Do bigger companies win even when they lose out on corrupt deals?

For more than 40 years, the U.S. Foreign Corrupt Practices Act has made it illegal to bribe public officials to win government business. Since the act’s adoption in 1977, the Department of Justice has brought more than 390 enforcement actions under the law. In 2019, the agency, together with the Securities and Exchange Commission, which also is responsible for enforcement, imposed a total of $2.6 billion in fines, the most ever for a single year.

In the largest single case, LM Ericsson, the Swedish telecom giant, in December 2019 agreed to pay more than $1 billion to settle DOJ and SEC charges that it funneled illegal payments to officials in China, Djibouti, Indonesia and other countries to win equipment contracts. In June 2019, Walmart agreed to pay $282 million to settle FCPA charges that it bribed officials in Mexico, China, Brazil and India for permits to build stores.

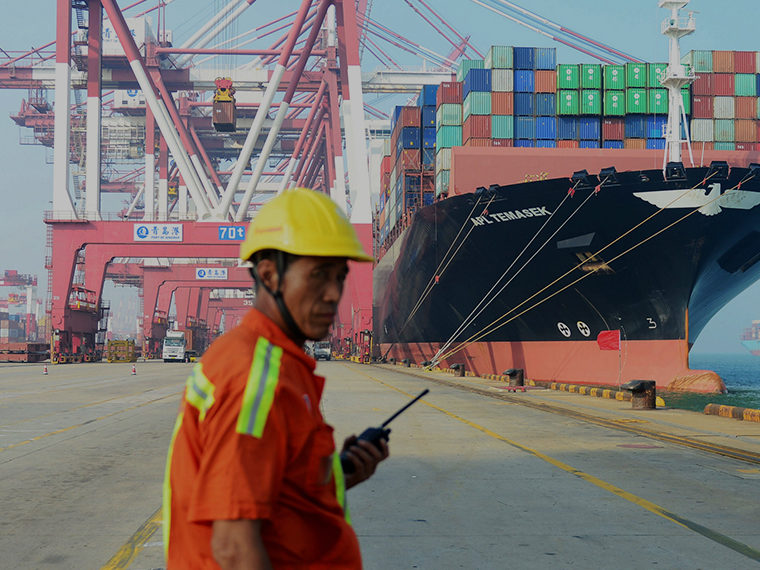

The U.S. isn’t alone. Most countries have laws against bribery in public- and private-sector contracts, and the United Nations, the OECD and other multinational organizations sponsor comprehensive corruption-fighting efforts. Yet, despite government crackdowns, corruption in large procurement contracts remains widespread. Especially in the developing world, winning a deal too often means paying a bribe.

Opt In to the Review Monthly Email Update.

A bribe increases the cost of doing business, of course, and that cuts into profit for the company selling a service or product to a foreign government. But there are reasons for companies big and small not to blow the whistle when asked for a bribe. Smaller firms are often at a cost disadvantage because they lack their larger rivals’ economies of scale. All things being equal, the larger company should be able to offer a lower price and still make a nice profit. Bribes can provide a critical edge to the smaller competitor. Of course, large companies aren’t immune to the temptations of corruption, as the recent prosecutions against corporate giants prove.

In a paper forthcoming in Production and Operations Management, Xiaoshuai Fan of Southern University of Science and Technology in Shenzhen, China, Ying-Ju Chen of Hong Kong University of Science and Technology and UCLA Anderson’s Christopher Tang explore the motivations of large companies in contracting situations marked by bribery.

They developed a model built on economic and competitive assumptions that suggests big companies have little incentive to expose corrupt bidding practices, even if they lose the contract — because they, in fact, benefit from the corruption.

“This result can be viewed as a plausible explanation for the ubiquitous existence and concealment of corrupt procurement auctions,” the authors write.

Using a game-theory model, the authors consider a case in which a large company and a smaller one compete for a contract in which the lowest bid wins.

In the model, the large company (call it Acme Inc.) starts with an inherent advantage, thanks to lower production costs and its economies of scale. The smaller competitor (Coyote & Co.) has to sacrifice some profits in its bid to be competitive. And because of its inherent disadvantage, it will always offer a bribe, the model suggests.

Also in the mix is a corrupt intermediary, who, in exchange for Coyote’s bribe will reveal Acme’s offer, giving Coyote the opportunity to underbid it. (If Acme also offers to pay a bribe, the intermediary keeps both bids secret, the sale proceeds fairly and only the winner pays up.)

Acme, assuming Coyote will offer a bribe, has to decide whether it should counter with one of its own. If its costs are high, then the added expense of the bribe could make the contract unprofitable. If its costs are low, it can pay a bribe and still submit a bid that earns a profit.

What complicates matters, the model suggests, is that the decision to bribe also sends a signal to Coyote about Acme’s costs. Even though the information is pretty general, the knowledge gives Coyote an added edge in the bidding. Since Coyote will always bid more aggressively, and a bribe cuts into Acme’s cost advantage, the model suggests that it’s never profitable for the larger company to offer a bribe. It’s better for it to compete on its lower cost structure alone.

If Acme can’t profit through bribery, then why doesn’t it expose the practice, beyond worries of offending the sensibilities of the next procurement intermediary it faces? The model suggests that corruption has contradictory effects on Acme’s inherent cost advantage. When the positive and negative effects are weighed, Acme is better off if it allows the corrupt bidding to go on unhindered.

The bribe Coyote offers adds to its costs and thins its potential profit margin. If the size of bribe or Acme’s initial cost advantage is large, then Acme can still underbid Coyote, win the contract and earn a profit, even if Coyote offers the bribe. If Coyote wins the contract, it likely ekes out a small profit on the work and is a less robust competitor on the next deal that comes up.

Of course, real-world procurements are far more complex than the one in this simplified model. In reality, big companies pay bribes just like small ones. Most procurement contracts involve multiple bidders of varied sizes, and it’s rare to see only two mismatched companies in competition. Finally, actual companies don’t behave as single, rational actors but instead are made up of lots of individuals with their own agendas.

Still, the model has value by virtue of helping to explain why so many companies keep silent in the face of corruption. “You can be better off by keeping quiet, which is commonly seen in many developing countries,” Tang said in an interview. “Now I have a better understanding why there are no whistle blowers.”

Featured Faculty

-

Christopher Tang

UCLA Distinguished Professor; Edward W. Carter Chair in Business Administration; Senior Associate Dean, Global Initiatives; Faculty Director, Center for Global Management

About the Research

Fan X., Chen, Y-J. & Tang, C. (in press). To bribe or not in a procurement auction under disparate corruption pressure. Production and Operations Management. doi: 10.1111/poms.13232