Companies with Chinese suppliers suffered — those with more diversified supply chains suffered more

Conventional economic wisdom warned that President Donald Trump’s trade war with China would backfire and hurt U.S. consumers and companies. A growing stack of studies suggests that conventional wisdom was right.

- One analysis concluded that U.S. exporters had to pay higher prices for components imported from China.

- Tariffs on imported washing machines raised prices for washers by almost 12% — and on dryers as well, researchers at the Federal Reserve and the University of Chicago found.

- Costs that weren’t passed on to consumers were absorbed by importers, Moody’s Investor Service reported.

Just how much U.S. companies were hurt by Trump’s tariffs is the subject of a working paper from Di Fan, Chris Lo and Andy Yeung of Hong Kong Polytechnic University; Monash University’s Yi Zhou; and UCLA Anderson’s Christopher S. Tang.

The researchers measure the damage in two ways. First, the tariffs increased the number of days goods were held in inventory, which raises holding costs and makes operations less efficient. Second, they looked at companies’ return on assets, a measure of profitability, which declined for many companies involved in world trade.

Tariffs Made U.S. Producers Less, Not More, Competitive

The buildup of inventories that the analysis found can also be seen in an increase in the U.S. trade deficit, which climbed 12% in 2018 to a 10-year high of $621 billion. The increase in both the deficit and inventories suggests that importers might have gone on a buying binge in anticipation of the tariffs. The deficit with China fell the following year, but overall trade imbalances rose; companies moved production from China to Vietnam, Mexico and other lower-wage countries.

Tariffs, the findings suggest, didn’t strengthen U.S. producers but instead made them less competitive.

“Managers should understand that protectionism may not necessarily protect domestic industries,” the authors write.

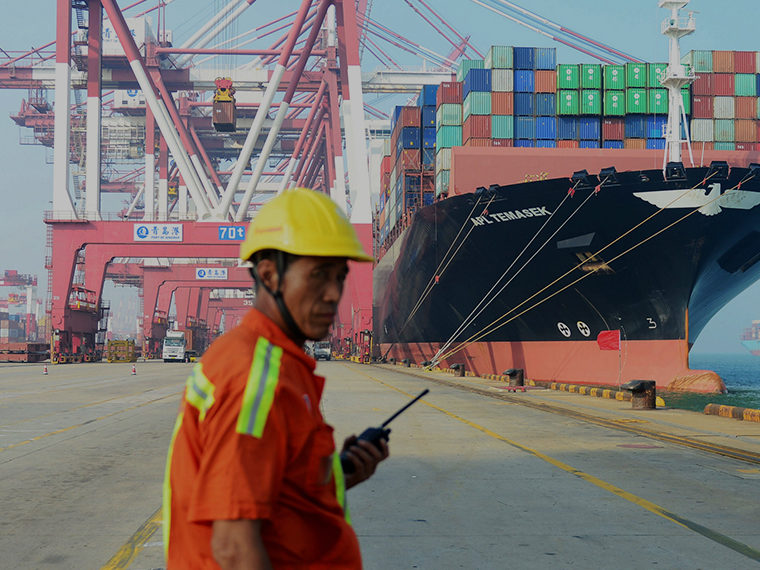

Trump launched his trade war with China in early 2018, eventually imposing tariffs on about $370 billion in imports. Tariffs, he said, were necessary to halt unfair trade practices, aid domestic manufacturers and reduce the U.S. trade deficit, and they would mainly hurt Chinese exporters, who would be forced to lower their prices to remain competitive.

Mainstream economists generally opposed the tariffs, predicting that the trade war would reduce U.S. gross domestic product, increase volatility in financial markets, and hurt U.S. consumers and businesses.

Whirlpool Corp., for instance, had lobbied for years for protection from lower cost imported washing machines from China and Korea, and imported washers were among the first to be hit with tariffs in the trade war.

But Whirlpool didn’t benefit as expected. Prices for washers and dryers climbed almost immediately after the tariffs went into effect, but so did Whirlpool’s raw materials cost, thanks to similar tariffs on steel and aluminium imports. Net income fell by $64 million, or 41%, to $94 million, in the first quarter of 2018 from the year before.

“In the era of the global supply chain, the costs of lobbying for tariff protection may not generate the benefits one would hope for,” the authors write.

Inventory Holds and Sales Decline Hurt Companies in Trade War

For their study, the researchers used a “quasi-natural” experiment — a method often used to measure the effects of a change in laws — to assess how tariffs affected U.S. importers. They did this by comparing 215 companies that purchased directly from Chinese suppliers with 215 otherwise similar companies without direct Chinese suppliers. They then measured the companies’ performance between 2015 and 2020.

One measure of a company’s performance is how many days of supply that it holds in inventory; holding inventories longer imposes higher costs. A threatened disruption in supplies, such as from an increase in tariff charges, gives companies an incentive to stock up before the charges take effect. A decline in sales can also increase inventory-holding periods.

After tariffs were raised, the study found, inventory-holding periods increased for companies with direct Chinese suppliers by about eight days more than for those that didn’t purchase directly from Chinese companies.

The trade war also hurt profitability for affected companies, as inventory costs rose and sales declined. The study saw a 3.89% decline in return on assets for companies with Chinese suppliers after higher tariffs went into effect.

The structure of a company’s supply chain had a significant impact on how much its profitability was hurt by the tariffs. Companies with a high degree of vertical integration — those that directly controlled more of the production of product components — experienced no decline in return on assets as a result of the tariffs.

But tariffs took a bigger bite out of the return on assets of companies with more diversified and complex supplier arrangements. For example, companies with Chinese suppliers and whose supply chains showed a high degree of “spatial complexity” — meaning their suppliers were spread among more regions — experienced return on assets 6.37% lower than those not directly affected by the tariffs.

For those whose supply chains have a high degree of “cooperative complexity,” such as when the output of one supplier serves as input for others in the same chain, return on assets was 8.25% lower after tariffs.

Supplier Diversification Brings Challenges with Market Disruption

Supplier diversification is supposed to help hedge against the risk of supply disruptions, such as a new tariff. But diversification comes with increased transaction costs, since more complex supply structures require greater communication and collaboration to make them work. The study suggests that can be an extra burden for global companies when international markets are disrupted.

“Firms with distributed supply bases suffered more from the tariff increases due to the U.S.-China trade war,” the authors write. “Our empirical evidence shows that sourcing diversification can become a burden for firms in responding to political risk events.”

Growing economic inequality, the loss of jobs to low-wage countries and increased nationalism have brought forth a resurgence in mercantilist economic ideas, which promote the notion that countries are better off if they have large trade surpluses with the rest of the world. But in a global economy, trade wars and other nationalistic policies no longer deliver on their promises.

“Because the supply chain of influential [multinational corporations] relies significantly on global trade, any disruption would have a serious impact on these firms’ operation and, in turn, on the domestic economy,” the authors write.

Featured Faculty

-

Christopher Tang

UCLA Distinguished Professor; Edward W. Carter Chair in Business Administration; Senior Associate Dean, Global Initiatives; Faculty Director, Center for Global Management

About the Research

Fan, D., Zhou, Y., Lo, C., Yeung, A, Tang, C.S. (2021). The impact of Tariff Trade Barriers on the Operating Performance of U.S. Firms: The Role of Supply Structure and Complexity.