Area: Finance

Unintended Consequence of Stale Corporate Bond Fund Prices Amid Fed Tightening

In wild markets, do the most dated prices actually reduce redemptions?

Underappreciated Investment Edge: Company Trademark Filings

Not part of financial reporting, trademark activity predicts stock returns

Treasury Securities Are Actually Cheap Sometimes

They don’t trade at an absolute equal to intrinsic value, despite their image as the world’s investment bedrock

To Wall Street, There’s No Crisis Like a Banking Crisis

Tyler Muir finds that neither war nor deep recession darkens investor sentiment like sudden turmoil in the financial system

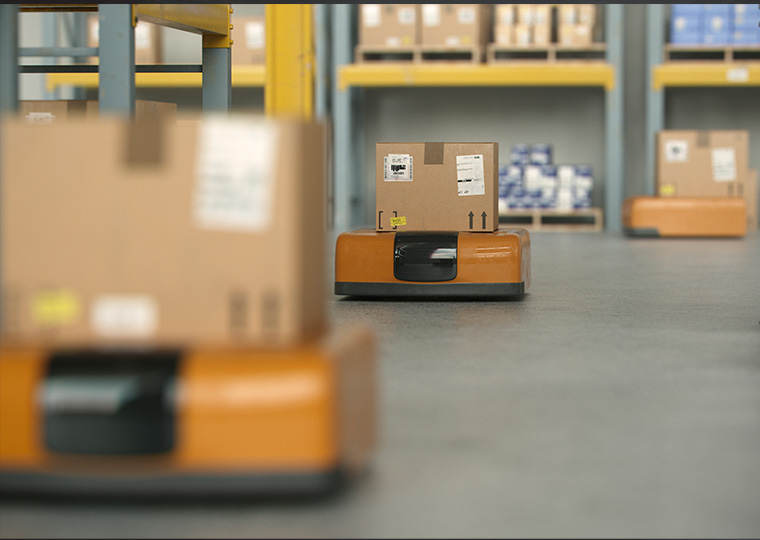

Think Your Job Is Safe From Robots?

Automation depresses career pay for many workers, notably including those in industries not automating

The Strange Case of the Missing Stock Market Return

Investors in leveraged companies take on extra risk, but research indicates they see no offsetting return

The Relative Well-Being of Generations: An Explanation for Falling Interest Rates?

Doing worse than mom and dad is a drag on the entire economy

The Moat That Keeps Complex Asset Strategies Profitable

Andrea Eisfeldt finds that hedge funds with infrastructure to execute sophisticated arbitrage crowd out less-expert investors

The Housing Meltdown Would Have Been Far Worse Without California’s Anti-Foreclosure Laws

Restraining lenders saved hundreds of billions in home value

The Collective Wisdom of Options Trades as Interest Rate Predictor

Skewness, measuring the range of biases, strongly suggests rate moves

Taking the Battle for Financial Literacy to Where the Eyeballs Are

Research by Bruce Carlin and Stephen Spiller suggests YouTube videos could help consumers make better money decisions

Some Homeowners Pay Their Underwater Mortgages Until the Government Offers a Better Option

Federal loan modification program led borrowers to default

Sizing Up the Measurable Good of Affirmative Action

An economic model sets aside who loses and focuses on efficiency and overall growth

Single-Family Rentals: What Drives Investor Return?

A unique data set provides fresh insights for the growing institutional investor market

Should Property Taxes Be a Bigger Consideration When Choosing Where to Live?

After some math, a $1 million home in a low-tax state could get you $1 million extra in retirement savings