centuries. But the impact of these disasters on national economies and the global economy has varied widely. While, for example, the 2007–2009 U.S. banking crisis stunned the world and fueled a deep recession, other financial calamities that seemed severe at the outset haven’t caused widespread economic harm.

In a working paper, Stanford’s Arvind Krishnamurthy and UCLA Anderson’s Tyler Muir set out to determine which financial shocks since the late-1800s deserved the label of “crisis” based on the damage done to banking systems and the economic after-effects. The researchers also sought to identify the market and economic conditions that typically led to true crises.

Their study is timely as 2019 dawns, given concerns about a worldwide economic slowdown after the huge buildup in government and private debt over the last 10 years. The International Monetary Fund estimates that global debt has reached a record $184 trillion, up from $112 trillion in 2007. So if debt levels were a worry 10 years ago, they’re a bigger one now.

Opt In to the Review Monthly Email Update.

The authors chose to define a financial crisis using parameters set out in a 2010 paper by Jorda et al. That study, Krishnamurthy and Muir write, focused on “events during which a country’s banking sector experiences bank runs and sharp increases in [loan] default rates, accompanied by large losses of capital that result in public intervention, bankruptcy, or forced merger of financial institutions.” And in each case, the financial system upheaval led to crippling recessions in the country or countries affected.

The authors identified 44 such crises worldwide since 1870, most of them centered in European countries but also including events in the U.S., Canada and Japan. The U.S. accounted for just two of the 44: the Depression-era crisis and the 2007–2009 debacle.

Notably absent from the crisis list are disasters that temporarily rocked the U.S. financial system, including the bankruptcy of Penn Central railroad in 1970, the failure of giant Continental Illinois bank in 1984, the implosion of the savings and loan industry in the late 1980s and the bailout of the Long-Term Capital Management hedge fund in 1998. Despite the fear triggered by those events, they had no “measurable” effect on the real economy as a whole, the study says — although Muir, in an interview, said there was “disagreement” among academics about whether to count the S&L collapse as a full-blown crisis. “On the one hand, there were clearly a large number of [S&L] failures, on the other, it wasn’t as severe as something like the Depression,” he said.

The study lays out how serious financial crises have unfolded since 1870:

- First, and for whatever reason, banks and bond investors become increasingly willing to lend money, leading to “unusually” rapid growth in the amount of credit outstanding to governments, businesses and consumers. In the interview, Muir said the debt expansion necessary to plant the seeds for a crisis involved sustained periods (about three years or more) during which credit growth significantly exceeds historical rates. In each case that growth has been driven partly by a narrowing “spread” between yields on high-quality bonds and yields on riskier bonds. In other words, bond investors become willing to accept relatively low returns on bonds issued by higher-risk borrowers. “We show that spreads are about 25 percent ’too low’ pre-crisis” compared with what would be expected given economic and business fundamentals, the researchers write.

- Inevitably, at some point in the credit boom, a negative surprise occurs — say, an unexpected default by a large borrower — that causes lenders to reappraise borrowers’ creditworthiness. But by then, widespread excessive risk-taking has weakened the entire financial system. So the negative surprise triggers panic, eventually leading to “bank runs as well as a credit crunch, i.e., a decrease in loan supply and a rise in lending rates,” the study says.

In the bond market, investors’ response then is to quickly jack up interest rates, driving yields on low-quality bonds sharply higher compared with high-quality bonds. “The typical crisis sees about a doubling of credit spreads,” Muir said. “So spreads would be twice the pre-crisis level, which is pretty substantial. Of course this is an average; in some episodes they widen even more.” - As credit dries up, it causes a cascade of pain across the economy. Heavy borrowers face ruin either from the rebound in interest rates or because new financing is shut off altogether. Stock markets sink as investors shed risky assets. The economic result: “Recessions in the aftermath of financial crises are severe and protracted,” the study says.

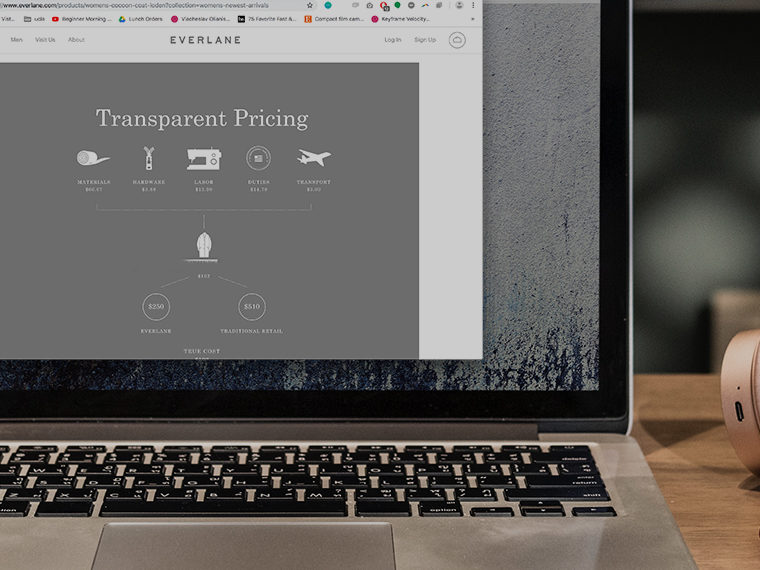

One key takeaway from the paper is that serious financial crises appear rooted in easy-money policies of lenders — in other words, they stem from credit “supply shocks” to the financial system as lenders offer up huge amounts of cheap loans. That was clearly the case in the mortgage-lending frenzy leading to the 2007–2009 financial crisis.

Credit supply shocks are the opposite of credit “demand shocks” that occur in, say, strong economies in which companies are eager to borrow in order to expand. Both types of shocks can result in rising debt levels. The difference is that lenders are likely to keep interest rates up during credit demand shocks, better protecting themselves from high-risk borrowers. The “behavior of both prices and quantities [of debt] suggests that credit supply expansions are a precursor to crises,” Krishnamurthy and Muir write.

Featured Faculty

-

Tyler Muir

Associate Professor of Finance

About the Research

Krishnamurthy, A., & Muir, T. (2016). How credit cycles across a financial crisis.