Measure of export intensity raises questions about trade policy and housing restrictions

The work-from-home, work-from-anywhere experience of COVID-19 has many corporate employees questioning whether they need to live in a big city and, indeed, whether big companies need to be located there, as well.

A working paper by University College London’s Jan David Bakker, Universidad de los Andes’ Alvaro Garcia-Marin, University of Edinburgh’s Andrei Potlogea, UCLA Anderson’s Nico Voigtländer and the IMF’s Yang Yang, however, serves as a reminder of what powerful and unique economic engines the world’s largest cities have become: The researchers document a strong increase in export intensity that occurs as cities grow in size.

Examining Export Intensity and City Growth

Export intensity takes into account both the number of firms involved in exporting and the portion of their sales to nondomestic customers.

While one might assume that a concentration of particularly trade-driven industries accounts for this difference, the researchers find that this is not the case: More than two-thirds of the association between city size and export intensity is due to differing levels of export activity within industries — say, electronics companies in large cities out-exporting those in smaller urban areas.

The authors compare export intensity in the very largest metropolitan areas, those at the 95th percentile in population, with metro areas in the 75th percentile:

- In the U.S., the larger areas’ export intensity is 2.5 times greater.

- In China, nearly three times greater.

- In Brazil, nearly four times greater.

- And in France, where export activity is relatively more evenly spread, the larger areas’ intensity is 45% higher.

These variations hold true even after controlling for differences in geography such as locations of ports.

The findings suggest limits to the power of traditional trade policy to help struggling locales and their companies. While trade agreements are typically aimed at bolstering an entire industry, the most export-intensive companies — disproportionately housed in the largest cities — are best positioned to take advantage of the programs.

Garcia-Marin and Voigtländer, in an earlier paper, showed how companies become remarkably more productive when they start exporting, reacting to the rigors of global competition to sell their goods.

Trade’s Power Grows in Locales that Support Workforce

The latest paper also notes the large role that housing — and a given city’s ability and willingness to expand the number of housing units to accommodate a growing workforce — plays in the growth of export intensity.

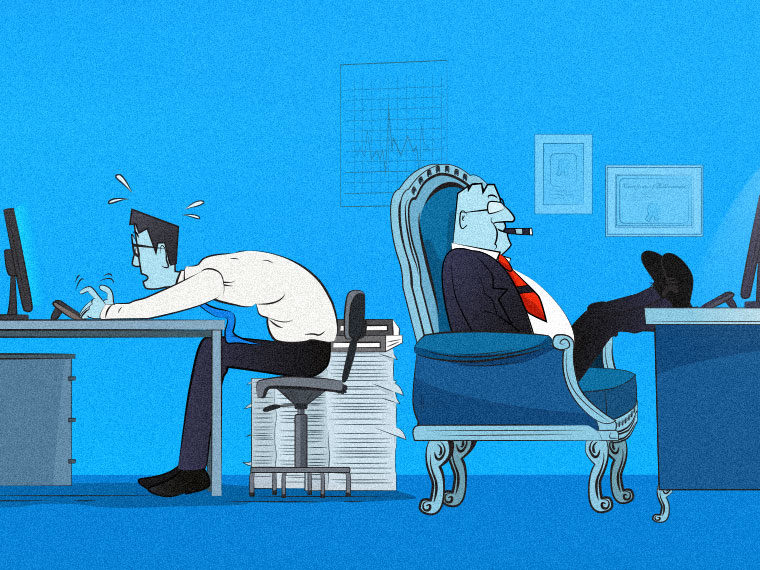

More productive firms “sort into large cities” and become even more efficient because of agglomeration economies, the ecosystem of skilled labor, knowledge and supporting businesses that develops around an industrial hub, according to the study. This allows those firms to become even more productive despite the higher operating costs (labor, real estate) in large cities.

In recent years, however, particularly on the West Coast, large cities that are export hubs — notably Los Angeles, San Jose, San Francisco and Seattle — have developed housing shortages as local political opposition to home construction and other barriers restrict supply. Rather than continue to expand in such cities, some companies have instead moved operations elsewhere to cities that have or can build adequate housing to attract workers.

The research suggests that loosening up housing constraints during a period of trade liberalization exerts a positive economic force because it amplifies the welfare and productivity gains by allowing the most efficient firms to export and grow faster.

The researchers build a model using data on 655 Chinese cities, 312 metro areas in the U.S., 210 cities in France and 420 micro-regions in Brazil. They also used detailed data on more than 1 million Chinese businesses and nearly 200,000 in France.

“The same firm-level fundamentals that lead firms to select into exporting may also cause them to locate in large, productive but expensive cities,” the authors note.

Featured Faculty

-

Nico Voigtländer

Professor of Global Economics and Management

About the Research

Bakker, Jan D. , Garcia-Marin, A., Potlogea, A., Voigtländer, N., Yang, Y. (2021). Cities, Heterogeneous Firms, and Trade.