Topic: Finance

Corporate Bond Market Meltdown Averted after Fed Action

Decade-old bank-risk limits may have exacerbated liquidity problems

Companies Sued for Securities Fraud Adopt More Conservative Accounting

The shift spreads through auditors to other clients, potentially clouding the financial information investors rely upon

Calculating a Value for the Government Support Banks Enjoy

Researchers’ model could quantify the risks in the growing movement to ease up on Dodd-Frank regulations

Businesses Vastly Overestimate the Likelihood of Being Audited

Should tax-collecting agencies keep audit activity secret to discourage cheating?

Bringing a Sharper Focus to the Study of the Decline of Investment Diversification

Research measures the impact of global economic factors on returns

Boo! Does Merely Mentioning an Audit Increase Taxpayer Compliance?

Research undermines the notion that companies coldly calculate tax avoidance

Adapting Value Investing to the 21st Century

Including intangible assets in book value vastly improves the strategy’s returns

A Tool for Finding Mispriced Stocks

Less sophisticated investors reveal their sentiment in certain trades, and a 20-year study measures it company by company

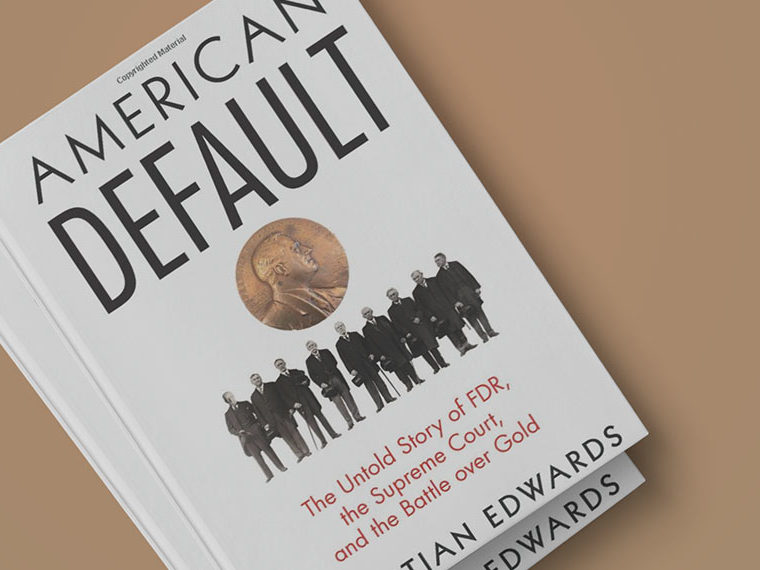

A Shocking Tale of Sovereign Default and Private Contracts Nullified

Sebastian Edwards brings to life a widely forgotten chapter of U.S. history starring FDR, his no-name economist and the demise of the gold standard

What Investors Infer From External News And Management Silence

Uncertainty about outside news alters company disclosures and how markets interpret them, study finds

“How’re Sales, Roger?” “Good Question, Roger!”

When CEO and analyst share a first name, earnings estimates are sharper