A monthly check, not just a pile of cash: Studies demystify the instruments too few are using

More than 50 years ago economist Menahem Yaari laid out the academic case that individuals looking to optimize their spending in retirement without compromising their financial security would be motivated to convert all their wealth to fixed annuities.

And there is no doubt that many of today’s DIY retirees would benefit from annuitizing a portion of their assets. For instance, one strategy recommended by retirement planning experts is to cover all basic living expenses from guaranteed income sources. If Social Security and a pension (if applicable) aren’t sufficient, using a portion of 401(k) or other retirement assets to purchase additional guaranteed income can boost retirement confidence and sleep quality.

And yet, that economically rational move is still not widely adopted. Annuities — of all types — account for less than 10 percent of the $25 trillion in U.S. retirement assets.

Opt In to the Review Monthly Email Update.

Why? Loss aversion explains some of the reticence. It’s not exactly easy to hand over a wad of money to an insurer with the prospect you may die long before getting paid back anywhere near your lump sum investment. For the record, that thinking misses the point that an annuity is insurance — against living a very long life — not solely an investment whose value is a function of ROI. To overcome objections, recent annuity design tweaks address the early-death conundrum by offering the ability to buy payments for a set period of time (or, period-certain in industry parlance) to the annuitant or a beneficiary.

Also weighing against annuity purchases is the perceived risk. Purchasing an annuity today is a calculated bet that the insurer will have the staying power to send you payouts two or three decades down the line. That is, will a financially strong insurer today be just as strong in 25 years? Again, for the record, instances of an insurer’s going belly up are rare, and there are state insurance guaranty funds that serve as a backstop, up to certain account limits.

Even if someone is able to get past those issues, there’s the maddeningly complex annuity marketplace, where choices include the plain vanilla (that’s a compliment) single premium immediate annuity and single premium deferred annuity, as well as the variable and equity-indexed versions of annuities that include an investment component. All those options require careful cost and benefit comparisons, and each of those types of annuities can be stuffed with add-on bells and whistles that test the analytic skills of a CFA, let alone a consumer.

Given that annuities remain a hard sell despite their potential value as a much desired and needed insurance against outliving your savings, some well-placed nudges seem in order. In “Consumer Preferences for Annuity Attributes: Beyond Net Present Value” UCLA Anderson’s Suzanne B. Shu and Robert Zeithammer, along with Duke University’s John Payne, found that expanding the information presented to consumers about an annuity could increase demand without having to increase the payout as an incentive.

The authors, in a survey conducted via a nationwide internet panel of 657 adults ages 40-65, also found that reactions to particular features of annuities didn’t match the actual dollar value offered. People tended, for instance, to place a higher value on period-certain annuity features than the contracts actually provided. In turn, they placed a lower value on inflation-protection features than a purely economic judgment would.

The information presentation the authors constructed increased overall liking of annuities and it also helped people do a better job of analyzing particular features and their worth.

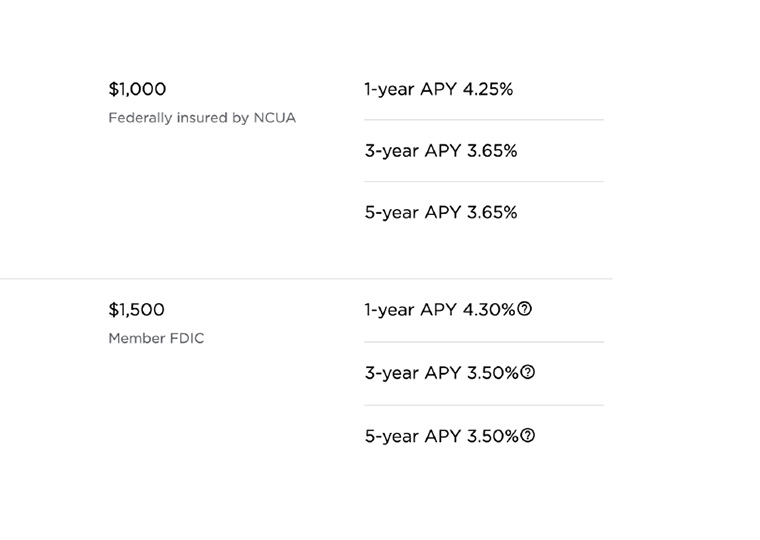

Policy-level nudges could also help pre-retirees consider annuities as a potential key tool in their retirement savings “decumulation” plan. Providing easy access through a retirement plan to a basic fixed payout annuity would be a significant nudge to help retirees lock in more guaranteed income. Access through a plan to fixed annuities would also circumvent the need for consumers to have to navigate the private annuity marketplace on their own, which is where the trickier investment-laden variable and indexed equity annuities are hawked by commission-focused agents.

Yet less than 10 percent of plans offer any type of guaranteed income product.

That’s despite the fact that the U.S. Department of Labor, which oversees retirement plans covered under the Employee Retirement Income Security Act (ERISA, 1974) has slowly been giving its blessing on adding these features.

Safe harbor rules for offering annuities within a plan have been around since 2008, but clarifications to those rules, issued in 2015, were designed to encourage more plans to offer the product.

In 2014, the Internal Revenue Service gave its blessing to allow retirees to purchase a Qualified Longevity Annuity Contract (QLAC) with money from a 401(k) or other defined contribution plan. Money used to purchase a QLAC is exempt from the required minimum distribution all traditional 401(k) plan participants must take beginning at age 70 ½. A QLAC is also known as a fixed deferred annuity. Payouts begin only at a future date 15 to 20 years or so after purchase. This type of annuity is insurance if you have the fortunate burden of a long life: needing to make sure your money outlasts you. Because payouts are deferred, the upfront cost to purchase a QLAC is a fraction of the cost of a fixed annuity that begins payments immediately at age 65 or so. (After all, the odds are a bit lower that you’ll still be alive at 80 or 85 – and beyond – to collect the deferred payout.)

And late last year, the Department of Labor signed off on allowing fixed annuities to be part of a target-date-fund offering within a retirement plan, when the TDF itself is a “default” investment for plan participants.

Nonetheless, for all the professed concern employers have that their employees be able to retire securely and on time (an ill-prepared worker doesn’t want to retire), very few have added guaranteed income options within their plans. According to benefit consulting firm Aon, less than 10 percent of plans offer a fixed annuity and just 3 percent currently have a QLAC option.

Aon says sponsors are waiting for the in-plan annuity product to “evolve” before they consider jumping in, and some plans cite continued fiduciary concerns related to offering and monitoring income solutions.

Meanwhile, the first generation of DIY retirement savers are stuck trying to work through their behavioral biases on their own, and ace the challenge of becoming a master decumulator.

Featured Faculty

-

Suzanne Shu

Professor Emeritus of Marketing

-

Robert Zeithammer

Professor of Marketing

About the Research

Shu, S.B., Zeithammer, R., & Payne, J.W. (2013). Consumer Preferences for Annuities: Beyond NPV