Area: Finance

Why Risk and Reward Don’t Always Move in Concert

Investors initially underreact to volatility, then overreact

Adapting Value Investing to the 21st Century

Including intangible assets in book value vastly improves the strategy’s returns

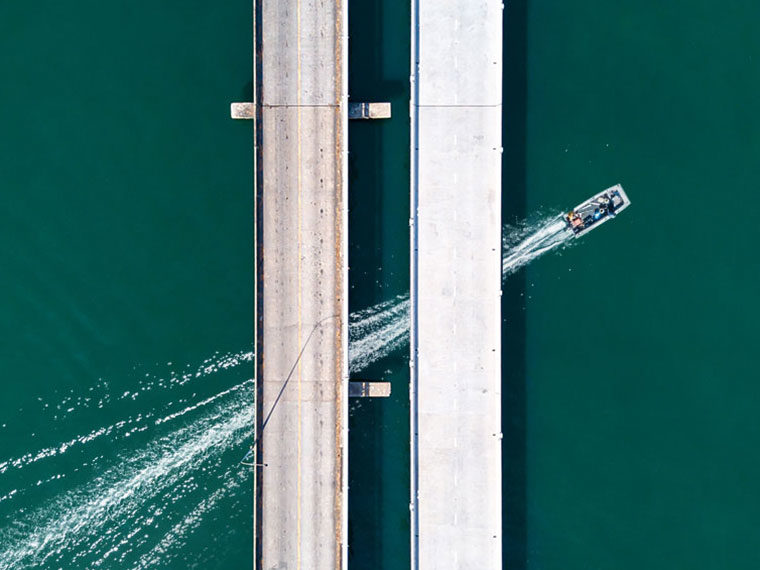

When the Fed Taps the Brakes, Not All Banks Slow Down

Some lenders’ balance sheets are less affected by a rising federal funds rate

Could Tech Giants Be Making Our Economy Less Innovative?

With a business model built on fewer employees, their dominance saps dynamism.

Did Bank Capital Rules Make Credit Card Borrowing More Expensive?

Though defaults are low, rates on credit card loan-backed notes are high

Out of the 1990s Asian Crisis, a New Bond Market Rises

Local currency sovereign bonds transfer risk from issuer to buyer

Unwelcome Gift Message: ‘I Know You Need Money’

The same gift, with a message on saving the recipient time, is more welcome

Puncturing the Small-Investors-are-Bad-Investors Narrative

Individuals using the Robinhood trading app appear to beat the market

The Relative Well-Being of Generations: An Explanation for Falling Interest Rates?

Doing worse than mom and dad is a drag on the entire economy

Consumer Spending and Jobless Data: a Peculiar Threshold

A 12-month high in local unemployment triggers savings behavior

One European Country Defaults: How Hard-Hit Is the Euro?

A predictive model employs credit default swaps across currencies

Rising Rents Force Families to Curtail Spending on Food and Health Care

Cost burdens affect half of U.S. households that rent, as housing shortage worsens

Less Leveraged Than the Competition: Ready to Snag Distressed Assets in a Recession

When bad times hit, highly indebted companies often have to sell operations and equipment at fire-sale prices

Credit Scores, Used to Predict Repayment, Can Restrain Economic Recovery

Rigid adherence to scoring systems can reduce consumer spending when it’s most needed

How Will You Spend Your IPO Windfall?

“Uh, I already bought a house”: Tech workers spend ahead of actual stock sales

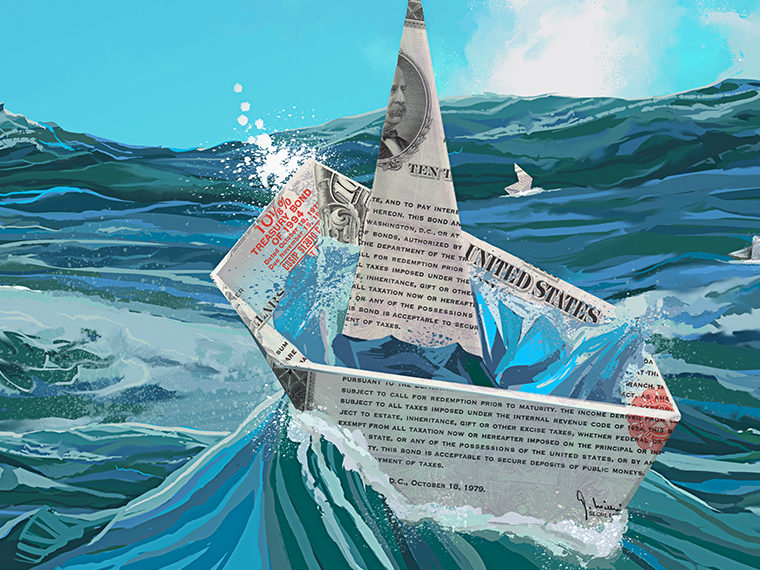

A ‘Safer’ Treasury Bond

The government’s floating rate notes feature an added measure of security: higher interest earnings in times of rising rates