Topic: Risk Management

Muni Bond Buyers Pay a Little Extra for the Pleasure of Not Being Taxed

Doing so, they subsidize government, which is, well, sort of like a tax

Why We Think Differently About Money Than About Probabilities

Learning gradually versus all at once and how we estimate value

A Different Way to Evaluate Private Equity Performance

An approach tailored to investor risk appetite and more comparable to stocks

A Quiet Expansion of Deposit Insurance Could Disrupt U.S. Banking

Seen as a backstop to small- and midsized banks, the program, allowing insurance in multiples of $250,000, alters banking’s risk calculus

Amateurs Struggle To Incorporate Market Signals About Pricing into Their Trades

Disregarding data, novices often sail into strong winds

Banks Transmit Financial Shocks, Including from Natural Disasters

How a localized flood may result in fewer loans to a far-off community

Banks, Freed to Operate Across State Lines, Helped Stabilize the Economy

Lenders financed expansion in some markets, offsetting problems in others

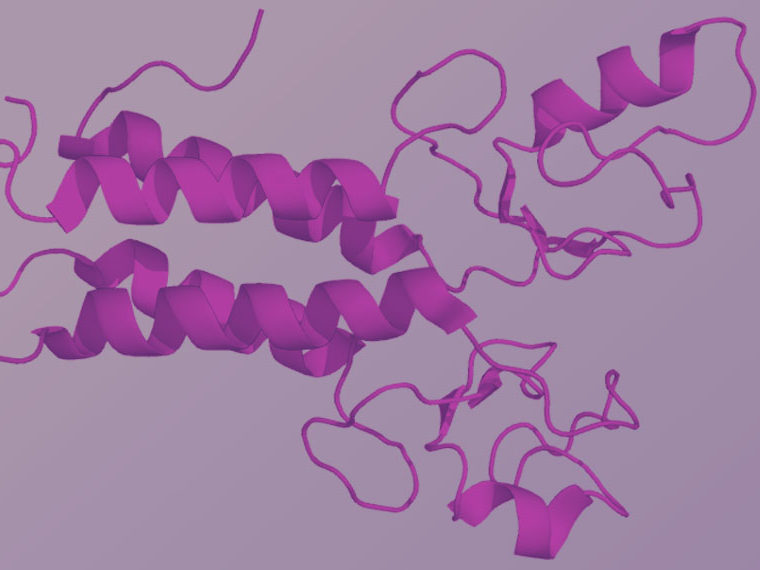

BRCA Mutation: New Model Quantifies How Surgeries Reduce Cancer Risk

Informed by personal experience, a researcher parses data to help those mulling mastectomy and gynecological surgeries

Calculating a Value for the Government Support Banks Enjoy

Researchers’ model could quantify the risks in the growing movement to ease up on Dodd-Frank regulations

Can Banks, Disrupted by Fintech, Adopt New Habits, Too?

In China, patent data shows commercial banks’ use of new technologies helps improve efficiency and reduce risk

CEO Succession: Execs Running a Subsidiary Offer a Balance Between Insider and Outsider

In an analysis of transitions from 1993 to 2017, they wrung more from operations facing tumult

Corporate Bosses, Given Fewer Stock Options, Turn Risk-Averse

Research might give pause to corporate boards changing compensation models

Forecasting a Recession Using Easy-to-Grasp Images

A look at the shape of five variables through the last seven downturns vs. today’s numbers

Has the Term ‘Competitive Advantage’ Outlived Its Usefulness?

Popular in business schools and executive suites, it’s no longer a meaningful way to compare companies

How Life Insurers Insulate the Markets from Turmoil

Valentin Haddad’s research finds that insurers’ patient investing shields risky assets — and those who hold them — from steeper declines

Ignorance — About One’s Investments, Anyway — Isn’t Always Bliss

Valentin Haddad’s research looks at the phenomenon of “information aversion,” when individual investors stop tracking their portfolios for fear of bad news