Topic: Banking

Mobile Banking, a Boon to Many, Disadvantages Those Who Bank at Branches

Banks close neighborhood outlets and raise prices for branch-delivered services

A Quiet Expansion of Deposit Insurance Could Disrupt U.S. Banking

Seen as a backstop to small- and midsized banks, the program, allowing insurance in multiples of $250,000, alters banking’s risk calculus

Banks Rent Out Their Balance Sheets — So Derivatives Cost More

Even before Dodd-Frank rules, the costs were significant

Banks Transmit Financial Shocks, Including from Natural Disasters

How a localized flood may result in fewer loans to a far-off community

Banks, Freed to Operate Across State Lines, Helped Stabilize the Economy

Lenders financed expansion in some markets, offsetting problems in others

Calculating a Value for the Government Support Banks Enjoy

Researchers’ model could quantify the risks in the growing movement to ease up on Dodd-Frank regulations

Can Banks, Disrupted by Fintech, Adopt New Habits, Too?

In China, patent data shows commercial banks’ use of new technologies helps improve efficiency and reduce risk

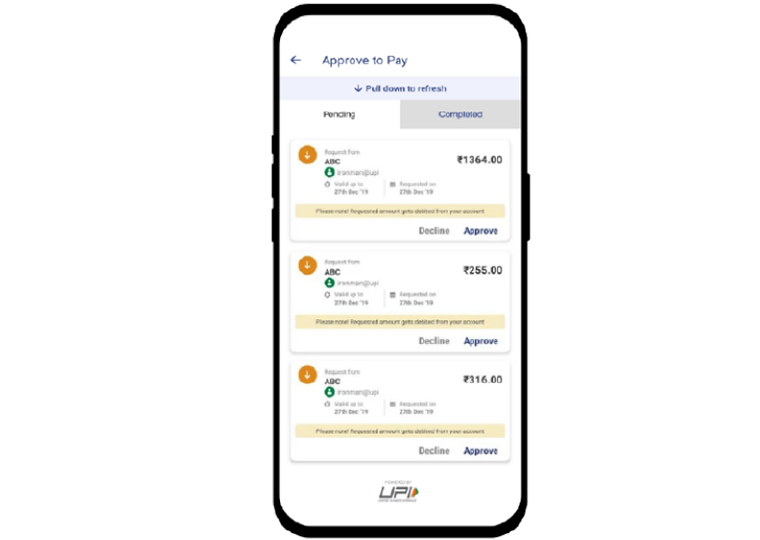

Cashless Payments: Faster Transactions, Easier Borrowing and Increased Household Income

System provides digital record of payments for India’s vast self-employed ranks, satisfying lenders, and raising the likelihood of starting a business

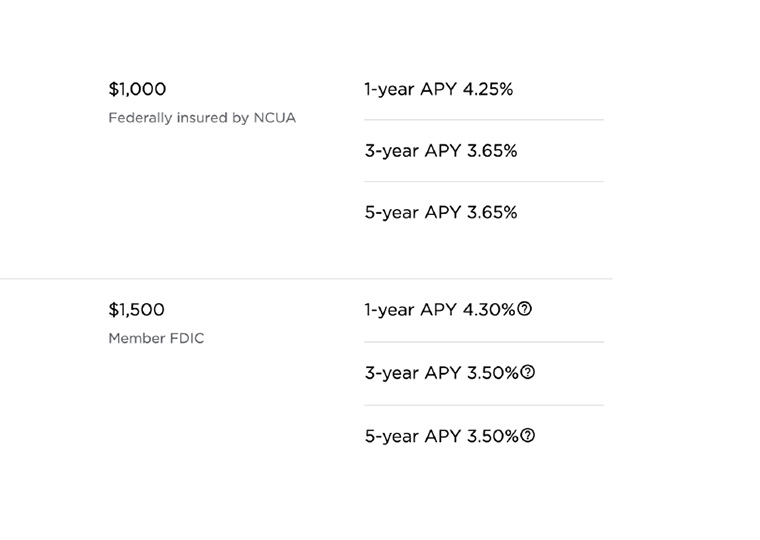

CD Withdrawal Penalties: Often More Than Worth the Risk

Banks know you won’t do the math: Even after a penalty for early withdrawal, the longer-term CD often nets out to a better deal

Did Bank Capital Rules Make Credit Card Borrowing More Expensive?

Though defaults are low, rates on credit card loan-backed notes are high

Good Information Alone Won’t Drive Financial Well-Being

A review of academic research finds the path to saving more and spending less often involves emotional prompts

How Banking’s Bifurcated Deposit Approach Is Altering Lending — and Risk

Offering higher deposit rates lessens emphasis on loans of fixed rate and longer maturity

How Commodity Price Swings Destabilize Bank Relationships

Small firms in Peru shop nationwide for cheap credit, but loyalty runs two ways

In a Crisis, Solvent Borrowers are Overcharged, Subsidizing Troubled Bank Clients

An unusual data trove from Greece’s economic collapse reveals the practice

Joint Bank Accounts Make for Happier Couples

Those who keep finances separate are likelier to split up, be less satisfied with their relationship

Keynes vs. FDR: Lessons from the Great Recession

Sebastian Edwards finds Keynes’ public take-down of Roosevelt’s gold policies still relevant today