Area: Finance

You Call That Fun? Why Individual Stock Investors Bother

Avanidhar Subrahmanyam studies how some investors’ gambling mentality affects share prices

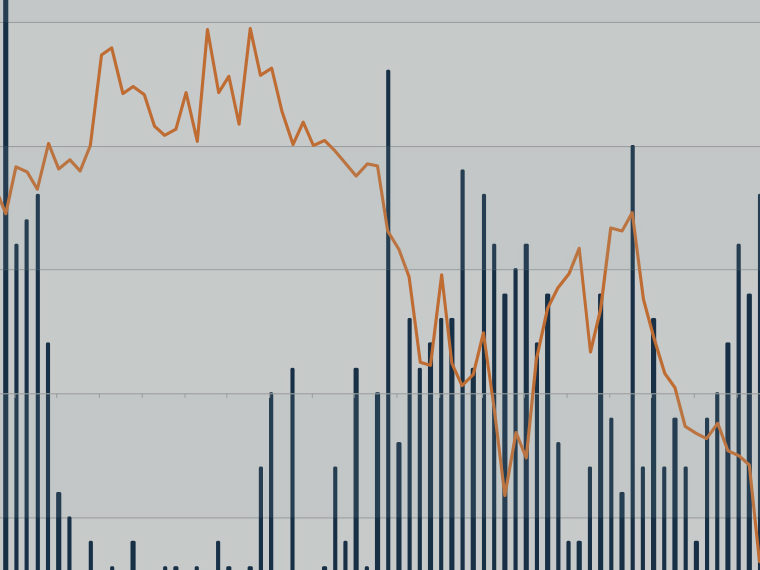

With Bonds, the Past Can Be Prologue

Patterns in corporate bond returns include abrupt short-term performance reversals and “momentum” waves that persist

Why the Stock Market Needs Gamblers

They counteract the impulses of two other market personality types

Why Risk and Reward Don’t Always Move in Concert

Investors initially underreact to volatility, then overreact

Why Rising Stocks Sometimes Reverse, Then Rally

Cultural differences and investor behavior can drive reversals and momentum

Why Do Banks With Little Skin in the Game Still Monitor Borrowers?

Tax policy change triggers an incentive for lenders to be more aggressive

Why Big Banks Can Pay Less on Deposits

Their level of technology and services makes up for it; it’s vice versa with little banks

Who Does — and Doesn’t — Suffer From Lack of Competition for Workers

Nurses, cosmetologists and other professionals find wages suppressed more than many lower-skilled workers

When Younger Investors Overreact to News, Others Feel It

Inexperienced investors, lacking historical context, impact markets

When the Fed Taps the Brakes, Not All Banks Slow Down

Some lenders’ balance sheets are less affected by a rising federal funds rate

When Homeowners Confide in Google, Forecasters See Clues to Mortgage Defaults

Researchers developed an index that warns earlier than others about approaching home loan problems

When Financial Intermediaries Sneeze, These Assets Catch a Cold

Some investment vehicles are more reliant than others on the health of trading firms

When Exchange Rates Move, U.S. Companies Feel It — Even More Than Previously Thought

Firm-specific export data enables researchers to potentially solve a puzzle in economics

What Makes a True Financial Crisis?

Data back to 1870 show similarities in the worst banking system shocks — focusing on loose lending before a meltdown

What Drives LBO Fever? More Than Just Cheap Loans

Private equity investors weigh the total cost of capital — not just debt, but equity as well — when pursuing buyouts

Unwelcome Gift Message: ‘I Know You Need Money’

The same gift, with a message on saving the recipient time, is more welcome