As alternative pricing schemes proliferate, researchers examine beliefs about their fairness

Buying goods and services in the U.S. typically means paying a preset cost in actual dollars and cents. But in some instances, we also kick in non-monetary resources.

For example, sports fans stand in line for limited game tickets, paying with time as well as money. Military personnel can use social clout to board flights early, while others fork over additional cash for the privilege. Applicants for college scholarships sometimes expend physical labor (when performing community service) or mental energy (when filling out paperwork). Broadway enthusiasts tap theater friends for tickets to hit shows.

These alternative pricing schemes — those that distribute limited goods according to how much time, social connections, additional cash or other resources are spent — often trigger strong opinions about fairness. We’re appreciative of some but offended by others.

Opt In to the Review Monthly Email Update.

For example, you might consider Disney theme parks’ system allowing one to pre-book ride times a fair way to bypass the longest lines, but you might bristle if someone can jump queues because her father is a park manager. Selling tchotchkes to the highest-dollar bidder seems fair enough, while doling out transplant kidneys the same way doesn’t. We resent some, but not all, pricing schemes by airlines, hotels and ride shares, although each routinely charges different prices to different customers for the same service.

UCLA Anderson’s Franklin Shaddy and University of Chicago’s Anuj K. Shah investigate why some of these policies seem fairer than others in a paper they published in the Journal of Consumer Research. This work offers a grounding in notions of fairness and how they play out in the consumer marketplace. The research specifically looks at attitudes around how to allocate goods and services that are at times scarce.

Seeking the Fairest Currency

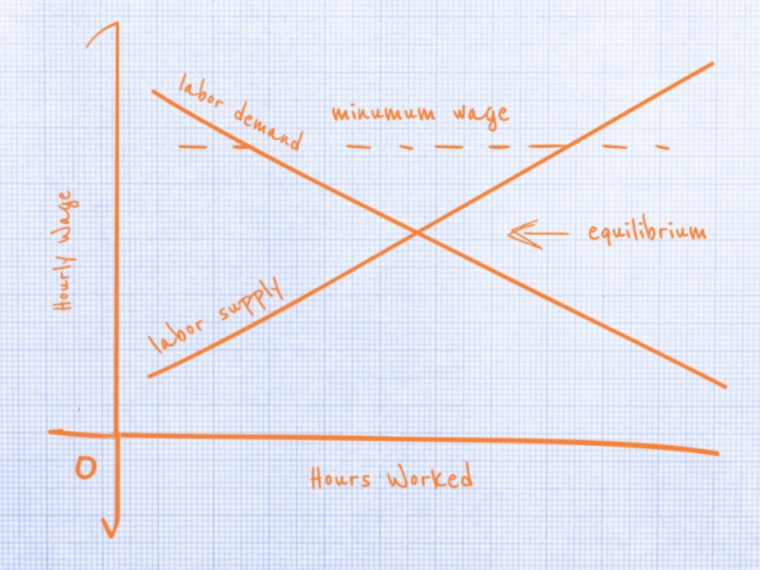

In a series of six studies, the researchers solicited impressions about scenarios in which buyers used time, mental or physical energy, money, connections or status to acquire limited goods. They found participants’ ultimate fairness judgments of each scheme to be steeped in a shared philosophy: goods and services should go to those who want or need them most. The currency perceived as fairest for determining allocation is the one that most clearly communicates, or reveals, the strongest preferences for the goods, according to the study’s findings.

Standing in line for football tickets, waiting long hours for medical treatment or otherwise spending time waiting reveals high levels of want and need, according to the participants. Thus, they rated time-based policies (i.e., those requiring people to spend time) as the fairest ways to divide goods.

Outlays of physical labor and mental energy were seen as good measures of desires, too, though not quite as revealing as time commitments, according to the findings. Scenarios that required paperwork (i.e., spending mental energy) for tax breaks, slots in popular elementary schools or public benefits received decent marks for fairness.

Considered less reliable indicators of preferences, and therefore potentially less fair, were policies that required additional monetary payments. Participants often distrusted add-on fees that gave payers significant advantages over those who spent more time for the purchase.

Similarly, using petitions, well-connected friends or other resources influenced by social circles and popularity did not instill feelings of fairness, the studies find. Kickstarter campaigns drew lukewarm fairness ratings when participants perceived success on the fundraising platform to be based on one’s number of social connections. They particularly disliked schemes that gave celebrities advantages for getting restaurant tables, club entry and other sought-after access — policies that allow people to wield their social influence.

“The take-home message here for designing policies is that you should think about whether the resource you’re asking people to spend — whether it’s time, money, social influence and so on — tells you who actually wants or needs a good or service the most,” Shaddy said in an interview. “This is because people generally want things to go to those who have the strongest preferences for them.”

Predictable Reactions

The researchers began the series by explaining, without specific examples, how each of six different resources (e.g., money, time, physical energy, etc.) can be used as currency to acquire goods.

Participants then rated the fairness of six hypothetical schemes for releasing for rental popular U.S. Forest Service cabins, based on those resources. The service could, for example, rent to applicants who reserved first (i.e., those who spent time), or to those who bid the most money. Applicants willing to work for the rentals, perhaps by volunteering to weed or perform computer data entry, might get first dibs.

Consistently, participants gave the highest fairness marks to schemes based on resources matching their picks as most indicative of wants and needs.

With this link in mind, participants’ attitudes toward real-life scenarios became surprisingly predictable, Shaddy says. The connection between revealing wants and needs and fairness held even when participants disagreed about which resource was needed to get the goods. Participants who thought new edition iPhones went to those who spend the most money said Apple’s allocation process was less fair than those who said pre-ordering or standing in line was the surest way to land one.

Why We Despise Uber Surge

Why, then, does Uber Surge pricing grate on us? The scheme uses an algorithm that quickly changes ride prices during peak ride times, and our general loathing of the policy is a common topic for writers ranging from psychologists to World Bank bloggers.

Surge pricing taps the not-so-revealing money resource. Older academic research suggests that people resent the scheme because they think the company is gouging. Yet, airlines and hotels use similar tactics every day without drawing the intense backlash Uber has attracted.

Shaddy and Shah propose an alternative explanation. They say some allocation schemes lack characteristics needed to create strong signals about who wants and needs them most. Without this information, they find, the policies seem biased.

For a policy to be accepted as fair, the resource used for allocation should be something that is, naturally, equally held by all, according to the study. Standing in line often seems a fair price to pay because everyone has an equal number of hours in a day to spend. The person who agrees to spend the most money for a football ticket may just be wealthier than a bigger fan.

The study illustrates the point with a real-life scenario involving food assistance benefits that can be gained only through personal appearances at government offices. When told that some applicants worked during those office hours — they had less free time than others — fairness ratings dropped.

Also, the amount of a resource required for a purchase should be readily clear to potential buyers, according to the study. A scheme to auction popular housing to employees posted in foreign countries was deemed fairer when the exchange rate for their U.S. paychecks was fixed, and applicants could accurately predict the costs. Giving college students points to spend on seats in popular courses was deemed unfair when some students didn’t know how to use them.

In a similar way, Uber surge pricing compounds the unequal distribution of money with a lack of context for the service’s costs. The displayed “2.1x” surge price does not give enough information for riders to determine if the new rate is unusually high, according to the study. Participants thus rated surge pricing fairer when potential passengers were shown average peak rates for their rides.

When Everyone Needs It

If fairness lies in doling out goods and services to those who want or need them the most, lotteries are particularly unfair division schemes. Nothing about need or want is revealed by a randomly drawn ticket.

And yet, in ongoing research, Shaddy and Shah hypothesize that lotteries can seem the fairest form of division when everyone’s needs are roughly equal. Using scenarios involving wait lists for organ transplants, they note that every possible recipient is in desperate need. In these situations, spending different resources like time or money won’t tell you who needs an organ the most, because everyone has high need. Thus, random distribution seems fair.

The researchers stress that their work does not try to peg which distribution schemes are actually fairest. They hope instead to shed light on factors that shape our perceptions of fairness. Their findings can potentially help firms and policymakers alike think about creating a greater sense of fairness, whatever price is paid.

Featured Faculty

-

Franklin Shaddy

Assistant Professor of Marketing and Behavioral Decision Making

About the Research

Shaddy, F., & Shah, A.K. (2018). Deciding who gets what, fairly. Journal of Consumer Research, 45(4), 833–848.

Kahneman, D., Knetsch, J.L., & Thaler, R. (1986). Fairness as a constraint on profit seeking: Entitlements in the market. American Economic Review, 76(4), 728–741.