Can nudges, tailored to personality traits, persuade retirees to wait?

The obstacle course that is retirement planning ends with a doozy of a challenge: how to convert years of saving into a reliable stream of income that can last for 25 or more years.

Most Americans trip up on one of the most important ways to increase retirement income. A recent white paper estimates that the average household leaves $110,000 on the table by choosing the wrong time to start collecting Social Security income. The report, published by tech-driven wealth management firm United Income, has serious chops. A former chief economist at the Social Security Administration (SSA) and a former research director at Social Security are among the co-authors. The SSA coughed up data on the actual claiming choices of more than 2,000 households for the research.

Opt In to the Review Monthly Email Update.

That six-figure flub is caused by Social Security’s unfortunate claiming architecture that all but goads retirees to make the wrong decision. There is a ridiculously wide eight-year window between the ages of 62 and 70 when someone can choose to start payouts. The prospect of finally getting money out of the system you’ve paid into for decades makes starting early appear enticing. But there’s a costly tradeoff.

The benefit you are entitled to at 62 is 25 percent to 30 percent less than the benefit you would get if you waited for your full retirement age (FRA) — which is somewhere between ages 66 and 67, depending on the year you were born. And continuing to hold out past your FRA wins you still more valuable retirement income. Claim at age 70 and your benefit is 24 percent higher than at your FRA and 76 percent higher than if you started at 62. (After age 70 there are no more credits for waiting.)

One of You Needs to Wait

Scholarly research has unequivocally found that having the highest earner in a household wait until age 70 to claim Social Security is a crucial way to boost retirement income. Yet fewer than 5 percent of people wait that long. In the latest report from Social Security, more than 7 in 10 recipients started before age 64. United Income puts the collective price tag of current and future retirees’ claiming too early at $3.4 trillion.

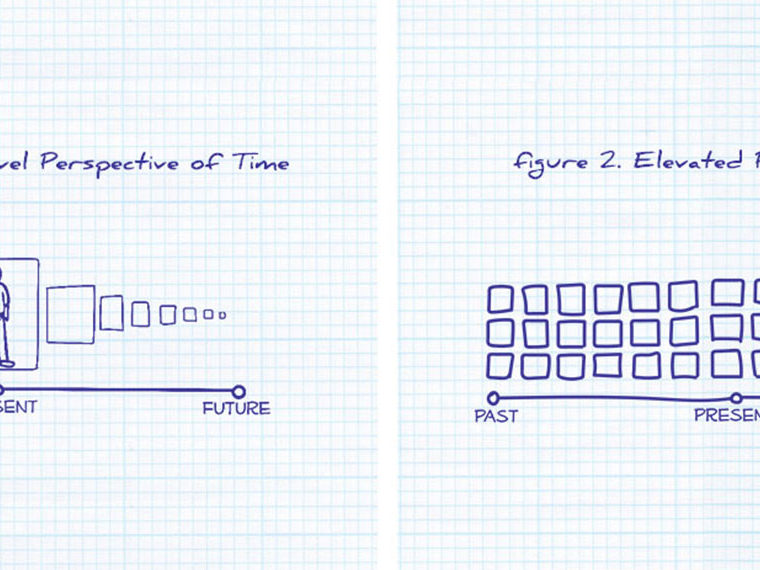

There is a laundry list of behavioral reasons why waiting is not more common. The basic human condition that resists delayed gratification is front and center. Those prone to loss aversion bias are going to fixate on what they “give up” if they delay claiming and then die earlier than expected.

Social Security may be a guilty party. In a review of biases that are at play in retirement income decisions, UCLA Anderson’s Suzanne Shu and City, University of London’s Stephen Shu posit that the label full retirement age (FRA) used by Social Security could be contributing to the problem. At your FRA you are entitled to 100 percent of your earned benefit. Sounds like a green light, but it should probably be yellow, as waiting until 70 would earn you a fuller benefit: 124 percent of your FRA.

Also at play are an underappreciation of how long one might live and how delaying Social Security to age 70 becomes valuable longevity insurance, as is a belief that Washington will stiff near-retirees when it eventually shores up the program. (For the record, Social Security needed fixing in the early 1980s, too. It got done with rational tweaks that did not unduly burden any age group. The same is possible today, absent politics.)

Cue the Behavioral Nudge Machine

Given the magnitude of the problem — both in the number of people claiming at suboptimal ages and the amount of retirement income they forgo — there has been much research into whether behavioral nudges might be able to move the needle. The majority of research focuses on one or a few possible nudges.

Bocconi University’s Adam Eric Greenberg and UCLA Anderson’s Hal Hershfield, Suzanne Shu and Stephen Spiller have rolled 13 of the nudges into one research project that is in the process of measuring the impact of nudges for 13 biases and how 20 personal character traits (e.g., patience, risk appetite, financial literacy) might interact with a given intervention. The SSA provided a grant for the research.

Using Amazon’s Mechanical Turk, the researchers began in 2018 to solicit participants between the ages of 40 and 61. With a stated goal of 4,500 participants, the research is being conducted in waves, as there is not typically a ready universe of that many 40–61-year-old study subjects.

As of their presentation of a working paper at the 2018 meeting of Social Security’s Retirement Research Consortium,* only a few interventions had been strongly effective in pushing people to a later start date. And the ability of personal traits to move the delay needle for a given intervention worked in just a few iterations.

The research rolls all participants through a short explanation of Social Security benefits that is accompanied by a table that shows the different monthly benefit amounts a typical retiree would collect, based on different starting ages.

Each participant is sorted into one of the 13 interventions tested (a control group did not see an intervention), and is then asked to give an intended claiming age.

Among the biases tested were: framing (early claiming will result in a loss versus delayed claiming will result in a gain); the pull of social norms (here’s when other people claim their benefit); and the extent to which a participant cares about how benefit choices will impact his or her future (older) self.

Participants were then presented with a series of short tests to measure different traits that focused on personality, numeracy, financial literacy and risk tolerance.

One anomaly the study showed was that the average claiming age among the control group was nearly 68 years, which is well above what actual claiming data would suggest (it’s possible survey subjects partly answered to please the researchers). That, the authors contend, is less important than the extent to which any of the interventions measurably changed claiming attitudes among subjects outside the control group.

On that front, only two of the 13 interventions nudged participants to say they’d claim Social Security at a significantly later age.

When participants were tasked with listing reasons why it would be good to receive benefits later, or bad to receive benefits earlier, they reported an intended claiming age that was 10 months later than the control group’s average claiming age.

Another group of participants was nudged to think about the longer-term consequences of a claiming decision. They were asked to recommend a claiming age to someone who was going to live to an old age, and to give the exercise some personalized context. They were also asked to consider someone they knew who lived to an old age. After completing that exercise, participants in this group, on average, chose an intended claiming age that was six months past the control group.

Four other interventions were effective, but less so.

The “gain frame” (your benefit will be higher if you wait) cajoled participants to state that they intended to start collecting between five and six months after the control group. The same delay was reported by participants who were told that retirees who had claimed early regretted their decision.

Participants presented with an “injunctive norm” message (delaying your claiming is a good idea for your financial well-being) reported an average claiming delay that was five months longer than the control group. The same delay was reported by participants who were primed to focus on the benefit that delaying would garner for their future (older) self.

The researchers conclude that “although claiming intentions are relatively difficult to influence” their findings suggest that some nudges are more influential than others. That’s fertile ground for more research. They also note that their initial findings might eventually help online tools to be more effective in encouraging users to delay collecting Social Security. If a tool first prompts users for information related to personal traits (e.g., how patient the user is, how attuned to loss aversion), and then delivers nudges customized to those predilections, it might be able to guide a person to see the value of delaying.

*The group’s official name was recently changed to the Retirement and Disability Research Consortium; it is a joint project that includes the NBER Retirement and Disability Research Center, the Center for Retirement Research at Boston College, the University of Michigan Retirement and Disability Research Center and the University of Wisconsin-Madison’s Center for Financial Security Retirement and Disability Research.

Featured Faculty

-

Hal Hershfield

Professor of Marketing and Behavioral Decision Making

-

Suzanne Shu

Professor Emeritus of Marketing

-

Stephen Spiller

Associate Professor of Marketing and Behavioral Decision Making

About the Research

Greenberg, A.E., Hershfield, H.E., Shu, S.B., & Spiller, S.A. (2018). What motivates Social Security claiming age intentions? Testing behaviorally informed interventions alongside individual differences