Operating costs decline when riders get free rentals for docking dying electric vehicles

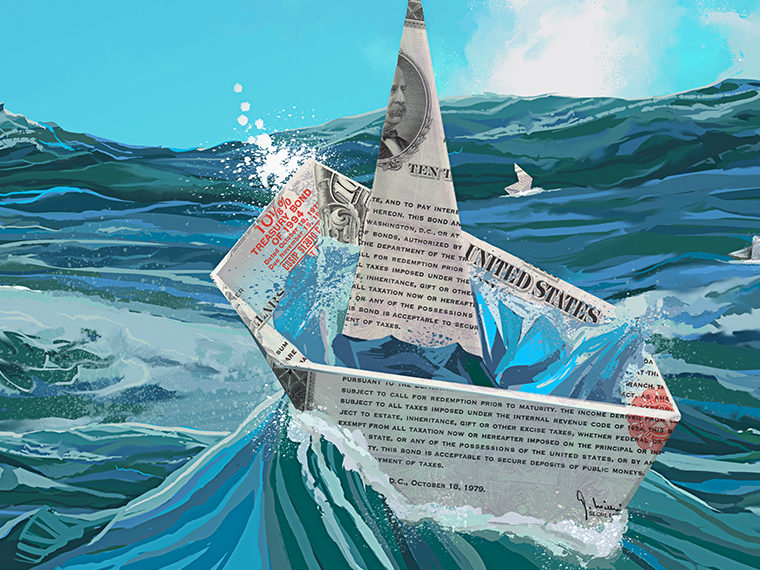

The scooter- and bike-sharing industry is scaling up rapidly across hundreds of cities with rent-by-the-minute electric vehicles. Investors are latching onto dockless companies like Lime, Bird and Skip. Bird alone collected nearly $100 million in fares while still in its infancy.

But to turn all that revenue into profits, companies might heed a study that suggests a counterintuitive strategy: Don’t charge every customer. Strategically offering free rides cuts operating costs, expands the rentable fleet and keeps the customer base happy, according to a working paper by UCLA Anderson’s Bobby Nyotta (a Ph.D. student) and Fernanda Bravo and Washington University’s Jacob Feldman. The strategy can expand long-term profits in exchange for some short-term revenue growth, the findings suggest.

The study addresses recharging logistics — a huge source of cost, headaches and missed revenue for every dockless vehicle business. Ideally, an operator always has a well-charged, well-positioned vehicle ready to rent for every potential customer. But that dockless perk means customers can abandon their rentals almost anywhere they want to end their rides, which isn’t often at battery charging docks. Without intervention, revenue falls off as dead and dying vehicles accumulate throughout the day.

Opt In to the Review Monthly Email Update.

Some companies address the problem with heavy fines on customers who don’t park at charging stations when batteries are low. Others employ bounty hunters to round up scooters and bikes into their own vehicles, ferry them to recharging stations and reposition them throughout the city. Sometimes operators text credits for future rides when a customer agrees to recharge. Many electric scooter and bike companies use combinations of these tactics.

Most operators are getting grilled now by potential investors keen to know how they’ll cut these costs and keep their fleets perpetually rented. The study offers insights, as well as an adaptable model, that can help explain.

The Customers Work for Us, Too

The study finds that operators can entice customers to reposition most of the fleet daily by texting or sending push notifications of this offer to anyone who picks a low-battery scooter or bike: End your ride today at a recharging station, and it’ll cost you nothing. The text is triggered anytime a customer checks out a vehicle, within a prescribed location, that holds a prescribed range of battery charge. The customer can accept or reject the offer.

Unlike the threat of a fine, this message doesn’t irritate paying customers. Customer utility, which Nyotta described in a phone interview as a measure of customer happiness, is 10 times higher when the operator offers the choice of docking than when it threatens a $25 fine.

The need to reposition vehicles via corporate hires is about 65 percent to 75 percent lower in this simplified free ride model than in a much more complex (and expensive) scheme that also includes free offers, according to the findings.

Far more often, fining reduces the need to manually reposition, according to the modeled scenarios, which implies even larger operating cost reductions than free ride policies. Also, revenues in the fine-based scenario, as well as the complex system, are about 9 percent higher, according to the findings.

But the study warns that the higher revenue results for fines “should be taken with a grain of salt” and not as an indicator of higher sales long term. The free rides help keep more of the fleet charged, and therefore rentable, than the fine-based policy, the study notes. The free ride operators see fewer potential customers walk away because they couldn’t find a charged scooter or bike, according to the findings.

Moreover, customers are not happy when they’re fined, and that’s not good for long-term profits, Nyotta explained in the interview. They may choose a competitor for their next ride.

Sales Versus Cost Versus Repeat Business

The model quantifies the trade-offs between revenue, customer satisfaction and operating costs for various recharging strategies. Using historic data from a large scooter company that employs fines, the researchers ran 100-day scenarios that compared the effects of different policies.

The authors included a scenario involving a very complex free ride policy that uses multiple variables, including some time and distance on routes, to determine when each free ride will be offered. Theoretically, this scheme should be very efficient, although it would require an enormous amount of computing power to set up and maintain, Nyotta explained. They used this scenario as a benchmark against results from the simpler free ride and fine policies.

The model does not directly address profits, in part because it doesn’t capture the cost of repositioning vehicles without customer help. However, among its findings are revenues from fares, the number of times per day corporate repositioning is required and changes to customer utility. One can infer some effects on profit.

For example, when no offers or fines for recharging are employed, the operator moves vehicles for recharging about 24 times per day. When customers are fined, moving requirements drop to about twice a day, but customers are far less satisfied with their experiences. Ostensibly, the fining company spends a lot less money on repositioning but loses some repeat business as a result.

Operators can customize model variables, such as the size of a discount or battery life parameters, for triggering offers and fines. Nyotta noted that the “optimal” policy will vary by operator and may change as the business evolves. For example, an operator in an uncompetitive market who wants fast revenue growth may choose the fine policy despite its drawbacks.

No company has yet proven it can make a lot of money in this business. Competition is strong in many cities, and jacking up prices increases risk of turning off customers before they’re hooked on the service.

But giving away some rides might improve margins and build brand loyalty enough to turn some merely popular companies profitable. Sometimes maximizing revenue over the long run means giving up some of it today.

Featured Faculty

-

Fernanda Bravo

Assistant Professor of Decisions, Operations and Technology Management

About the Research

Nyotta, B., Bravo, F., & Feldman, J. (2019). Free rides in dockless, electric vehicle sharing systems.