Area: Finance

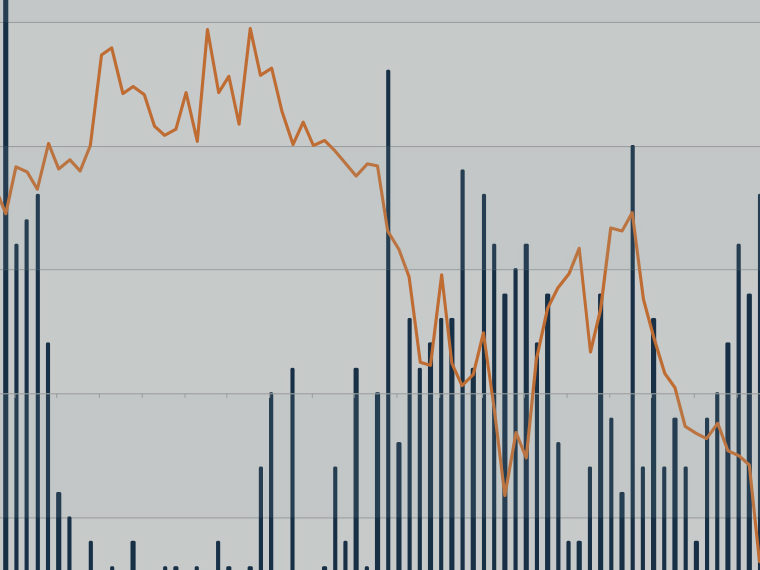

Rethinking Buy-and-Hold Investing

The case for using rising market volatility as a signal to pare back on stocks — does higher risk always mean higher return?

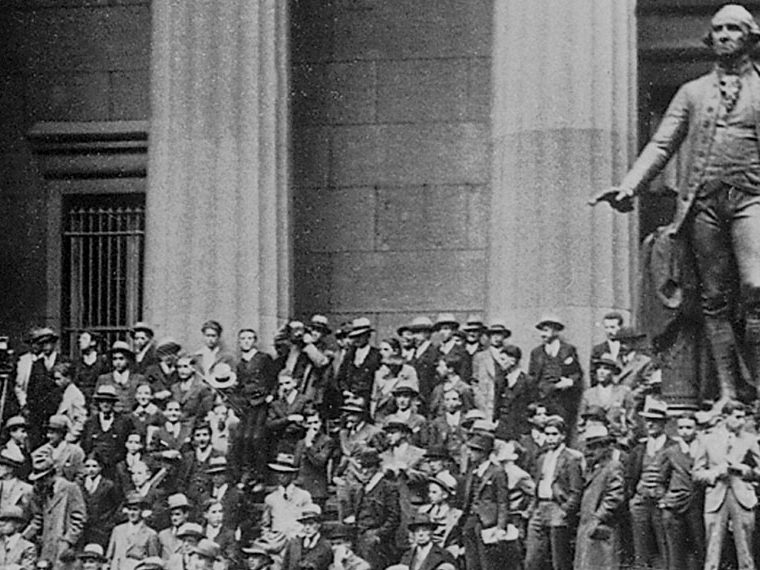

What Makes a True Financial Crisis?

Data back to 1870 show similarities in the worst banking system shocks — focusing on loose lending before a meltdown

What Drives LBO Fever? More Than Just Cheap Loans

Private equity investors weigh the total cost of capital — not just debt, but equity as well — when pursuing buyouts

New Appreciation for a Classic Stock Market Gauge

The relationship between short- and longer-term moving averages has strong predictive power for share price returns

Behind the Annuity Conundrum: The Belief They’re Unfair

Researchers find little commonality among haters of the difficult-to-sell retirement products, except when discussing fairness

Momentum Investing: It Works, But Why?

After a quarter century of sprawling study, it’s time to narrow the focus and settle on an explanation

How ETFs Muffle Stock Market Feedback to Managers

The rise of passive investing leaves companies mistrusting market signals on how best to deploy capital

With Bonds, the Past Can Be Prologue

Patterns in corporate bond returns include abrupt short-term performance reversals and “momentum” waves that persist

Ignorance — About One’s Investments, Anyway — Isn’t Always Bliss

Valentin Haddad’s research looks at the phenomenon of “information aversion,” when individual investors stop tracking their portfolios for fear of bad news

Could Costly Housing Bring Down Superstar Cities?

Stuart Gabriel’s research shows how a vibrant economic hub loses essential residents

Quantitative Easing Kept the Foreclosure Crisis from Being Even Worse

The Fed’s gambit didn’t trigger a home-price recovery, but research shows it reduced subprime foreclosure risk

How Life Insurers Insulate the Markets from Turmoil

Valentin Haddad’s research finds that insurers’ patient investing shields risky assets — and those who hold them — from steeper declines

To Wall Street, There’s No Crisis Like a Banking Crisis

Tyler Muir finds that neither war nor deep recession darkens investor sentiment like sudden turmoil in the financial system

The Moat That Keeps Complex Asset Strategies Profitable

Andrea Eisfeldt finds that hedge funds with infrastructure to execute sophisticated arbitrage crowd out less-expert investors

Taking the Battle for Financial Literacy to Where the Eyeballs Are

Research by Bruce Carlin and Stephen Spiller suggests YouTube videos could help consumers make better money decisions

How an Excess of Stock Analyst Optimism Lands on Companies Least Deserving of It

Results of financially weak firms are difficult to forecast; in uncertainty, Wall Street’s views are overly generous