Topic: Corporate Finance

“How’re Sales, Roger?” “Good Question, Roger!”

When CEO and analyst share a first name, earnings estimates are sharper

Corporate Bond Market Meltdown Averted after Fed Action

Decade-old bank-risk limits may have exacerbated liquidity problems

When Lenders Put a Muzzle on Borrowers

Companies hide from shareholders information about loans — more than likely to appease banks

Does Better Corporate Disclosure Boost Markets?

Stronger financial reporting standards seem to mean more for growth of countries’ credit markets than their stock markets

Upside Earnings Surprise Issued Late: Signal of Possible Manipulation

Companies that take longer than expected to announce results may be buying time for accounting tricks

Might More Lobbying Groups, Rather than Fewer, Be Good for Industry and the Public?

Make the influence industry more competitive, a theoretical study suggests

In Some Industries, Are Corporate Combinations Actually Good for Consumers?

A model focuses on startups that, while developing innovative products, seek a lucrative buyout

Less Leveraged Than the Competition: Ready to Snag Distressed Assets in a Recession

When bad times hit, highly indebted companies often have to sell operations and equipment at fire-sale prices

Forgoing a Tax Refund to Signal Brightening Financial Prospects

Companies that use loss carry-forwards to offset future tax liability, instead of claiming a refund, enjoy favorable lending terms

What Drives LBO Fever? More Than Just Cheap Loans

Private equity investors weigh the total cost of capital — not just debt, but equity as well — when pursuing buyouts

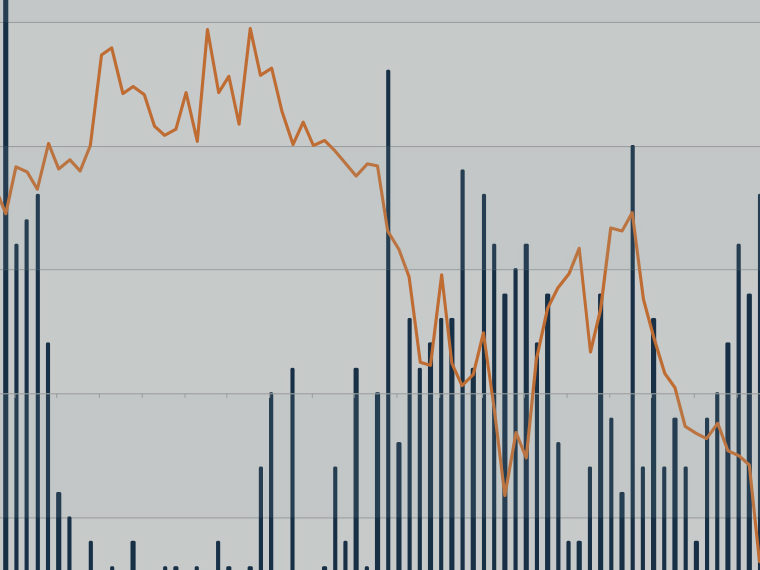

With Bonds, the Past Can Be Prologue

Patterns in corporate bond returns include abrupt short-term performance reversals and “momentum” waves that persist

Calculating a Value for the Government Support Banks Enjoy

Researchers’ model could quantify the risks in the growing movement to ease up on Dodd-Frank regulations

Does Big News Drown Out Corporate Earnings Disclosures?

Henry Friedman’s research finds, surprisingly, that major economic news actually heightens attention paid to company announcements

Boo! Does Merely Mentioning an Audit Increase Taxpayer Compliance?

Research undermines the notion that companies coldly calculate tax avoidance

Low-Quality Earnings: The Uncoupling of Stock Price from Fundamentals

Studying Chinese A and B shares reveals investor uncertainty

Bringing a Sharper Focus to the Study of the Decline of Investment Diversification

Research measures the impact of global economic factors on returns